PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698283

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698283

Utility Scale Shunt Reactor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

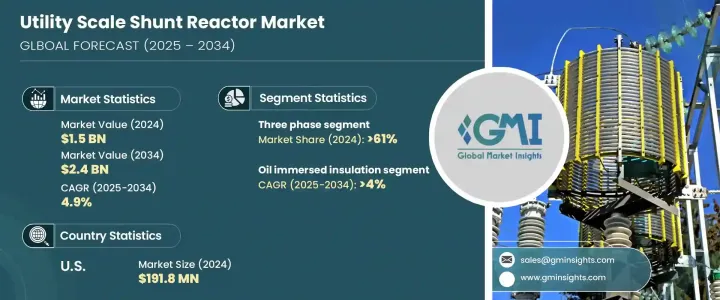

The Global Utility Scale Shunt Reactor Market generated USD 1.5 billion in 2024 and is projected to expand at a CAGR of 4.9% between 2025 and 2034. This steady growth is fueled by the increasing demand for energy worldwide, the modernization of aging electrical grids, and the rapid integration of renewable energy sources. As countries prioritize grid efficiency and reliability, shunt reactors play a vital role in voltage regulation and power management, reducing transmission losses and enhancing overall grid stability. With the surge in electricity consumption and the transition toward renewable power generation, utility-scale shunt reactors are becoming an essential component of the evolving power infrastructure.

Technological advancements and government initiatives aimed at upgrading energy transmission networks are further boosting the demand for these systems. Emerging economies are heavily investing in new power infrastructure, while developed nations are focused on modernizing existing grids. Cross-border electricity transmission projects and ultra-high voltage transmission lines are driving the adoption of advanced shunt reactor solutions. The rise of digitalized and automated power grid systems is another key trend shaping market dynamics, as utilities seek to enhance real-time monitoring and control mechanisms. Additionally, regulatory policies supporting sustainable energy practices are prompting power companies to integrate efficient voltage management solutions, ensuring stable operations even with fluctuating renewable energy inputs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $2.4 Billion |

| CAGR | 4.9% |

The market is segmented into two primary categories: three-phase reactors and single-phase reactors. Three-phase reactors accounted for a dominant 61% market share in 2024 and are poised for significant growth over the coming years. Their widespread adoption stems from the expansion of ultra-high voltage transmission networks and industrial grid modernization. These reactors are essential in managing reactive power within interconnected power grids, optimizing efficiency, and minimizing transmission losses. As large-scale energy projects expand, including cross-border power interconnections, the demand for three-phase reactors continues to rise.

Based on insulation type, the market is divided into oil-immersed and air-core reactors. Oil-immersed reactors led the market with a 62.8% share in 2024 and are expected to grow steadily at a rate of 4% through 2034. Their dominance is attributed to their superior cooling performance and high reliability, making them particularly suitable for high-voltage applications. As the global power sector focuses on grid stability and efficient voltage regulation, the preference for oil-immersed reactors remains strong. The advancement of transformer oil technologies further enhances their appeal, allowing utilities to achieve optimal performance in high-power transmission networks.

U.S. utility scale shunt reactor market was valued at USD 191.8 million in 2024 and is set to grow as the country continues upgrading its aging grid infrastructure. The rising dependence on renewable energy sources is accelerating the adoption of advanced shunt reactor technologies, including digital monitoring capabilities. High-voltage transmission grid expansions and smart grid developments are reinforcing the market's upward trajectory, aligning with the broader trend of modernization within the U.S. energy sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Phase, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Single phase

- 5.3 Three phase

Chapter 6 Market Size and Forecast, By Insulation, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Oil immersed

- 6.3 Air core

Chapter 7 Market Size and Forecast, By Product, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Fixed shunt reactors

- 7.3 Variable shunt reactors

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 CG Power & Industrial Solutions

- 9.2 Fuji Electric

- 9.3 GBE

- 9.4 GE

- 9.5 GETRA

- 9.6 HICO America

- 9.7 Hitachi Energy

- 9.8 Hyosung Heavy Industries

- 9.9 Nissin Electric

- 9.10 SGB SMIT

- 9.11 Shrihans Electricals

- 9.12 Siemens Energy

- 9.13 TMC Transformers

- 9.14 Toshiba Energy Systems & Solutions Corporation

- 9.15 WEG