PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698279

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698279

Student Information System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

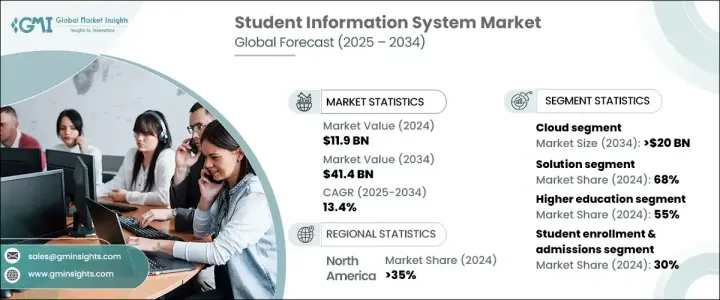

The Global Student Information System Market was valued at USD 11.9 billion in 2024 and is expected to grow at a CAGR of 13.4% between 2025 and 2034. The demand for personalized learning solutions is driving market growth as educational institutions focus on improving student engagement and retention. AI and analytics are being integrated into these systems to enhance the learning experience, track achievements, and provide adaptive feedback. Schools and colleges are increasingly adopting cloud-based platforms for their scalability, cost-effectiveness, and real-time access to student records. Security and compliance with regulations such as FERPA and GDPR remain crucial concerns as institutions transition to cloud-based solutions.

Blockchain technology is transforming how educational records, including diplomas and transcripts, are verified. Institutions are leveraging blockchain to ensure credential authenticity, streamline administrative processes, and reduce fraud. The rise of mobile-first student information systems is making it easier for students, faculty, and administrators to access grades, schedules, and coursework from smartphones and tablets. As mobile adoption increases, these solutions are enhancing engagement and optimizing administrative functions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.9 Billion |

| Forecast Value | $41.4 Billion |

| CAGR | 13.4% |

The student information system market is segmented by deployment mode into cloud and on-premises solutions. In 2024, cloud-based SIS held over 60% of the market and is projected to surpass USD 20 billion by 2034. Educational institutions prefer cloud-based systems due to their centralized access, lower infrastructure costs, and seamless integration with learning management systems and financial aid platforms. AI-driven analytics are also playing a significant role in identifying at-risk students, automating grading, and personalizing learning experiences. The use of AI-powered chatbots is further streamlining administrative processes by managing student inquiries and enrollment.

Subscription-based pricing models are making SIS solutions more accessible for institutions of all sizes. Cloud-based SIS eliminates the need for significant upfront investments, enabling smaller schools to leverage advanced technology affordably. However, long-term subscription costs and reliance on third-party providers remain key considerations for institutions adopting cloud-based systems.

Automation and AI-powered analytics are reshaping student enrollment, admissions, and financial aid management. SIS platforms are now capable of analyzing historical data to predict student success and dropout rates, thereby assisting institutions in refining their recruitment strategies. Automated chatbots and virtual assistants are improving the admissions process by addressing student inquiries in real-time. Additionally, financial aid management is becoming more efficient through AI-driven fraud prevention, transparent grant distribution, and digital payment solutions. Mobile applications now allow students to monitor financial aid applications and access secure, real-time billing information.

Higher education institutions accounted for approximately 55% of the SIS market in 2024, with cloud-based solutions driving growth. These platforms enable flexible learning models by providing seamless access to academic data for students, faculty, and administrators. Real-time analytics are helping institutions optimize resources, improve student retention, and implement data-driven decision-making. The student enrollment and admissions segment held around 30% of the market in 2024, with automation reducing administrative workload and improving efficiency. AI-driven enrollment tools are streamlining document verification, application tracking, and student outreach.

North America led the global SIS market in 2024, with the United States holding a dominant share. Institutions in the region are prioritizing compliance with data security regulations while adopting mobile-friendly SIS solutions. These platforms provide students with instant access to academic information, facilitating communication with faculty and simplifying administrative tasks. The increasing reliance on mobile technology is driving greater user engagement and operational efficiency across educational institutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Solution provider

- 3.1.2 Services provider

- 3.1.3 Technology provider

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Adoption of cloud-based systems in educational institutions

- 3.7.1.2 Increasing need for data-driven decision-making in education

- 3.7.1.3 Rising demand for personalized learning experiences

- 3.7.1.4 Integration of AI for student data analysis

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Data security concerns with cloud-based student information systems

- 3.7.2.2 High costs associated with system implementation and maintenance

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Enrollment

- 5.2.2 Academics

- 5.2.3 Financial Aid

- 5.2.4 Billing

- 5.3 Services

- 5.3.1 Professional

- 5.3.2 Managed

Chapter 6 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 K-12 Education

- 7.3 Higher Education

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Student enrollment & admissions

- 8.3 Attendance tracking & monitoring

- 8.4 Financial management

- 8.5 Communication & notifications

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Anthology

- 10.2 Anubavam

- 10.3 Arth Infosoft

- 10.4 Blackboard

- 10.5 Campus Management

- 10.6 Canvas by Instructure

- 10.7 ComSpec International

- 10.8 Ellucian

- 10.9 Focus School Software

- 10.10 Illuminate Education

- 10.11 ITG America

- 10.12 Jenzabar

- 10.13 Moodle

- 10.14 Oracle

- 10.15 SAP

- 10.16 Skyward

- 10.17 Tribal Group

- 10.18 Unit4

- 10.19 Veracross

- 10.20 Workday