PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698269

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698269

e-Corner System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

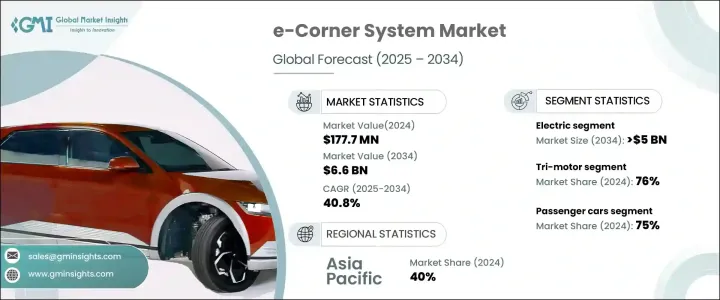

The Global e-Corner System Market, valued at USD 177.7 million in 2024, is projected to expand at a remarkable CAGR of 40.8% between 2025 and 2034, driven by the increasing adoption of electric vehicles (EVs) and the push for advanced vehicle control systems. This exponential growth is fueled by the automotive industry's transition toward electrification, with manufacturers focusing on sustainability, efficiency, and enhanced driving performance.

The e-Corner system is revolutionizing EV design by integrating steering, braking, suspension, and propulsion into each wheel. This technology enhances vehicle maneuverability, allowing for precise torque control and improved stability. Automakers are increasingly adopting e-Corner systems as they seek innovative solutions to optimize energy consumption and extend battery range. As governments worldwide implement stricter emission regulations and promote zero-emission vehicles, the demand for these advanced systems is expected to surge. The growing preference for intelligent and adaptive mobility solutions is further boosting market expansion, positioning e-Corner systems as a critical component in next-generation EVs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $177.7 Million |

| Forecast Value | $6.6 Billion |

| CAGR | 40.8% |

Segmented by propulsion type, the e-Corner system market includes electric and internal combustion engine (ICE) vehicles. The electric segment dominated in 2024, capturing 80% of the market share, and is projected to generate USD 5 billion by 2034. The rise in EV adoption is a significant factor driving this trend, as e-Corner systems play a crucial role in optimizing propulsion efficiency and improving vehicle handling. These systems enable precise control over each wheel's movement, enhancing traction, safety, and overall driving experience. With global EV sales on the rise, the adoption of e-Corner technology is expected to accelerate, further cementing its importance in the future of automotive engineering.

The market is also categorized by motor configuration, with tri-motor and quad-motor setups being the primary options. In 2024, the tri-motor segment accounted for 76% of the market share, offering superior torque distribution and enhanced vehicle dynamics. Tri-motor configurations optimize power allocation across individual wheels, improving traction and control in complex driving conditions. Automakers are investing in refining powertrain technologies to deliver better handling, stability, and performance. As the industry continues to prioritize advanced vehicle control systems, tri-motor setups remain the preferred choice for premium and high-performance EVs.

Regionally, the Asia Pacific market held a 40% share in 2024, driven by the region's rapidly expanding EV sector. Automakers across China, Japan, and South Korea are heavily investing in advanced propulsion and handling solutions, making e-Corner systems a key technology in modern electric mobility. With a strong push for energy-efficient solutions, governments and manufacturers are focusing on the development of high-performance, differentiated control systems to enhance vehicle safety and efficiency. As demand for EVs continues to surge across Asia Pacific, the e-Corner system market is poised for substantial growth, reinforcing its role as a transformative technology in the automotive industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component manufacturers

- 3.1.2 Technology providers

- 3.1.3 Automotive manufacturers

- 3.1.4 Suppliers & distributors

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Case studies

- 3.9 Cost-benefit analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Growing demand for enhanced vehicle maneuverability and advanced parking solutions

- 3.10.1.2 Rising adoption of autonomous and electric vehicles integrating steer-by-wire and brake-by-wire technologies

- 3.10.1.3 Increasing focus on vehicle safety, stability, and dynamic control

- 3.10.1.4 Advancements in in-wheel motor technology and modular e-corner architectures

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High development and integration costs

- 3.10.2.2 Regulatory and standardization challenges

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Motor Configuration, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Tri-motor configuration

- 5.3 Quad-motor configuration

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchbacks

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

- 7.3.1 BEV

- 7.3.2 HEV

- 7.3.3 PHEV

- 7.3.4 FCEV

Chapter 8 Market Estimates & Forecast, By Vehicle Configuration, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 2-Wheel Drive (2WD)

- 8.3 All-Wheel Drive (AWD)

- 8.4 4-Wheel Drive (4WD)

Chapter 9 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Hydraulic

- 9.3 Electric

- 9.4 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Benteler

- 11.3 Canoo

- 11.4 Continental

- 11.5 Denso

- 11.6 Elaphe

- 11.7 Faurecia

- 11.8 GKN Automotive

- 11.9 Hitachi

- 11.10 Hyundai

- 11.11 Indigo Technologies

- 11.12 Mitsubishi

- 11.13 Nissan

- 11.14 Protean Electric

- 11.15 REE Automotive

- 11.16 Schaeffler

- 11.17 Siemens

- 11.18 Valeo

- 11.19 Zeekr

- 11.20 ZF Friedrichshafen