PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698267

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698267

Automotive Traction Motor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

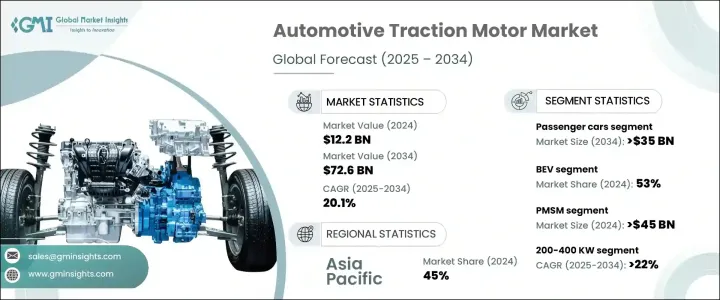

The Global Automotive Traction Motor Market was valued at USD 12.2 billion in 2024 and is projected to grow at a CAGR of 20.1% from 2025 to 2034. A significant rise in electric vehicle (EV) production worldwide is a key driver of this growth. Governments are pushing for lower carbon emissions by reducing reliance on diesel fleets and promoting vehicle electrification. Consumers are also becoming more conscious of sustainability and fuel conservation, further accelerating the transition to EVs.

Technological advancements in power electronics and motor control are improving the efficiency and performance of traction motors. The adoption of silicon carbide (SiC) and gallium nitride (GaN) semiconductors enhances power efficiency, minimizes energy loss, and optimizes motor output. This progress allows manufacturers to develop more compact and lightweight motors, leading to better vehicle performance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.2 Billion |

| Forecast Value | $72.6 Billion |

| CAGR | 20.1% |

The automotive traction motor market is categorized by motor type into Permanent Magnet Synchronous Motors (PMSM) and AC induction motors. PMSM dominated the market in 2024, generating over USD 45 billion in revenue. These motors are preferred due to their lightweight structure, superior torque, and higher efficiency, making them a popular choice for EV traction systems. As PMSMs consume more electric energy compared to induction motors, manufacturers are prioritizing their integration into modern EV designs.

Rising costs and supply concerns surrounding rare earth materials have prompted manufacturers to develop rare-earth-free PMSMs that function efficiently without neodymium or dysprosium. These innovations are stabilizing the supply chain and facilitating broader adoption of PMSMs in EVs. As these designs continue to improve, more manufacturers are expected to implement them, further driving market expansion.

The market is also segmented by power output into three categories: less than 200 kW, 200-400 kW, and above 400 kW. The 200-400 kW segment is anticipated to grow at a CAGR of over 22% by 2034. High-output traction motors in this range are becoming increasingly popular in electric SUVs, sports cars, and commercial vehicles. Automakers are integrating these motors to enhance acceleration and performance, meeting the growing demand for powerful yet efficient electric drivetrains.

Electric commercial vehicles, including trucks and buses, are also fueling the demand for high-power traction motors. Logistics and freight transport are transitioning toward electrification, increasing the need for motors with high torque and power capacity. Many EVs are now equipped with dual-motor all-wheel-drive (AWD) systems, improving stability and traction while requiring power ratings within the 200-400 kW range. Automakers are adopting this design to optimize vehicle dynamics, further driving the demand for high-power traction motors.

Asia Pacific remains a dominant force in EV production, with countries such as China, Japan, South Korea, and India investing heavily in EV infrastructure and manufacturing. The presence of leading EV manufacturers and advancements in the regional supply chain, particularly in rare earth magnet production, are supporting market growth. China, as the world's largest EV market, continues to expand production capacity to cater to both domestic and global demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material & component suppliers

- 3.1.2 Manufacturers

- 3.1.3 Automotive manufacturers

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trend

- 3.9 Case studies

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing government incentives and emission reduction policies promoting electric vehicles

- 3.10.1.2 Rising consumer demand for eco-friendly and energy-efficient electric vehicles

- 3.10.1.3 Advancements in motor efficiency, reducing energy consumption and extending vehicle range

- 3.10.1.4 Growing adoption of AI and autonomous technologies, driving innovation in traction motor systems

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Supply chain constraints for critical materials such as rare earth elements needed for motors

- 3.10.2.2 High development costs associated with advanced traction motor technologies

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUV

- 5.3 Commercial vehicles

- 5.3.1 Light Commercial Vehicles (LCV)

- 5.3.2 Heavy Commercial Vehicles (HCV)

- 5.4 Two-wheelers

- 5.5 Off-road vehicles

Chapter 6 Market Estimates & Forecast, By Electric Drivetrain, 2021 - 2034($Bn, Units)

- 6.1 Key trends

- 6.2 Battery Electric Vehicle (BEV)

- 6.3 Hybrid Electric Vehicle (HEV)

- 6.4 Plug-in Hybrid Electric Vehicle (PHEV)

Chapter 7 Market Estimates & Forecast, By Motor, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 PMSM

- 7.3 AC Induction

Chapter 8 Market Estimates & Forecast, By Power Output, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Less than 200 KW

- 8.3 200-400 KW

- 8.4 Above 400 KW

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Audi

- 10.2 Bosch

- 10.3 Continental

- 10.4 Ford

- 10.5 General

- 10.6 Honda

- 10.7 Hyundai

- 10.8 Kia

- 10.9 Magna

- 10.10 Magneti Marelli

- 10.11 Mercedes Benz

- 10.12 Mitsubishi

- 10.13 Nidec

- 10.14 Parker Hannifin

- 10.15 PSA Group

- 10.16 SAIC Motor

- 10.17 Schaeffler

- 10.18 Valeo

- 10.19 Volkswagen

- 10.20 ZF Friedrichshafen