PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698257

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698257

Automotive Thermal System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

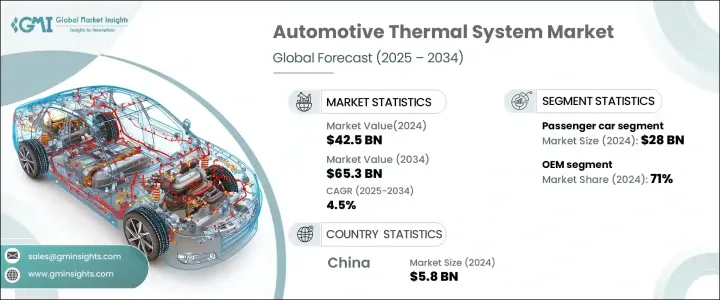

The Global Automotive Thermal System Market reached USD 42.5 billion in 2024 and is projected to grow at a CAGR of 4.5% between 2025 and 2034. As consumers increasingly prioritize comfort, luxury, and fuel efficiency, automakers are integrating advanced thermal management solutions into modern vehicles. From temperature-controlled seats to efficient heating and cooling systems, innovations in thermal technology are shaping the future of the automotive sector.

The rising demand for luxury vehicles featuring enhanced comfort settings, such as heated and cooled steering wheels, humidity control, and multi-zone climate control, is accelerating market growth. Furthermore, advancements in material science, including the use of high-performance polymer materials for heat exchange, are further optimizing thermal system efficiency. With growing environmental concerns and stringent regulatory frameworks, automakers are investing in next-generation thermal systems to enhance vehicle performance, improve fuel efficiency, and reduce emissions. These factors are positioning thermal management as a critical component in the evolution of modern automobiles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $42.5 Billion |

| Forecast Value | $65.3 Billion |

| CAGR | 4.5% |

The market is segmented by application into powertrain cooling, HVAC, battery thermal management, waste heat recovery, and seat heating and cooling. Powertrain cooling dominates the segment due to its crucial role in improving fuel efficiency and minimizing emissions. Effective thermal management directly impacts vehicle performance, making high-performance radiators, intercoolers, and water pumps essential for maintaining engine temperature. With increasingly strict emissions regulations worldwide, automakers are leveraging advanced cooling technologies to ensure superior heat dissipation, prolonged engine lifespan, and overall vehicle reliability. Thermal solutions are becoming indispensable for energy-efficient and environmentally friendly transportation, enabling automakers to comply with regulatory standards while enhancing driving performance.

The automotive thermal system market is also categorized by vehicle type, with passenger cars leading the segment. Passenger vehicles generated USD 28 billion in 2024, driven by growing consumer demand for premium comfort and advanced climate control features. Automakers are enhancing HVAC systems to include innovations such as air purification, multi-zone temperature control, and humidity regulation, catering to consumer preferences for a more comfortable driving experience. The increasing adoption of electric and hybrid vehicles further strengthens this market, as efficient thermal management is essential for optimizing battery performance and extending vehicle range.

Asia Pacific held a 35% share of the automotive thermal system market in 2024, with China emerging as a dominant player. The country's leadership in the electric vehicle sector is driving an accelerated demand for cutting-edge thermal management technologies, particularly for battery cooling and cabin climate control. As government incentives and stringent emissions policies encourage the transition to electric mobility, automakers are implementing innovative cooling solutions, such as liquid-cooled battery packs and waste heat recovery systems, to enhance efficiency and performance. These advancements are positioning China as a key growth hub in the global automotive thermal system market, contributing to the region's expanding market share.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising adoption of electric and hybrid vehicles

- 3.10.1.2 Stringent emission regulation driving efficiency improvements

- 3.10.1.3 Advancements in battery thermal management systems

- 3.10.1.4 Increasing demand for cabin comfort and HVAC efficiency

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Complexity in multi-zone climate control systems

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Compressor

- 5.3 Heat exchanger

- 5.4 Electric pump

- 5.5 Electric fan

- 5.6 Thermoelectric module

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light-duty

- 6.3.2 Medium-duty

- 6.3.3 Heavy-duty

Chapter 7 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 All-electric

- 7.5 Hybrid

- 7.6 FCEV

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Powertrain cooling

- 9.3 HVAC

- 9.4 Battery thermal management

- 9.5 Waste heat recovery

- 9.6 Seat Heating and Cooling

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AKG

- 11.2 BorgWarner

- 11.3 Bosch

- 11.4 Continental

- 11.5 Dana

- 11.6 Denso

- 11.7 Eberspaecher

- 11.8 Grayson

- 11.9 Hanon Systems

- 11.10 HRS

- 11.11 Johnson Electric

- 11.12 Kendrion

- 11.13 Lennox

- 11.14 MAHLE

- 11.15 Marelli

- 11.16 Modine

- 11.17 Schaeffler

- 11.18 Valeo

- 11.19 Visteon

- 11.20 ZF