PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698252

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698252

Automotive Heat Exchanger Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

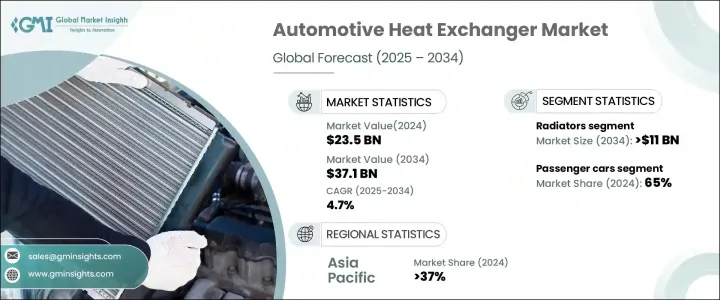

The Global Automotive Heat Exchanger Market was valued at USD 23.5 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The increasing adoption of electric vehicles (EVs) and stringent emission regulations worldwide are driving demand for efficient heat management solutions. With improvements in charging infrastructure and declining component costs, EV adoption is rising, leading to a greater need for thermal management systems. Lithium-ion batteries, widely used in EVs, require stable temperature control within 15°C to 35°C to ensure longevity and performance. Heat exchangers help maintain optimal battery conditions, preventing overheating and extending battery life. Hybrid vehicles also rely on these systems to regulate temperatures for both internal combustion engines and electric motors, ensuring efficient operation.

Governments in various countries, including the US, UK, and China, are enforcing stricter emissions policies, prompting automakers to develop advanced heat management solutions. Technologies like exhaust gas recirculation (EGR) systems are being incorporated to reduce nitrogen oxide emissions and enhance fuel efficiency. The growing emphasis on sustainability has further accelerated innovations in thermal management, making heat exchangers a crucial component in modern vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.5 Billion |

| Forecast Value | $37.1 Billion |

| CAGR | 4.7% |

The automotive heat exchanger market is categorized by product, with radiators leading at over 30% market share in 2024 and expected to surpass USD 11 billion by 2034. Radiators are essential for engine cooling, preventing overheating, and optimizing fuel efficiency, particularly in internal combustion engine (ICE) vehicles. Despite the rise of alternative fuels, gasoline and diesel vehicles remain prevalent due to cost and accessibility, reinforcing the demand for efficient cooling systems.

By vehicle type, passenger cars accounted for 65% of the market share in 2024, driven by their widespread usage. Heat exchangers are critical in these vehicles for ensuring safety, comfort, and operational efficiency. The increasing demand for automobiles is fueling the adoption of moderate radiation heat management systems that include radiators, oil coolers, and condensers to maintain engine performance and longevity.

Government initiatives to curb emissions are leading to advancements in thermal management solutions. Approximately 31% of CO2 emissions in the US originate from vehicles, emphasizing the need for stricter regulations and technological enhancements. Enhanced heat exchanger systems are increasingly integrated into vehicles to meet these evolving standards, further propelling market growth.

Material-wise, aluminum dominated the market in 2024, attributed to its cost-effectiveness, lightweight nature, and high thermal conductivity. The automotive industry is shifting towards more lightweight materials to improve fuel efficiency and vehicle performance, with aluminum emerging as the preferred choice due to its durability and resistance to corrosion. This extends component lifespan, reducing long-term costs for manufacturers and consumers.

In terms of sales channels, original equipment manufacturers (OEMs) held a significant share in 2024. Automakers collaborate closely with heat exchanger manufacturers to develop standard and custom components tailored to vehicle specifications. The growing EV and hybrid vehicle market has led to increased partnerships between OEMs and heat exchanger suppliers, streamlining production and integration processes.

Asia Pacific led the automotive heat exchanger market with a 37% share in 2024. China remains the dominant player, projected to reach USD 3 billion by 2034. The region's strong automobile manufacturing base, combined with lower production and labor costs, has attracted global automakers, driving high demand for heat exchanger components. Additionally, the aftermarket for these components is thriving due to the region's high vehicle population, leading to consistent replacement demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Heat exchanger manufacturers

- 3.2.3 Distributors

- 3.2.4 End Use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Price trend

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Growth of electric and hybrid vehicles

- 3.9.1.2 Stringent emissions and fuel efficiency regulations

- 3.9.1.3 Advancements in heat exchanger material

- 3.9.1.4 Increasing vehicle production and demand

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High material and manufacturing costs

- 3.9.2.2 Complexity of thermal management systems

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Radiators

- 5.3 Intercoolers

- 5.4 Oil coolers

- 5.5 Exhaust gas recirculation (EGR)

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 HCV

- 6.4 Off highway vehicle

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Aluminum

- 7.3 Copper

- 7.4 Others

Chapter 8 Market Estimates & Forecast, By Design, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Plate bar

- 8.3 Tube fin

- 8.4 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Ahaus Tool & Engineering

- 11.2 AKG Group

- 11.3 American Industrial Heat Transfer

- 11.4 Banco Products

- 11.5 Denso

- 11.6 G&M Radiator

- 11.7 Hanon Systems

- 11.8 HAUGG Group

- 11.9 Koyorad

- 11.10 Mahle

- 11.11 Modine Manufacturing

- 11.12 Nippon Light Metals

- 11.13 Nissens

- 11.14 S.M. Auto Engineering

- 11.15 Sanden

- 11.16 Senior

- 11.17 Spectra Premium

- 11.18 T.RAD Co.

- 11.19 Tokyo Radiator

- 11.20 Valeo