PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698244

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698244

Truck Refrigeration Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

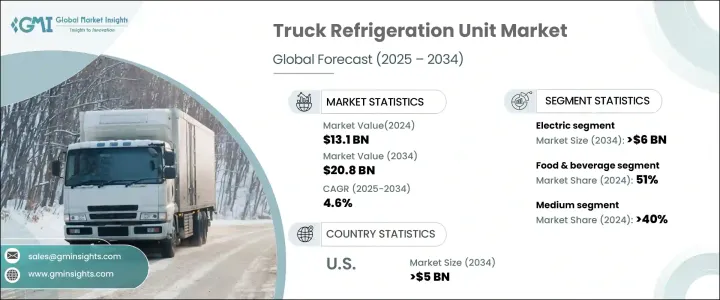

The Global Truck Refrigeration Unit Market, valued at USD 13.1 billion in 2024, is projected to expand at a CAGR of 4.6% between 2025 and 2034. The growth is driven by the rising demand for efficient transportation solutions that ensure product quality and security. The increasing need for temperature-controlled logistics is a key factor fueling this expansion, particularly in industries such as food and beverages, pharmaceuticals, and chemicals.

As cross-border trade continues to flourish and e-commerce platforms expand their reach, companies are investing heavily in innovative refrigeration technologies. These advancements help maintain the integrity of perishable goods while improving supply chain efficiency. Regulatory compliance is another major driver, with governments worldwide implementing strict temperature control guidelines for sensitive products. Companies are integrating cutting-edge solutions to meet these standards and optimize performance. Sustainability is also reshaping the market as businesses seek eco-friendly alternatives to reduce emissions and enhance energy efficiency. Electric and hybrid refrigeration units are gaining traction, with manufacturers focusing on long-term sustainability and operational cost reductions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.1 Billion |

| Forecast Value | $20.8 Billion |

| CAGR | 4.6% |

The market is segmented by propulsion type into internal combustion engine (ICE), electric, and hybrid refrigeration units. ICE-powered systems remain dominant, accounting for 45% of the market in 2024, largely due to their established infrastructure, widespread availability, and suitability for long-haul transportation. These units offer reliable cooling capabilities, making them the preferred choice for large-scale logistics operations. However, the industry is gradually shifting toward electric-powered refrigeration solutions. Advancements in battery technology are improving energy efficiency, making electric units an increasingly viable alternative. By 2034, the electric segment is projected to generate USD 6 billion, reflecting a strong push toward sustainable refrigeration options.

End-use applications for truck refrigeration units span various industries, with the food and beverage sector leading the market. In 2024, this segment accounted for 51% of the total market share, driven by the rising demand for fresh produce, dairy, frozen foods, and meat. Strict regulations mandating proper temperature control for perishable goods are pushing logistics providers to adopt advanced cooling technologies. The pharmaceutical industry is another major growth driver, expected to expand at a CAGR of 6% between 2025 and 2034. Vaccines, biologics, and temperature-sensitive medications require precise refrigeration solutions, leading to increased investment in specialized cold chain logistics.

The US truck refrigeration unit market generated USD 3.9 billion in 2024 and is projected to reach USD 5 billion by 2034. A well-established transportation and logistics network supports market expansion alongside strong demand from the food and pharmaceutical sectors. As sustainability concerns grow, companies in the US are actively integrating advanced refrigeration systems, including electric and hybrid models, to enhance efficiency and minimize environmental impact. With continuous technological advancements and regulatory pressure for greener alternatives, the market is poised for significant transformation in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Component Manufacturers

- 3.1.2 OEM

- 3.1.3 Distributors

- 3.1.4 End use

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Profit margin analysis

- 3.5 Patent landscape

- 3.6 Cost breakdown

- 3.7 Technology & innovation landscape

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for fresh and frozen food products

- 3.10.1.2 Growth in the pharmaceutical and biotechnology sectors

- 3.10.1.3 Expansion of e-commerce and last-mile delivery services

- 3.10.1.4 Technological advancements in electric and hybrid refrigeration units

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial costs and maintenance expenses for refrigeration units

- 3.10.2.2 Stringent environmental regulations

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 ICE engine

- 5.3 Electric

- 5.4 Hybrid

Chapter 6 Market Estimates & Forecast, By Temperature, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Frozen

- 6.3 Chilled

Chapter 7 Market Estimates & Forecast, By Trailer Size, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Below 20ft

- 7.3 20-40ft

- 7.4 Above 40ft

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Light Commercial Vehicles (LCV)

- 8.3 Medium Commercial Vehicles (MCV)

- 8.4 Heavy Commercial Vehicles (HCV)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Food & beverage

- 9.3 Pharmaceuticals

- 9.4 Chemicals

- 9.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Carrier Transicold

- 11.2 Daikin

- 11.3 Daimler

- 11.4 Denso

- 11.5 Frigoblock

- 11.6 GAH Refrigeration

- 11.7 Guangzhou Lianxing

- 11.8 Kingtec Refrigeration

- 11.9 Klinge Corporation

- 11.10 Lamberet

- 11.11 Mitsubishi Heavy Industries

- 11.12 Tewis Refrigeration

- 11.13 Thermo King

- 11.14 Thermoking India

- 11.15 Trane Technologies

- 11.16 Transport Refrigeration

- 11.17 Utility Trailer Manufacturing

- 11.18 Volvo Group

- 11.19 Webasto Group

- 11.20 Zanotti