PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698236

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698236

Battery Thermal Management System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

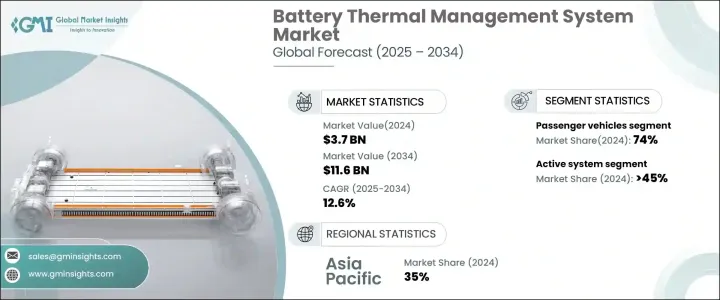

The Global Battery Thermal Management System Market was valued at USD 3.7 billion and is projected to expand at a CAGR of 12.6% between 2025 and 2034, driven by the rising production of electric vehicles (EVs) and advancements in battery technologies. As the demand for high-performance and long-lasting batteries continues to rise, manufacturers are focusing on innovative thermal management solutions that ensure battery efficiency, safety, and longevity.

With the shift towards EVs gaining momentum, battery thermal management systems have become a critical component in optimizing battery performance. These systems regulate temperature, prevent overheating, and enhance battery lifespan, addressing key concerns such as energy efficiency, charging speed, and safety. Stringent government regulations on battery safety and the increasing adoption of fast-charging technology are further fueling market growth. Additionally, the expansion of EV charging infrastructure and continuous research and development (R&D) in battery cooling technologies are creating lucrative opportunities for industry players.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $11.6 Billion |

| CAGR | 12.6% |

The market is segmented by the type of thermal management system, including active, passive, and hybrid systems. In 2024, the active system segment held a dominant 45% market share, primarily due to its ability to regulate temperature effectively within the battery pack. Active systems use liquid or air cooling mechanisms to maintain optimal thermal conditions, making them a preferred choice for high-performance batteries. Meanwhile, passive systems, which rely on natural cooling methods, are projected to grow at a CAGR of 14% through 2034 as they complement active systems in enhancing battery safety and efficiency. Hybrid systems, which integrate both active and passive cooling mechanisms, are also gaining traction due to their ability to provide superior temperature regulation.

By vehicle type, the battery thermal management system market is categorized into passenger vehicles and commercial vehicles. In 2024, passenger vehicles accounted for a substantial 74% market share, driven by the increasing adoption of EVs and the need for efficient battery cooling solutions. The growing preference for longer driving ranges and faster charging times has made advanced thermal management systems indispensable for passenger vehicles. However, commercial vehicles are expected to witness a faster growth rate, with a projected CAGR of 13% through 2034. The rising demand for electric trucks, buses, and delivery vans, along with government initiatives promoting sustainable transportation, is propelling the adoption of thermal management solutions in this segment.

Asia Pacific emerged as a key player in the battery thermal management system market, holding a 35% share in 2024. China leads the region, driving both production and consumption of thermal management solutions. The presence of well-established supply chains and major battery manufacturers in China, Taiwan, and India is boosting market expansion. The rapid increase in EV adoption, coupled with urbanization and supportive government policies, is further accelerating demand for battery thermal management systems in the region. Industry players are focusing on technological advancements, strategic partnerships, and manufacturing expansion to strengthen their market position in the competitive landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Use cases

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for electric vehicles (EVs)

- 3.9.1.2 Advancements in battery technology

- 3.9.1.3 Increasing adoption of fast-charging stations

- 3.9.1.4 Growing investment in EV infrastructure

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs

- 3.9.2.2 Complexity in integration

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Offering, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Active system

- 5.3 Passive system

- 5.4 Hybrid system

Chapter 6 Market Estimates & Forecast, By Battery, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Lithium-ion battery

- 6.3 Nickel-Metal Hydride (NiMH) battery

- 6.4 Lead-acid battery

- 6.5 Solid-state battery

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles Light

- 7.3.1 Commercial Vehicles (LCV)

- 7.3.2 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Battery Electric Vehicles (BEVs)

- 8.3 Plug-in Hybrid Electric Vehicles (PHEVs)

- 8.4 Hybrid Electric Vehicles (HEVs)

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv PLC

- 10.2 BASF

- 10.3 Bosch

- 10.4 Continental

- 10.5 Dana Limited

- 10.6 Gentherm

- 10.7 Hanon Systems

- 10.8 Hitachi

- 10.9 Infineon

- 10.10 Johnson Control

- 10.11 MAHLE GmbH

- 10.12 Marelli

- 10.13 Modine

- 10.14 Modine Manufacturing

- 10.15 Sanden Corporation

- 10.16 Schaeffler

- 10.17 Valeo

- 10.18 Vitesco Technologies

- 10.19 VOSS Automotive

- 10.20 ZF Friedrichshafen