PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698234

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698234

Insomnia Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

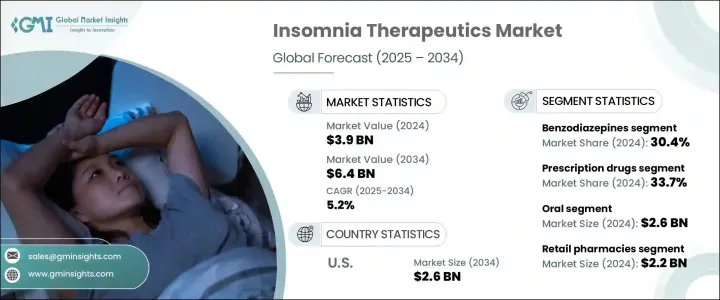

The Global Insomnia Therapeutics Market was valued at USD 3.9 billion in 2024 and is projected to grow at a CAGR of 5.2% between 2025 and 2034. Insomnia therapeutics encompass a broad spectrum of treatments designed to help individuals struggling with sleep disorders, particularly those who have difficulty falling asleep or maintaining sleep. The increasing prevalence of insomnia worldwide, driven by modern-day stressors, shifting lifestyles, and aging populations, is fueling the demand for effective treatment solutions. With growing awareness of the impact of sleep disorders on overall health, the market for insomnia therapeutics is expanding rapidly, providing significant growth opportunities for pharmaceutical companies, healthcare providers, and digital health platforms.

Rising cases of chronic insomnia are propelling innovation in drug development and alternative therapies. Stress-related sleep disorders have surged due to urbanization, long working hours, and increased screen time, leading to a higher demand for prescription and over-the-counter (OTC) medications. Advancements in cognitive behavioral therapy for insomnia (CBT-I) and the integration of artificial intelligence in sleep management solutions are further reshaping the market. Additionally, increased research funding and regulatory approvals for novel insomnia treatments are expected to bolster market expansion. The emphasis on personalized treatment plans and precision medicine is also gaining traction, enabling tailored solutions that cater to individual patient needs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $6.4 Billion |

| CAGR | 5.2% |

The market is categorized by drug class, with key segments including benzodiazepines, non-benzodiazepines, orexin receptor antagonists, antidepressants, antihistamines, melatonin supplements, and other medications. Benzodiazepines held the largest share of the market in 2024, accounting for 30.4% of total sales. These drugs are widely prescribed for insomnia associated with stress and anxiety, as they effectively reduce sleep onset time and enhance sleep quality. Their continued popularity stems from their fast-acting results and widespread availability, making them a dominant choice in insomnia treatment.

The insomnia therapeutics market is further segmented by sales channels, with prescription and OTC drugs as the two primary categories. In 2024, prescription drugs accounted for 33.7% of total market sales. The rise of telemedicine and online healthcare consultations has made it easier for individuals to receive timely diagnoses and appropriate treatment, contributing to increased prescription medication sales. Additionally, growing consumer awareness about the health risks of sleep deprivation and its link to mental health disorders has encouraged more individuals to seek medical intervention.

The U.S. Insomnia Therapeutics Market generated USD 1.6 billion in 2024 and is expected to reach USD 2.6 billion by 2034. The presence of leading pharmaceutical companies, coupled with robust research initiatives and regulatory support, is driving market growth in the country. U.S.-based healthcare organizations continue to emphasize the importance of sleep health, advocating for increased research funding and innovative treatment solutions. FDA approvals for new and improved insomnia drugs are further accelerating market expansion, solidifying the U.S. as a key player in the global insomnia therapeutics industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of insomnia

- 3.2.1.2 Advancements in research and development

- 3.2.1.3 Growing awareness of sleep disorders

- 3.2.1.4 Increasing global geriatric population

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of biologic and advanced therapies

- 3.2.2.2 Side effects and compliance issues

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Patent analysis

- 3.7 Pipeline analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Benzodiazepines

- 5.3 Non-benzodiazepine

- 5.4 Orexin receptor antagonists

- 5.5 Antidepressants

- 5.6 Antihistamines

- 5.7 Melatonin supplements

- 5.8 Other drug classes

Chapter 6 Market Estimates and Forecast, By Sales Channel, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Over-the-counter (OTC) drugs

- 6.3 Prescription drugs

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

- 7.4 Transdermal

- 7.5 Intranasal

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Eisai

- 10.2 Eli Lilly and Company

- 10.3 Meiji Seika Pharma

- 10.4 Merck & Co.

- 10.5 Neurocrine Biosciences

- 10.6 Pfizer

- 10.7 Sanofi

- 10.8 Takeda Pharmaceutical Company Limited

- 10.9 Teva Pharmaceutical Industries

- 10.10 Vanda Pharmaceuticals

- 10.11 Woodward Pharma Services