PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698231

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1698231

Lawful Interception Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025-2034

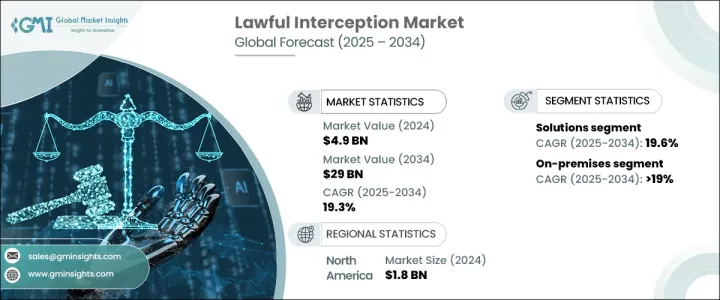

The Global Lawful Interception Market, valued at USD 4.9 billion in 2024, is expected to grow at a CAGR of 19.3% from 2025 to 2034. This market growth is primarily driven by the rapid expansion of 5G technology, the surge of Internet of Things (IoT) devices, and the rising volumes of data traffic that are enhancing connectivity worldwide. However, the transition to 5G has introduced substantial security concerns, as the increased speed and reduced latency of these networks make them more vulnerable to exploitation by criminals and cyber threats. The global emphasis on improving cyber laws and regulations to address issues like cybercrime, terrorism, and other security threats is creating new opportunities for companies in the lawful interception sector. Governments worldwide have established stricter compliance requirements for telecom service providers to ensure that networks can accommodate lawful interception, all while balancing privacy concerns.

The lawful interception market is divided into solutions and services, with the solutions segment leading the market, accounting for USD 3.3 billion in 2024. This segment is projected to maintain its dominance, with a CAGR of 19.6%. Telecom providers, intelligence agencies, and governments focus on deploying advanced mediation devices, probes, and interfaces that ensure interception capabilities for voice, data, and video communication. These technologies help meet the growing demand for real-time monitoring, which is essential for national security, counterterrorism, and cybercrime prevention.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $29 Billion |

| CAGR | 19.3% |

Additionally, the market is segmented by deployment modes into on-premises and cloud-based solutions, with on-premises systems commanding 73% of the market share in 2024. These solutions are crucial for real-time monitoring, which is integral to law enforcement and security operations. The increasing sophistication of cyber threats, along with the global expansion of IoT devices and the transition to 5G, is spurring innovation in interception technologies.

North America continues to lead the lawful interception market, driven by strict regulations such as the Communications Assistance for Law Enforcement Act (CALEA), which ensures compliance among service providers. As 5G networks and IoT devices become more prevalent, telecom providers and government agencies face the challenge of developing more advanced interception technologies to stay ahead of emerging security threats.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 Network operators/communication service providers (CSPs)

- 3.2.3 System integrators

- 3.2.4 Law enforcement and intelligence agencies

- 3.2.5 Regulators/governments

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising cybercrime and terrorism threats

- 3.8.1.2 The rapid deployment of 5G and the rise of IoT-connected devices

- 3.8.1.3 Governments worldwide enforcing stricter compliance regulations

- 3.8.1.4 Advancements in AI and big data analytics

- 3.8.1.5 Growing digital communication platforms

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Privacy concerns and ethical issues

- 3.8.2.2 Encryption and end-to-end security

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solutions

- 5.2.1 Mediation devices

- 5.2.2 Intercept access points

- 5.2.3 Routers & gateways

- 5.2.4 Handover interfaces

- 5.2.5 Probes

- 5.2.6 Network management systems

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

Chapter 6 Market Estimates & Forecast, By Network Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Voice-over-internet protocol (VoIP)

- 6.3 Long term evolution (LTE)

- 6.4 Wireless local area network (WLAN)

- 6.5 Worldwide interoperability for microwave access (WiMAX)

- 6.6 Digital subscriber line (DSL)

- 6.7 Public switched telephone network (PSTN)

- 6.8 Integrated services for digital network (ISDN)

- 6.9 Others

Chapter 7 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Voice communication

- 7.3 Data communication

- 7.4 Video communication

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud-based

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Government & law enforcement agencies

- 9.3 Intelligence agencies

- 9.4 Telecom service providers

- 9.5 Internet service providers (ISPs)

- 9.6 Enterprises

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AQSACOM

- 11.2 AT&T Inc

- 11.3 Atos

- 11.4 BAE Systems

- 11.5 Cisco Systems

- 11.6 ClearTrail Technologies

- 11.7 Elbit Systems

- 11.8 Ericsson

- 11.9 Gamma Group

- 11.10 Incognito Software Systems

- 11.11 IPS S.p.A

- 11.12 NetQuest Corporation

- 11.13 NICE Systems

- 11.14 Nokia

- 11.15 SS8 Networks

- 11.16 Trovicor Intelligence

- 11.17 Utimaco

- 11.18 Verint Systems

- 11.19 Vocal Technologies Ltd

- 11.20 ZTE Corporation