PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685228

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685228

Oyster and Clam Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

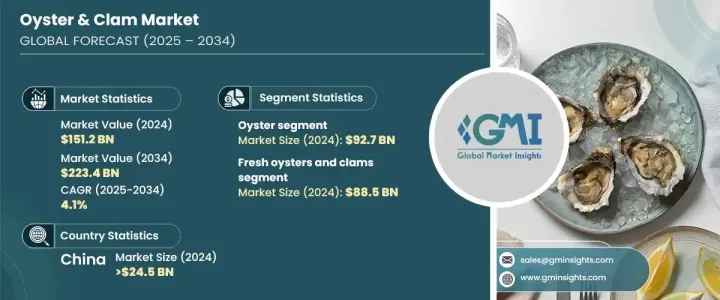

The Global Oyster And Clam Market reached USD 151.2 billion in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2034. Oysters and clams continue to be an essential part of the seafood industry, recognized for their distinct taste, versatility in the kitchen, and numerous health benefits. The increasing consumer preference for nutritious, sustainable, and premium sources of protein has significantly contributed to the market's expansion. Oysters and clams offer a wealth of nutritional benefits, including omega-3 fatty acids, vitamins, and minerals that support cardiovascular and cognitive health. As more people turn to seafood as a health-conscious option, the demand for these mollusks has been on the rise, making them a staple in kitchens worldwide. With this increasing awareness of their health advantages, oysters and clams are becoming integral to diets globally, not only in traditional regions but also in emerging markets, pushing the boundaries of their culinary reach.

In 2024, oysters are the dominant category, generating USD 92.7 billion. Each type, whether oysters or clams, is distinguished by its unique flavor and texture, catering to a wide variety of consumer preferences. These differences allow them to be incorporated into an extensive range of dishes, from appetizers to main courses, in both home cooking and high-end restaurants. Fresh oysters and clams are particularly popular, generating USD 88.5 billion in 2024 and commanding 60% of the market share. Consumers continue to favor fresh seafood for its unmatched flavor and quality, making it the go-to option for dining establishments. Meanwhile, frozen oysters and clams remain a viable choice for many due to their convenience, longer shelf life, and maintained quality. This growing trend towards frozen seafood reflects the increasing need for options that provide easy access without compromising on taste and nutritional value.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $151.2 Billion |

| Forecast Value | $223.4 Billion |

| CAGR | 4.1% |

In terms of distribution, the retail sector is showing robust growth, expected to expand at a CAGR of 3.5% through 2034. With more consumers turning to supermarkets, seafood specialty stores, and online platforms for their seafood purchases, the retail market is becoming an essential channel. The food service sector continues to play a significant role, driven by the increasing popularity of seafood dishes in restaurants and catering services. From casual eateries to fine dining, oysters and clams are a popular choice, ensuring the continued strength of food service as a key distribution channel.

In 2024, China's oyster and clam market alone generated USD 24.5 billion, solidifying its position as a leading player in the global market. The country's vast aquaculture industry, along with diverse species of oysters and clams, contributes to its dominance. Extensive farming operations along China's coastlines provide a steady supply of these mollusks to global markets, especially North America and Europe, further fueling international trade and establishing China as a key export hub in the industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for seafood

- 3.6.1.2 Perceived Health Benefits

- 3.6.1.3 Rising culinary trends amongst young generation

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Threat of disease and parasites

- 3.6.2.2 Changing climate conditions impacting availability & quality

- 3.6.2.3 Market Volatality

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Oyster type

- 5.2.1 Slipper oyster

- 5.2.2 Pacific cupped oyster

- 5.3 Clam type

- 5.3.1 Hard clam

- 5.3.2 Taca clam

- 5.3.3 Stimpson surf

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Fresh

- 6.3 Frozen

- 6.4 Canned

Chapter 7 Market Size and Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Retail

- 7.3 Foodservice

- 7.4 Other

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Clearwater Seafoods

- 9.2 Colville Bay Oyster Co. Ltd

- 9.3 Five Star Shellfish Inc

- 9.4 High Liner Foods

- 9.5 Island Creek Oysters

- 9.6 Mazetta Company, LLC

- 9.7 Pacific Seafood

- 9.8 Pangea Shellfish Company

- 9.9 Royal Hawaiian Seafood

- 9.10 Taylor Shellfish Farms

- 9.11 Ward Oyster Company

- 9.12 Woodstown Bay Shellfish Ltd