PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685213

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685213

Electrical Insulation Materials Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

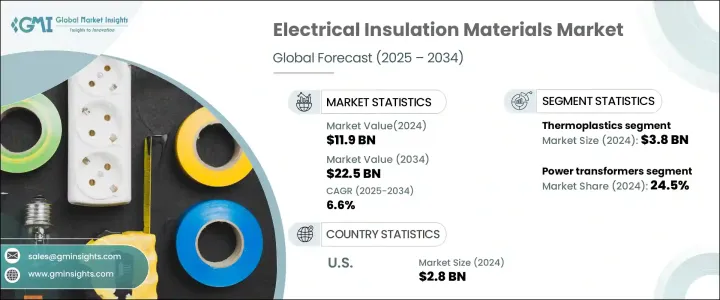

The Global Electrical Insulation Materials Market reached USD 11.9 billion in 2024 and is set to expand at a CAGR of 6.6% from 2025 to 2034. This growth is driven by the increasing demand for efficient, reliable, and safe electrical systems across various industries. Electrical insulation materials play a critical role in protecting electrical components, ensuring longevity, and enhancing system performance in both commercial and industrial applications.

As industries evolve, there is a rising need for innovative, durable, and sustainable insulation solutions to meet stricter regulations and performance standards. Advancements in material technology, along with a growing emphasis on energy efficiency and sustainability, are further fueling demand. The continued expansion of infrastructure, particularly in renewable energy and modernized electrical grids, is also contributing to the positive market outlook. With the ongoing shift toward eco-friendly solutions, manufacturers are focusing on providing products that not only improve performance but are also environmentally responsible.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.9 Billion |

| Forecast Value | $22.5 Billion |

| CAGR | 6.6% |

Based on material type, the market segments include thermosets, fiberglass, mica, ceramics, thermoplastics, cellulose, cotton, and others. In 2024, the thermoplastics segment generated USD 3.8 billion. Thermosets are known for their exceptional durability and high-temperature resistance, making them a popular choice in demanding applications. Ceramics are highly valued for their superior dielectric properties, ideal for high-voltage operations, while fiberglass provides strength and excellent insulation capabilities. Mica remains a preferred material in high-voltage environments, providing both heat resistance and electrical protection. Additionally, cellulose and cotton are emerging as eco-friendly materials that offer fire resistance, aligning with the growing trend of sustainable and safe solutions in the electrical sector.

The applications of electrical insulation materials are wide-ranging, serving industries like power transformers, distribution transformers, electrical motors and generators, wires and cables, switchgear, batteries, and circuit breakers. Power transformers accounted for 24.5% of the market share in 2024, with strong growth expected through 2034. Insulation materials are crucial for optimizing the performance and efficiency of distribution transformers and electrical motors, further boosting demand across critical sectors such as power generation, transmission, and industrial automation.

In the U.S., the electrical insulation materials market reached USD 2.8 billion in 2024 and is expected to grow significantly due to substantial investments in infrastructure. Modernizing outdated electrical grids and expanding renewable energy initiatives are driving the adoption of advanced insulation materials. With a focus on sustainability and energy-efficient solutions, the U.S. is poised to remain a major player in the regional market, ensuring continued growth throughout the forecast period.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in automotive industry

- 3.6.1.2 Rising adoption in aerospace applications

- 3.6.1.3 Growing chemical processing industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of electrical insulation materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Material, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fluorocarbon elastomers (FKM)

- 5.3 Perelectrical insulation materials (FFKM)

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Seals and gaskets

- 6.3 O-rings

- 6.4 Hoses and tubings

- 6.5 Others

Chapter 7 Market Size and Forecast, By End Use Industries, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace

- 7.4 Oil & gas

- 7.5 Chemical processing

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 AGC (Asahi Glass)

- 9.3 Chemours

- 9.4 Daikin Industries

- 9.5 DowDuPont

- 9.6 DuPont (E. I. du Pont de Nemours and Company)

- 9.7 Gujarat Fluorochemicals

- 9.8 HaloPolymer

- 9.9 Mitsui Chemicals

- 9.10 Momentive Performance Materials

- 9.11 Saint-Gobain Performance Plastics

- 9.12 Shin-Etsu Chemical

- 9.13 Solvay

- 9.14 Wacker Chemie

- 9.15 Zeon Corporation