PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685188

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685188

Endocrine Testing Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

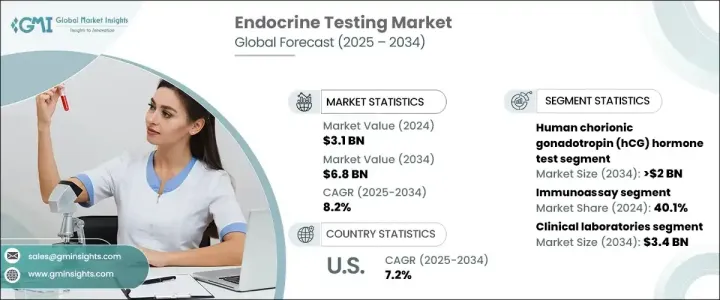

The Global Endocrine Testing Market, valued at USD 3.1 billion in 2024, is poised for significant growth, with a projected CAGR of 8.2% from 2025 to 2034. This growth is driven by several factors, including the rising prevalence of endocrine disorders, increasing awareness of routine health check-ups, and government-backed initiatives aimed at improving healthcare accessibility. The growing emphasis on preventive healthcare has led to a surge in demand for endocrine tests, particularly among individuals managing chronic conditions such as diabetes and thyroid disorders.

Technological advancements in diagnostic tools and improved access to testing services are further accelerating market expansion. The integration of innovative testing methods, such as point-of-care diagnostics and personalized healthcare solutions, is also reshaping the landscape, making endocrine testing more accessible and efficient. As healthcare systems worldwide prioritize early detection and management of endocrine-related conditions, the market is expected to witness sustained growth over the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.1 Billion |

| Forecast Value | $6.8 Billion |

| CAGR | 8.2% |

Among the various test types, the human chorionic gonadotropin (hCG) hormone test is anticipated to grow at a CAGR of 7.6%, reaching USD 2 billion by 2034. Widely used for pregnancy detection, hCG tests are favored for their accuracy and ease of use. These tests are readily available in both clinical settings and for at-home use, making them a convenient option for individuals seeking reliable pregnancy confirmation. The increasing adoption of these tests reflects the growing demand for user-friendly and precise diagnostic solutions.

The market is segmented by end-use, with clinical laboratories holding the largest share in 2024. This segment is projected to reach USD 3.4 billion by 2034. Clinical laboratories are equipped with advanced diagnostic technologies and staffed by skilled professionals, making them the preferred choice for accurate hormone testing. These facilities specialize in comprehensive diagnostic services for conditions such as diabetes, thyroid dysfunction, and adrenal disorders, which require detailed and precise testing. The expertise and reliability offered by clinical laboratories continue to drive their dominance in the market.

The U.S. endocrine testing market generated USD 1.2 billion in 2024 and is forecast to grow at a CAGR of 7.2% through 2034. The presence of leading diagnostic firms and laboratories offering state-of-the-art testing solutions supports the market's growth in the United States. Government initiatives aimed at addressing chronic illnesses and promoting preventive care further contribute to the market's expansion. Additionally, the increasing adoption of point-of-care testing and personalized healthcare solutions is driving demand for endocrine testing across the country. As the focus on early diagnosis and tailored treatment options intensifies, the U.S. market is expected to remain a key contributor to the global endocrine testing industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of diabetes, thyroid, and obesity

- 3.2.1.2 Supportive government funding initiatives

- 3.2.1.3 Technological advancements

- 3.2.1.4 Growing awareness of routine health monitoring

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost for the development of testing technologies

- 3.2.2.2 Lack of awareness

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Human chorionic gonadotropin (hCG) hormone test

- 5.3 Thyroid stimulating hormone (TSH) test

- 5.4 Insulin test

- 5.5 Progesterone test

- 5.6 Luteinizing hormone (LH) test

- 5.7 Prolactin test

- 5.8 Other test types

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Immunoassay

- 6.3 Mass spectroscopy

- 6.4 Chromatography

- 6.5 Nucleic acid based

- 6.6 Other technologies

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Clinical laboratories

- 7.3 Hospitals

- 7.4 Diagnostic centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 Agilent

- 9.3 BECKMAN COULTER

- 9.4 BIO RAD

- 9.5 biomedical TECHNOLOGIES

- 9.6 BIOMERIEUX

- 9.7 DH TECH

- 9.8 Diasorin

- 9.9 labcorp

- 9.10 QuidelOrtho

- 9.11 QIAGEN

- 9.12 Quest Diagnostics

- 9.13 Roche

- 9.14 SCIEX

- 9.15 SIEMENS Healthineers

- 9.16 Thermo Fisher SCIENTIFIC