PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685179

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685179

Atherectomy Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

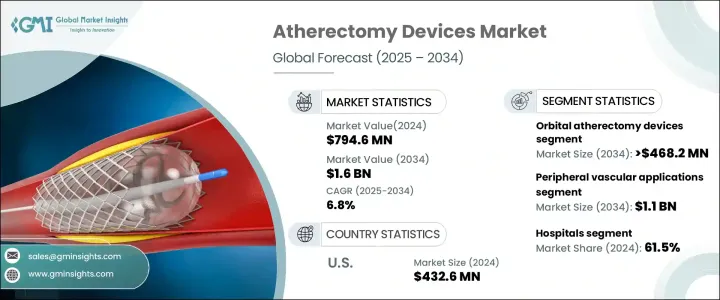

The Global Atherectomy Devices Market reached USD 794.6 million in 2024 and is projected to grow at a CAGR of 6.8% between 2025 and 2034. The rising prevalence of peripheral artery disease (PAD) and coronary artery disease (CAD) is fueling demand for advanced treatment solutions. As aging populations increase and sedentary lifestyles become more common, cases of diabetes and obesity are surging, further driving the need for minimally invasive procedures. Healthcare providers are seeking precision-driven solutions to enhance plaque removal while minimizing complications, making atherectomy devices an essential tool in cardiovascular treatment.

The increasing shift toward patient-centric healthcare is pushing hospitals and medical centers to adopt technologies that improve clinical outcomes. Minimally invasive atherectomy procedures offer faster recovery times, reduced hospital stays, and lower risks of post-surgical complications compared to traditional treatment methods. This shift is encouraging higher adoption rates among physicians and patients. Continuous technological advancements, regulatory approvals, and ongoing clinical trials are strengthening confidence in these devices, paving the way for their broader implementation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 794.6 Million |

| Forecast Value | $ 1.6 Billion |

| CAGR | 6.8% |

Market expansion is also being driven by growing investment in research and development. Companies are introducing innovative atherectomy systems that provide superior efficiency, precision, and safety. Automated and AI-integrated devices are emerging, allowing clinicians to optimize treatment approaches while reducing procedure times. Favorable reimbursement policies and an increasing number of outpatient cardiovascular procedures are further propelling market growth. As medical institutions prioritize cost-effective solutions that deliver high success rates, atherectomy devices continue to gain momentum.

By product type, the market is segmented into orbital, laser, directional, and rotational atherectomy devices. Orbital atherectomy devices are set to experience substantial growth, with market value expected to reach USD 468.2 million by 2034 at a CAGR of 6.6%. These devices improve procedural accuracy by utilizing a high-speed spinning crown or burr to remove plaque while preserving arterial integrity. Their consistent success in treating both peripheral and coronary arteries has positioned them as a preferred choice among healthcare professionals managing complex cases. As hospitals and surgical centers prioritize innovative and efficient treatment options, the demand for orbital atherectomy devices continues to rise.

Based on application, the market is divided into peripheral vascular and coronary procedures. The peripheral vascular segment is expected to expand significantly, projected to reach USD 1.1 billion by 2034 at a CAGR of 6.3%. Peripheral artery disease severely impacts mobility and quality of life, creating an urgent need for effective treatment alternatives. Atherectomy procedures offer notable advantages, including reduced recovery periods, fewer complications, and shorter hospital stays compared to traditional surgery. As awareness of these benefits grows, more patients and healthcare providers are opting for minimally invasive interventions, boosting the demand for atherectomy devices.

The U.S. atherectomy devices market accounted for USD 432.6 million in 2024 and is anticipated to grow at a CAGR of 6.2% from 2025 to 2034. The country's increasing burden of cardiovascular diseases, including PAD and CAD, is driving demand for advanced treatment solutions. A growing elderly population, coupled with high obesity and diabetes rates, is further accelerating market growth. Medical institutions are increasingly adopting cutting-edge atherectomy devices that enhance procedural precision, improve patient safety, and ensure faster recoveries. As the demand for minimally invasive cardiovascular procedures rises, the U.S. market is expected to maintain its dominant position in the global landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in preference for minimally invasive procedures

- 3.2.1.2 Growing target patient population

- 3.2.1.3 Recent technological advancements

- 3.2.1.4 Rising prevalence of peripheral arterial diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of the products

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Reimbursement scenario

- 3.6 Technology landscape

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Orbital atherectomy devices

- 5.3 Laser atherectomy devices

- 5.4 Directional atherectomy devices

- 5.5 Rotational atherectomy devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Peripheral vascular applications

- 6.3 Coronary applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott

- 9.2 angiodynamics

- 9.3 AVINGER

- 9.4 B. Braun

- 9.5 BD (Becton, Dickinson and Company)

- 9.6 BIOMERICS

- 9.7 Boston Scientific

- 9.8 Cardinal Health

- 9.9 Cardiovascular Systems

- 9.10 Cordis

- 9.11 Philips

- 9.12 Medtronic

- 9.13 Nipro

- 9.14 Rex Medical

- 9.15 TERUMO