PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685157

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685157

Autonomous Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

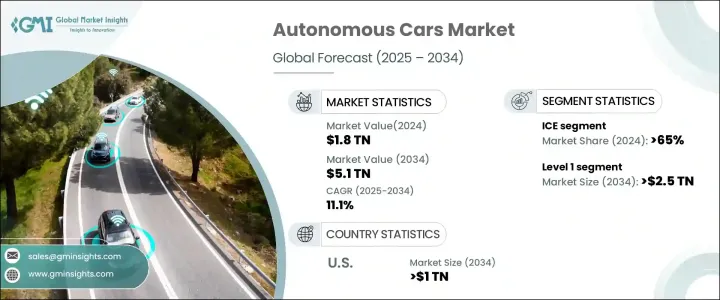

The Global Autonomous Cars Market reached USD 1.8 trillion by 2024 and is anticipated to grow at a CAGR of 11.1% through 2034. This surge is primarily driven by breakthroughs in artificial intelligence (AI) and machine learning, which are enhancing vehicle autonomy. Recent advancements in sensor technologies, such as LiDAR and cameras, have enabled vehicles to interact with their surroundings more reliably, leading to increased consumer confidence in adopting autonomous vehicles. These technological improvements are not only transforming vehicle capabilities but also improving real-time decision-making, which bolsters safety and optimizes routing efficiency. As the demand for connected and autonomous vehicles rises, these technologies are becoming essential to meet the growing consumer interest and expectations.

Another factor contributing to market expansion is the growing emphasis on traffic safety. Autonomous vehicles aim to reduce human error, which is responsible for a significant number of road accidents. The implementation of automated safety systems such as collision detection, adaptive cruise control, and automatic braking enhances safety and accelerates the market's growth. Governments and industry bodies are supporting the development and deployment of these systems through favorable regulations, further fueling market expansion. As autonomous technologies continue to evolve, they are expected to make an even greater impact on road safety and efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Trillion |

| Forecast Value | $5.1 Trillion |

| CAGR | 11.1% |

The market is segmented by levels of automation, including Level 1, Level 2, Level 3, and Level 4. As of 2024, Level 1 automation commands over 55% of the market share, a position it is expected to maintain through 2034, with projections to exceed USD 2.5 trillion. This level is particularly attractive due to its versatility and cost-effectiveness, as it can be incorporated into a wide range of vehicles without requiring major infrastructure changes. Features such as lane-keeping assistance and adaptive cruise control not only improve driver safety but also cater to consumers who are hesitant to fully embrace autonomous systems.

Fuel type also plays a significant role in the market, with internal combustion engines (ICE), electric, and hybrid engines making up the major segments. In 2024, ICE vehicles accounted for more than 65% of the market. The widespread use of ICE vehicles, coupled with their relatively lower cost, ensures their continued dominance in the market. ICE vehicles are compatible with existing fuel infrastructure, which enhances their practicality and appeal to consumers.

Geographically, the United States leads the North American market, holding more than 90% of the regional share in 2024, with projections to surpass USD 1 trillion by 2034. The U.S. is a hub for autonomous car technology, thanks to its robust technological infrastructure and significant investments in AI, machine learning, and sensor technologies. Additionally, the U.S. benefits from a supportive regulatory framework that facilitates testing and deployment of autonomous vehicles. The strong demand for electric and self-driving vehicles, coupled with the rapid development of supporting infrastructure, is expected to further drive market growth in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Autonomous car manufacturers

- 3.2.3 Technology providers

- 3.2.4 Distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Price trend

- 3.5 Cost breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Patent analysis

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising adoption of eco-friendly transportation

- 3.10.1.2 Growing autonomous car startups

- 3.10.1.3 Increasing adoption of self-driving technologies in North America

- 3.10.1.4 Supportive government regulations for autonomous driving technology

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Increasing technological advancements

- 3.10.2.2 High initial investments in autonomous cars

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Autonomy, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Level 1

- 5.3 Level 2

- 5.4 Level 3

- 5.5 Level 4

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 ICE

- 6.3 Electric

- 6.4 Hybrid

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Personal

- 7.3 Shared mobility

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Aptiv

- 9.2 Aurora Innovation

- 9.3 Baidu Apollo

- 9.4 BMW Group

- 9.5 Ford Motor

- 9.6 General Motors

- 9.7 Honda Motor

- 9.8 Hyundai Motor

- 9.9 Mercedes-Benz

- 9.10 Mobileye

- 9.11 NIO

- 9.12 Nissan Motor

- 9.13 Rivian Automotive

- 9.14 Stellantis N.V.

- 9.15 Tesla

- 9.16 Toyota Motor

- 9.17 Volkswagen Group

- 9.18 Volvo Cars

- 9.19 Waymo

- 9.20 Zoox