PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685150

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685150

Buckwheat Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

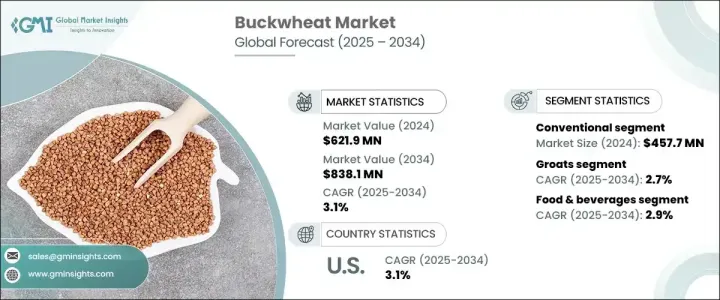

The Global Buckwheat Market, valued at USD 621.9 million in 2024, is expected to grow at a steady CAGR of 3.1% from 2025 to 2034. This growth is largely driven by the rising consumer awareness of buckwheat's impressive health benefits. The grain is known for being naturally gluten-free, which appeals to those with dietary restrictions, particularly individuals with celiac disease. Additionally, buckwheat is packed with essential nutrients, including high-quality protein, dietary fiber, B vitamins, and crucial minerals such as magnesium, which further bolsters its reputation as a healthful and versatile food option. As more people seek healthier, plant-based alternatives, the demand for buckwheat has surged. This trend aligns with the growing consumer preference for organic and gluten-free products, making it an ideal choice for individuals adopting cleaner, more health-conscious diets.

Buckwheat's nutritional profile positions it as a highly sought-after alternative for those looking to reduce chronic disease risks and manage their health more effectively. With its ability to be incorporated into a variety of products, such as flour, noodles, and snacks, buckwheat is increasingly found in consumer kitchens. The market's future growth is also supported by the ongoing trend toward sustainable and eco-friendly agriculture, as buckwheat is known for being relatively easy to grow and requiring fewer pesticides compared to other grains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $621.9 Million |

| Forecast Value | $838.1 Million |

| CAGR | 3.1% |

The conventional buckwheat segment has been the dominant player in the market, with a revenue of USD 457.7 million in 2024. It is expected to maintain a steady growth rate of 2.8% CAGR during the forecast period. Conventional buckwheat products are widely accessible and cost-effective, making them an attractive choice for consumers who are budget-conscious but still want to enjoy the benefits of this nutritious grain. These products offer a balance between affordability and health, ensuring their sustained demand across various markets globally.

In terms of product type, buckwheat groats generated USD 244.4 million in revenue in 2024, and this segment is projected to grow at a CAGR of 2.7% through 2034. Groats, known for their rich nutritional content, have gained substantial popularity among health-conscious consumers. They are recognized for their high protein and fiber content, along with their broad range of essential vitamins and minerals, making them a powerful dietary addition for those focused on nutrition.

The U.S. buckwheat market reached USD 121.4 million in 2024 and is forecast to grow at a CAGR of 3.1% through 2034. As demand for gluten-free, plant-based, and health-focused products increases, buckwheat is rapidly gaining popularity in this region. With more consumers adopting vegetarian and vegan diets, buckwheat is becoming a staple due to its versatility and remarkable nutritional profile. The grain's role in the production of gluten-free flour, noodles, and a variety of snacks has further propelled its growth in the U.S. market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Health and wellness trends

- 3.6.1.2 Increased consumption

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Weather and climate condition

- 3.6.2.2 Limited geographical range

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Source, 2021-2034 (USD Million) (Tons)

- 5.1 Key trends

- 5.2 Organic

- 5.3 Conventional

Chapter 6 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Tons)

- 6.1 Key trends

- 6.2 Groats

- 6.3 Flour

- 6.4 Flakes

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Tons)

- 7.1 Key trends

- 7.2 Food & beverages

- 7.3 Animal feed

- 7.4 Personal care & cosmetics

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland Company (ADM)

- 9.2 Birkett Mills

- 9.3 Bob's Red Mill Natural Foods

- 9.4 Bulk Barn Foods

- 9.5 Galinta IR Partneriai

- 9.6 Homestead Organics

- 9.7 Krishna India

- 9.8 Lee Kum Kee

- 9.9 Minn-Dak Growers

- 9.10 Ningxia Newfield Foods

- 9.11 Skvyrskyi Grain Processing Factory

- 9.12 UA Global

- 9.13 Wilmar International