PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685148

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685148

Intrusion Detection System / Intrusion Prevention System (IDS / IPS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

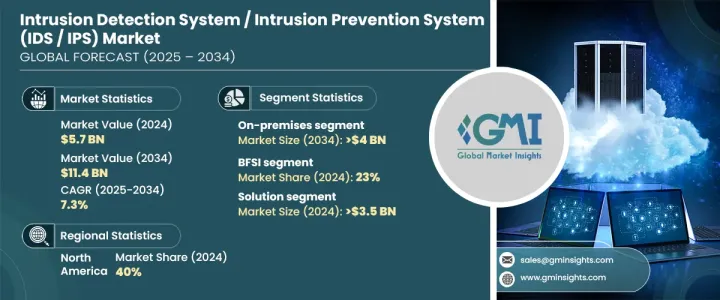

The Global Intrusion Detection System / Intrusion Prevention System Market was valued at USD 5.7 billion in 2024 and is projected to grow at a CAGR of 7.3% from 2025 to 2034. The increasing sophistication of cyber threats has driven the demand for advanced IDS/IPS solutions to protect networks, applications, and sensitive data. Businesses across industries are prioritizing these systems to enhance security, prevent unauthorized access, and detect potential breaches in real-time. The market's growth is further fueled by the rapid adoption of digital technologies, rising concerns over data breaches, and the need to comply with stringent data protection regulations.

As organizations recognize the growing value of sensitive data, investments in IDS/IPS solutions have become a critical component of their cybersecurity strategies. Additionally, the increasing reliance on cloud computing, IoT devices, and remote work environments has heightened the need for robust security measures, further propelling the market's expansion. The integration of artificial intelligence and machine learning into IDS/IPS systems is also enhancing their capabilities, enabling real-time threat detection and proactive responses to evolving cyber risks.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $11.4 Billion |

| CAGR | 7.3% |

The market is segmented by deployment models into on-premises, cloud, and hybrid solutions. In 2024, the on-premises segment accounted for over 40% of the market share and is expected to surpass USD 4 billion by 2034. Industries handling highly sensitive data, such as government, finance, and healthcare, prefer on-premises systems due to their enhanced control and security. These sectors prioritize mitigating third-party risks and ensuring compliance with regulations like HIPAA, PCI DSS, and GDPR. Additionally, industries such as aerospace and energy benefit from on-premises IDS/IPS solutions, as they allow for customized detection rules tailored to specific security needs. The cloud and hybrid deployment models are also gaining traction, driven by their scalability, cost-effectiveness, and ability to support remote operations.

By application, the IDS/IPS market serves various sectors, including BFSI (banking, financial services, and insurance), healthcare, IT and telecom, government, manufacturing, transportation and logistics, and retail. The BFSI segment held approximately 23% of the market share in 2024, driven by the increasing prevalence of digital transactions and the rising risk of cybercrime. As digital banking continues to grow, financial institutions are investing heavily in IDS/IPS solutions to safeguard sensitive customer data and maintain trust. Similarly, the healthcare sector is adopting these systems to protect patient data and comply with regulations, while the IT and telecom industry leverages IDS/IPS to secure vast networks and prevent service disruptions.

North America dominated the IDS/IPS market in 2024, holding a 40% share, with the United States being the largest contributor. The region's demand for advanced security systems is driven by the increasing frequency of cyberattacks targeting critical infrastructure, government organizations, and financial institutions. Cybercriminals are employing more sophisticated tactics, such as network intrusions and email compromises, which has intensified the need for reliable IDS/IPS solutions. As businesses and governments in North America continue to prioritize cybersecurity, the adoption of IDS/IPS systems is expected to remain strong, ensuring robust protection against evolving threats.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 IDS/IPS solution providers

- 3.1.2 IDS/IPS service providers

- 3.1.3 System integrators

- 3.1.4 Value-Added Resellers (VARs) and distributors

- 3.1.5 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Cybersecurity threats, by region

- 3.9 Case studies

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing frequency and sophistication of cyberattacks

- 3.10.1.2 Rapid adoption of cloud services and hybrid infrastructures

- 3.10.1.3 Rising integration of IoT devices

- 3.10.1.4 Growing regulatory compliance requirements

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High implementation and operational costs

- 3.10.2.2 Increasing complexity in managing false positives and maintaining system accuracy

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 IDS/IPS software

- 5.2.2 Physical/virtual appliances

- 5.2.3 Integrated security platforms

- 5.3 Services

- 5.3.1 Managed services

- 5.3.2 Professional services

Chapter 6 Market Estimates & Forecast, By Solution Architecture, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Host-based IDS/IPS

- 6.3 Wireless-based IDS/IPS

- 6.4 Network-based IDS/IPS

Chapter 7 Market Estimates & Forecast, By Detection Method, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Signature-based

- 7.3 Anomaly-based

- 7.4 Policy-based

Chapter 8 Market Estimates & Forecast, By Deployment Model, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud

- 8.4 Hybrid

Chapter 9 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Large enterprises

- 9.3 SME

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 BFSI

- 10.3 Aerospace & defense

- 10.4 Healthcare

- 10.5 IT & telecom

- 10.6 Government

- 10.7 Manufacturing

- 10.8 Transportation & logistics

- 10.9 Retail

- 10.10 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Alert Logic

- 12.2 AT&T

- 12.3 Barracuda Networks

- 12.4 Check Point Software Technologies

- 12.5 Cisco

- 12.6 CrowdStrike

- 12.7 Darktrace

- 12.8 F5 Networks

- 12.9 FireEye

- 12.10 Fortinet

- 12.11 IBM

- 12.12 Imperva

- 12.13 Juniper Networks

- 12.14 McAfee

- 12.15 Palo Alto Networks

- 12.16 SonicWall

- 12.17 Sophos

- 12.18 Splunk

- 12.19 Trend Micro

- 12.20 Trustwave