PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685145

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685145

Expanded Polypropylene (EPP) Foam Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

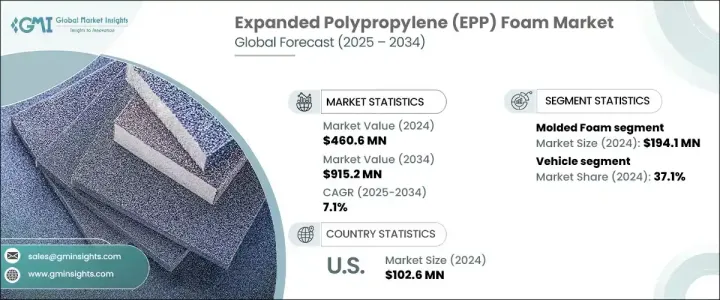

The Global Expanded Polypropylene Foam Market reached USD 460.6 million in 2024 and is projected to expand at a CAGR of 7.1% between 2025 and 2034. This growth is largely driven by increasing demand from key industries such as automotive, packaging, aerospace, and consumer goods. As businesses continue to seek lightweight and high-performance materials, EPP foam stands out for its exceptional cushioning, impact resistance, and energy absorption capabilities. These properties make it an indispensable material across multiple sectors, especially in industries where weight reduction and durability are critical.

EPP foam's growing popularity stems from its versatility and superior performance compared to conventional foam materials. It is widely recognized for its high strength-to-weight ratio, thermal insulation, and recyclability, aligning with the global push toward sustainability. With stringent regulations encouraging eco-friendly materials, manufacturers are integrating EPP foam into their products to meet evolving industry standards. Additionally, advancements in manufacturing techniques are enhancing product quality, customization options, and cost-efficiency, further fueling its adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $460.6 Million |

| Forecast Value | $915.2 Million |

| CAGR | 7.1% |

Market segmentation by type includes bead foam, molded foam, fabricated foam, automotive foam, and others. Among these, molded foam dominated in 2024, accounting for USD 194.1 million. Bead foam, widely used in automotive, packaging, and electronics, is valued for its shock-absorbing and insulating properties. Fabricated foam, known for its customization capabilities, serves industries requiring tailored solutions, such as medical devices and protective packaging. The diverse range of EPP foam types ensures a steady market expansion, catering to industry-specific demands while supporting the transition toward lightweight, high-performance materials.

The market is also segmented by application, with categories including vehicles, packaging, consumer goods, aerospace, building and construction, sports and leisure, and others. Vehicles accounted for a substantial 37.1% market share in 2024, with demand expected to rise as automakers continue prioritizing energy-efficient and impact-resistant materials. In packaging, EPP foam provides superior protection for fragile goods such as electronics, appliances, and perishables. The rapid expansion of the e-commerce industry has further accelerated its demand for protective packaging solutions. Aerospace manufacturers increasingly rely on EPP foam for impact resistance and thermal insulation, while its adaptability in consumer goods highlights its importance across various industries.

The U.S. expanded polypropylene foam market generated USD 102.6 million in 2024 and is poised for significant growth in the coming years. A strong automotive industry, prioritizing lightweight and energy-absorbing materials, remains a primary driver of this growth. Additionally, the booming e-commerce sector has fueled the need for advanced protective packaging, aligning with shifting consumer purchasing behaviors. The presence of advanced manufacturing facilities and a focus on innovation in the U.S. further solidify the country's leading position in the global EPP foam market. As demand for high-performance and sustainable materials continues to rise, EPP foam is expected to play an even greater role across multiple industries, driving long-term market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.2 Industry pitfalls & challenges

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bead foam

- 5.3 Molded foam

- 5.4 Fabricated foam

- 5.5 Automotive foam

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Vehicle

- 6.3 Packaging

- 6.4 Consumer goods

- 6.5 Aerospace

- 6.6 Building & construction

- 6.7 Sports & leisure

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Electronics

- 7.4 Medical

- 7.5 Packaging

- 7.6 Aerospace

- 7.7 Construction

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 JSP Corporation

- 9.2 BASF SE

- 9.3 Kaneka Corporation

- 9.4 Furukawa Electric Co.

- 9.5 DS Smith PLC

- 9.6 Hanwha Corporation

- 9.7 Sonoco Products Company

- 9.8 The Woodbridge Group

- 9.9 Knauf Industries GmbH

- 9.10 Greiner Holding AG

- 9.11 Recticel NV

- 9.12 Armacell International GmbH

- 9.13 Zotefoams plc

- 9.14 Swedfoam AB

- 9.15 FoamPartner AG