PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685076

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685076

Hematology Diagnostics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

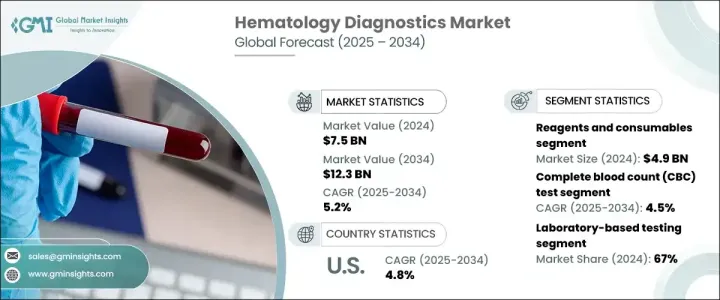

The Global Hematology Diagnostics Market, valued at USD 7.5 billion in 2024, is set to expand at a CAGR of 5.2% between 2025 and 2034. This growth is fueled by the increasing prevalence of hematological disorders, a rapidly aging population, and the rising incidence of chronic diseases. As blood-related conditions such as anemia, leukemia, and sickle cell disease become more common, the need for accurate and efficient diagnostic solutions continues to rise. Healthcare providers are increasingly prioritizing early disease detection, driving demand for advanced diagnostic technologies. Automated hematology analyzers, artificial intelligence-driven diagnostic tools, and molecular diagnostic techniques are transforming the industry, ensuring faster and more precise results. Growing investments in healthcare infrastructure and technological innovation further support market expansion, making hematology diagnostics an integral part of modern medical practice.

By product type, the market is divided into reagents and consumables and instruments. Instruments include hematology analyzers, flow cytometers, and other diagnostic devices, while reagents and consumables play a crucial role in delivering accurate test results. The reagents and consumables segment led the market in 2024 with USD 4.9 billion in revenue. This dominance is driven by the essential nature of these products in testing procedures and the increasing adoption of automated hematology analyzers in high-volume laboratories. As laboratories and healthcare facilities aim for greater efficiency and accuracy, the demand for high-quality reagents and consumables continues to grow.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.5 Billion |

| Forecast Value | $12.3 Billion |

| CAGR | 5.2% |

The market is segmented by test type into complete blood count (CBC), platelet function, hemoglobin, hematocrit, and other diagnostic tests. Among these, the CBC test segment generated USD 2.7 billion in revenue in 2024 and is projected to grow at a CAGR of 4.5% through 2034. CBC tests provide critical information about red and white blood cell counts, hemoglobin levels, and platelet counts, making them indispensable in routine check-ups and preventive healthcare. As the medical community focuses on early disease detection, the widespread use of CBC tests remains a key driver of market growth. The increasing incidence of blood disorders and the rising demand for comprehensive blood analysis further contribute to the segment's expansion.

The United States remains a dominant player in the hematology diagnostics market, generating USD 2.9 billion in revenue in 2024. The market is expected to grow at a CAGR of 4.8% through 2034, driven by the country's substantial patient population affected by hematological disorders. The need for precise and efficient diagnostic solutions in hospitals and clinical laboratories continues to propel market growth. Expanding healthcare infrastructure, rising healthcare expenditure and advancements in diagnostic tools are key factors contributing to the market's expansion. With an increasing emphasis on early and accurate detection, the U.S. hematology diagnostics market is poised for sustained growth, ensuring improved patient outcomes and greater accessibility to cutting-edge diagnostic solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of blood & related disorders

- 3.2.1.2 Rising demand for point-of-care testing in developing countries

- 3.2.1.3 Growing awareness and screening programs

- 3.2.1.4 Surging need for integrated digital solutions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced diagnostics

- 3.2.2.2 Lack of reimbursement and inadequate insurance coverage

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Reagents and consumables

- 5.3 Instruments

- 5.3.1 Hematology analyzers

- 5.3.2 Flow cytometers

- 5.3.3 Other instruments

Chapter 6 Market Estimates and Forecast, By Test Type, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Complete blood count (CBC) test

- 6.3 Platelet function test

- 6.4 Hemoglobin test

- 6.5 Hematocrit test

- 6.6 Other test types

Chapter 7 Market Estimates and Forecast, By Modality, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Laboratory-based testing

- 7.3 Point-of-care (POC) testing

Chapter 8 Market Estimates and Forecast, By Application, 2021 — 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Oncology

- 8.3 Anemia

- 8.4 Infectious diseases

- 8.5 Cardiovascular disorders

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic laboratories

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Abbott

- 11.2 BAG DIAGNOSTICS

- 11.3 BECKMAN COULTER

- 11.4 BIO-RAD

- 11.5 BioSystems

- 11.6 Boule

- 11.7 diatron

- 11.8 HemoCue

- 11.9 HORIBA Medical

- 11.10 mindray

- 11.11 NIHON KOHDEN

- 11.12 Roche

- 11.13 SIEMENS Healthineers

- 11.14 sysmex

- 11.15 Thermo Fisher Scientific