PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685058

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1685058

Turbine Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

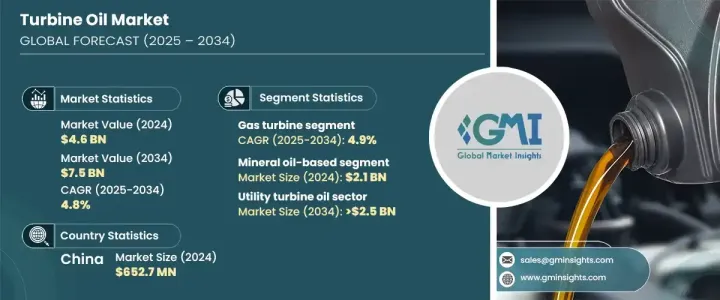

The Global Turbine Oil Market generated USD 4.6 billion in 2024 and is projected to grow at a CAGR of 4.8% between 2025 and 2034, driven by rising electricity demand and the ongoing expansion of power generation capacities worldwide. As the global energy sector continues to evolve, the need for high-performance lubricants becomes increasingly critical. Turbine oils play a vital role in ensuring the seamless operation of turbines by reducing friction, preventing corrosion, and enhancing overall efficiency. Their ability to withstand extreme operating conditions makes them indispensable in power plants, aviation, and marine applications.

The push for cleaner energy sources and the modernization of aging power infrastructure are further propelling the demand for advanced turbine oils. Emerging economies, particularly in Asia and the Middle East, are witnessing rapid industrialization, leading to an upsurge in electricity consumption. Investments in renewable energy projects, such as wind and hydropower, are also contributing to market growth. Manufacturers are focusing on innovation, developing turbine oils with improved thermal stability, oxidation resistance, and extended service life to meet the evolving requirements of the energy sector. Additionally, the integration of digital monitoring systems in power plants enables predictive maintenance, driving the adoption of premium-quality lubricants.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $7.5 Billion |

| CAGR | 4.8% |

The turbine oil market is segmented by product into mineral oil-based, synthetic, and bio-based turbine oils. Mineral oil-based turbine oils led the market, generating USD 2.1 billion in 2024, and are anticipated to grow at a CAGR of 5.1% through the forecast period. Their widespread use in power plants and industrial applications, combined with cost-effectiveness, continues to drive demand. Additionally, increasing awareness about equipment maintenance and efficiency optimization is influencing end users to invest in high-quality turbine oils, further fueling market expansion.

By application, gas turbines dominated the industry, accounting for USD 2.2 billion in revenue in 2024. The segment is forecasted to grow at a CAGR of 4.9% during the analysis period. The transition toward energy-efficient solutions, along with continuous R&D efforts, is shaping the competitive landscape. Manufacturers are introducing next-generation turbine oils with superior oxidative stability and enhanced performance to extend equipment life and minimize maintenance costs. These innovations are expected to accelerate product adoption, especially in sectors prioritizing sustainability.

China remains a key player in the turbine oil market, with a valuation of USD 652.7 million in 2024 and a strong growth trajectory over the forecast period. The country's energy sector is undergoing a major transformation fueled by rapid industrialization, infrastructure development, and aggressive investments in renewable energy. As the largest energy consumer and producer globally, China is expanding its wind and hydropower capacity to meet rising energy demands and achieve carbon neutrality targets. The surge in energy generation projects is significantly boosting the demand for turbine oils, particularly in wind and steam turbine applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for electricity

- 3.6.1.2 Expansion of power generation capacity

- 3.6.1.3 Surging investments in renewable energy

- 3.6.1.4 Implementation of stringent regulations and standards

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Price volatility of raw materials

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Mineral oil-based turbine oil

- 5.3 Synthetic turbine oil

- 5.4 Bio-based turbine oil

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Gas turbine

- 6.3 Steam turbine

- 6.4 Hydro turbine

- 6.5 Others

Chapter 7 Market Size and Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Industrial

- 7.3 Utility

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Afton Chemical

- 9.2 BP p.l.c.

- 9.3 Castrol

- 9.4 Chevron U.S.A. Inc.

- 9.5 Eastern Petroleum

- 9.6 Eastman Chemical Company

- 9.7 Exxon Mobil Corporation

- 9.8 FUCHS

- 9.9 Idemitsu

- 9.10 Indian Oil Corporation Ltd.

- 9.11 Kluber Lubrication

- 9.12 Lubrizol

- 9.13 LUKOIL Marine Lubricants

- 9.14 NYCO

- 9.15 Paras Lubricants Ltd.

- 9.16 Penrite Oil

- 9.17 PETRONAS

- 9.18 Quaker Chemical Corporation

- 9.19 Repsol

- 9.20 Shell

- 9.21 TotalEnergies

- 9.22 Valvoline Global