PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928904

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928904

Automotive Energy Recovery System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

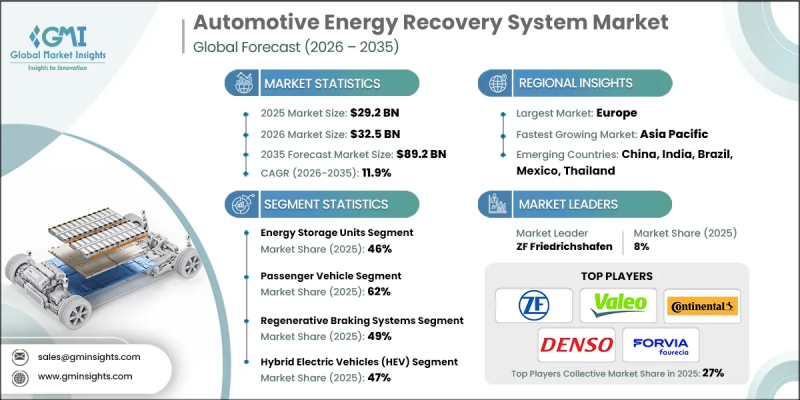

The Global Automotive Energy Recovery System Market was valued at USD 29.2 billion in 2025 and is estimated to grow at a CAGR of 11.9% to reach USD 89.2 billion by 2035.

Growth is driven by the need to improve vehicle energy utilization, lower fuel consumption, and meet increasingly strict environmental standards. Automotive manufacturers are prioritizing systems that capture and reuse energy that would otherwise be lost during vehicle operation, supporting both cost efficiency and emission reduction goals. The accelerating shift toward electric and hybrid powertrains is further reinforcing demand, as energy recovery solutions are becoming integral to vehicle architecture rather than optional add-ons. These systems support extended driving range, optimized energy management, and improved overall vehicle performance. Regulatory pressure across global markets continues to push automakers toward comprehensive energy optimization strategies. As a result, the market is evolving toward fully integrated system-level solutions where multiple recovery and management technologies operate together within advanced powertrain platforms.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $29.2 Billion |

| Forecast Value | $89.2 Billion |

| CAGR | 11.9% |

The energy storage units segment held a 46% share in 2025 and is forecast to grow at a CAGR of 12.2% from 2026 to 2035. This segment leads because recovered energy must be efficiently stored and redeployed to deliver measurable performance and efficiency benefits. Energy storage solutions support propulsion requirements, auxiliary systems, and overall power management across electrified and hybrid vehicle platforms. Their integration with recovery systems is central to maximizing energy reuse and improving operational efficiency.

The passenger vehicle category accounted for 62% share in 2025 and is projected to grow at a CAGR of 12% through 2035. Growth is supported by rising consumer interest in fuel-efficient and low-emission vehicles, combined with supportive policy frameworks and broader availability of electrified models across pricing tiers. Advanced recovery solutions are increasingly incorporated across both premium and high-volume vehicle segments.

Germany Automotive Energy Recovery System Market is expected to grow at a CAGR of 10% between 2026 and 2035. The country's strong automotive manufacturing base and regulatory focus on emissions reduction are accelerating the integration of advanced recovery technologies across multiple vehicle categories.

Key companies operating in the Global Automotive Energy Recovery System Market include Robert Bosch, Continental, ZF Friedrichshafen, Valeo, Schaeffler, Denso, Hyundai Mobis, Mahle, Forvia, and Mando. Companies in the Global Automotive Energy Recovery System Market are strengthening their competitive positions through continuous innovation and strategic integration. Manufacturers are investing heavily in research and development to improve system efficiency, reduce weight, and enhance compatibility with electrified powertrains. Collaboration with automakers is being prioritized to enable early-stage integration into vehicle platforms. Many players are expanding modular and scalable solutions to serve multiple vehicle categories. Geographic expansion and localization strategies help suppliers meet regional regulatory and cost requirements.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.3 Research trail and confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Best estimates and calculations

- 1.6.1 Base year calculation for any one approach

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Vehicles

- 2.2.4 System

- 2.2.5 Propulsion

- 2.2.6 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1.1 Growth drivers

- 3.2.1.2 Increasing adoption of electric and hybrid vehicles

- 3.2.1.3 Stringent emission regulations and fuel efficiency standards

- 3.2.1.4 Advancements in energy recovery technologies

- 3.2.1.5 Growing consumer demand for environmentally friendly and cost-efficient vehicles

- 3.2.1.6 Traffic congestion & urbanization pressures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial costs of energy recovery systems

- 3.2.2.2 Limited awareness and understanding of energy recovery technologies among consumers

- 3.2.3 Market opportunities

- 3.2.3.1 Rising adoption of electric and hybrid vehicles.

- 3.2.3.2 Stricter emission and fuel efficiency regulations.

- 3.2.3.3 Growing focus on fleet and commercial vehicle efficiency.

- 3.2.3.4 Advancements in energy storage and power electronics.

- 3.2.3.5 Emerging opportunities in developing automotive markets.

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 US- EPA MY2027+ standards

- 3.4.1.2 Canada - Canadian ZEV program

- 3.4.2 Europe

- 3.4.2.1 Germany- EU CO2 standards (37.5% reduction by 2030)

- 3.4.2.2 UK- UK ZEV mandate (100% new car sales zero-emission by 2035)

- 3.4.2.3 France- Bonus-malus incentive program

- 3.4.2.4 Italy- National Recovery and Resilience Plan (PNRR)

- 3.4.3 Asia Pacific

- 3.4.3.1 China- New Energy Vehicle (NEV) mandate

- 3.4.3.2 India- FAME-II program

- 3.4.3.3 Japan- METI subsidies for hybrid/electric vehicles

- 3.4.3.4 Australia- National Electric Vehicle Strategy

- 3.4.4 LATAM

- 3.4.4.1 Mexico- NOM-163-SCFI-2013 emissions standard

- 3.4.4.2 Argentina- Fuel economy regulation

- 3.4.5 MEA

- 3.4.5.1 South Africa- Road Traffic Emissions Standards

- 3.4.5.2 Saudi Arabia- National Industrial Development and Logistics Program

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Use cases & success stories

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.10.5 Carbon footprint considerations

- 3.11 Future outlook and opportunities

- 3.12 OEM Integration & Vehicle Architecture Fit

- 3.12.1 Packaging constraints (space, weight, thermal)

- 3.12.2 Integration with existing powertrain & braking systems

- 3.12.3 Platform-level readiness (ICE vs hybrid vs BEV skateboards)

- 3.12.4 Calibration & validation challenges

- 3.13 Cost-Benefit & Payback Analysis

- 3.13.1 Cost premium per vehicle

- 3.13.2 Fuel economy / range gains vs added cost

- 3.13.3 Payback period by vehicle type

- 3.13.4 Fleet vs passenger economics

- 3.14 ERS Performance Benchmarking

- 3.15 Software, Controls & Energy Management Intelligence

- 3.16 Thermal Management & Heat Rejection Constraints

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Energy storage units

- 5.2.1 Batteries

- 5.2.2 Supercapacitors

- 5.2.3 Flywheels

- 5.3 Energy conversion units

- 5.3.1 Electric motors/generators

- 5.3.2 Hydraulic or pneumatic converters

- 5.4 Control units

- 5.4.1 Electronic control modules (ECM)

- 5.4.2 Power management systems

Chapter 6 Market Estimates & Forecast, By Vehicle, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Hatchback

- 6.2.2 SUV

- 6.2.3 Sedan

- 6.3 Commercial Vehicles

- 6.3.1 Light commercial vehicles (LCVs)

- 6.3.2 Medium commercial vehicles (MCVs)

- 6.3.3 Heavy commercial vehicles (HCVs)

- 6.4 Electric and hybrid vehicles

Chapter 7 Market Estimates & Forecast, By System, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Kinetic energy recovery systems (KERS)

- 7.3 Regenerative braking systems

- 7.4 Exhaust energy recovery systems (EERS)

- 7.5 Suspension-based energy recovery systems

Chapter 8 Market Estimates & Forecast, By Propulsion, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Internal combustion engine (ICE) vehicles

- 8.3 Hybrid electric vehicles (HEV)

- 8.4 Plug-in hybrid electric vehicles (PHEV)

- 8.5 Battery electric vehicles (BEV)

Chapter 9 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Braking energy recovery

- 9.3 Exhaust heat recovery

- 9.4 Thermal management & waste heat utilization

- 9.5 Powertrain efficiency enhancement

- 9.6 Fuel economy improvement

- 9.7 Performance boosting

- 9.8 Others

Chapter 10 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Benelux

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Colombia

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aisin Seiki

- 11.1.2 BorgWarner

- 11.1.3 Continental

- 11.1.4 Cummins

- 11.1.5 Denso

- 11.1.6 Forvia

- 11.1.7 Hitachi Automotive Systems

- 11.1.8 Hyundai Mobis

- 11.1.9 Mahle

- 11.1.10 Mitsubishi Electric

- 11.1.11 Robert Bosch

- 11.1.12 Schaeffler

- 11.1.13 Valeo

- 11.1.14 ZF Friedrichshafen

- 11.2 Regional Players

- 11.2.1 Kongsberg Automotive

- 11.2.2 Mando

- 11.2.3 Nabtesco

- 11.2.4 Tenneco

- 11.2.5 TRW Automotive

- 11.3 Emerging Technology Innovators

- 11.3.1 BYD Auto

- 11.3.2 Leoni

- 11.3.3 Nidec

- 11.3.4 Rimac Automobili