PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684797

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684797

U.S. Commercial Water Heater Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

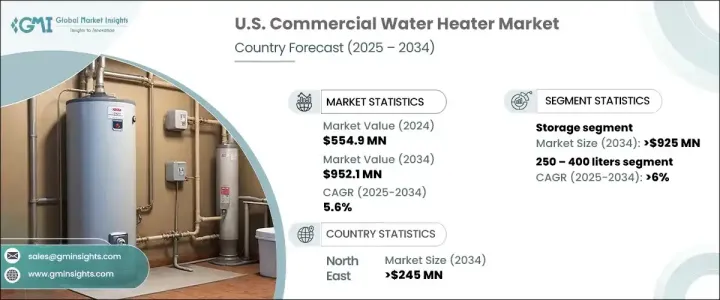

U.S. Commercial Water Heater Market was valued at USD 554.9 million in 2024 and is projected to expand at a steady CAGR of 5.6% from 2025 to 2034. Designed to provide reliable hot water for a variety of business and industrial applications such as hospitality, healthcare, and retail, commercial water heaters are crucial for day-to-day operations. These systems can be powered by electricity, natural gas, propane, or solar energy and are available in multiple types, each with different heating methods.

The growing emphasis on energy-efficient solutions, coupled with ongoing investments in sustainable technologies, is driving the market forward. Businesses across industries are increasingly upgrading traditional water heating systems to modern, smart equipment that promises improved efficiency and lower operational costs. With sustainability becoming a major focus for companies aiming to reduce their carbon footprints, the demand for energy-efficient water heaters is rising. The market is also benefiting from the increasing push toward cost-effective and high-performance solutions in commercial environments. As businesses continue to prioritize both sustainability and profitability, commercial water heaters are expected to see consistent growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $554.9 Million |

| Forecast Value | $952.1 Million |

| CAGR | 5.6% |

The storage water heater segment is expected to generate USD 925 million by 2034. With advancements in energy efficiency, these heaters have become more appealing to large-scale commercial users. Storage water heaters are designed to meet high-volume hot water demands while reducing overall energy consumption. Thanks to innovations like enhanced insulation and smart temperature controls, newer models minimize heat loss, making them much more energy-efficient than older models. The availability of government incentives or rebates for businesses adopting energy-efficient heating systems is also helping to drive further market growth.

The 250-400-liter capacity commercial water heater segment is projected to grow at a CAGR of 6% through 2034. This segment is being driven by initiatives promoting energy efficiency as well as the growing use of these units across a wide range of commercial settings. Their compact design, ease of installation, and affordability make them particularly attractive to businesses looking to upgrade their heating systems without major space or financial commitments. These units are especially beneficial for small to medium-sized facilities that need to improve energy use and efficiency.

The U.S. Northeast region's commercial water heater market is expected to generate USD 245 million by 2034. The demand for these systems is surging due to a combination of factors such as increasing disposable incomes and the rising need for advanced commercial facilities. Natural gas-powered systems, known for their lower operational costs, are playing a key role in meeting these demands. The growing shift toward cleaner, more sustainable technologies with reduced NOx emissions is further driving the adoption of energy-efficient water heaters, aligning with the region's environmental goals while optimizing business operations.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Price trend analysis

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Product, 2021 – 2034 (USD Billion & ‘000 Units)

- 5.1 Key trends

- 5.2 Instant

- 5.3 Storage

Chapter 6 Market Size and Forecast, By Capacity, 2021 – 2034 (USD Billion & ‘000 Units)

- 6.1 Key trends

- 6.2 <30 liters

- 6.3 30 – 100 liters

- 6.4 100 – 250 liters

- 6.5 250 – 400 liters

- 6.6 > 400 liters

Chapter 7 Market Size and Forecast, By Energy Source, 2021 – 2034 (USD Billion & ‘000 Units)

- 7.1 Key trends

- 7.2 Electric

- 7.3 Gas

- 7.3.1 Natural gas

- 7.3.2 LPG

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion & ‘000 Units)

- 8.1 Key trends

- 8.2 College/University

- 8.3 Offices

- 8.4 Government/Military

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2021 – 2034 (USD Billion & ‘000 Units)

- 9.1 Key trends

- 9.2 East North Central

- 9.2.1 Illinois

- 9.2.2 Indiana

- 9.2.3 Michigan

- 9.2.4 Ohio

- 9.2.5 Wisconsin

- 9.3 West South Central

- 9.3.1 Arkansas

- 9.3.2 Louisiana

- 9.3.3 Oklahoma

- 9.3.4 Texas

- 9.4 South Atlantic

- 9.4.1 Delaware

- 9.4.2 Florida

- 9.4.3 Georgia

- 9.4.4 Maryland

- 9.4.5 North Carolina

- 9.4.6 South Carolina

- 9.4.7 Virginia

- 9.4.8 West Virginia

- 9.4.9 Washington D.C.

- 9.5 North East

- 9.5.1 Connecticut

- 9.5.2 Maine

- 9.5.3 Massachusetts

- 9.5.4 New Hampshire

- 9.5.5 Rhode Island

- 9.5.6 Vermont

- 9.5.7 New Jersey

- 9.5.8 New York

- 9.5.9 Pennsylvania

- 9.6 East South Central

- 9.6.1 Alabama

- 9.6.2 Kentucky

- 9.6.3 Mississippi

- 9.6.4 Tennessee

- 9.7 West North Central

- 9.7.1 Iowa

- 9.7.2 Kansas

- 9.7.3 Minnesota

- 9.7.4 Missouri

- 9.7.5 Nebraska

- 9.7.6 North Dakota

- 9.7.7 South Dakota

- 9.8 Pacific States

- 9.8.1 Alaska

- 9.8.2 California

- 9.8.3 Hawaii

- 9.8.4 Oregon

- 9.8.5 Washington

- 9.9 Mountain States

- 9.9.1 Arizona

- 9.9.2 Colorado

- 9.9.3 Utah

- 9.9.4 Nevada

- 9.9.5 New Mexico

- 9.9.6 Idaho

- 9.9.7 Montana

- 9.9.8 Wyoming

Chapter 10 Company Profiles

- 10.1 American Standard Water Heaters

- 10.2 A. O. Smith

- 10.3 Ariston Holding N.V.

- 10.4 Armstrong International Inc.

- 10.5 Bosch Thermotechnology Corp.

- 10.6 Bradford White Corporation, USA

- 10.7 GE Appliances

- 10.8 Haier Group

- 10.9 Hubbell Electric Heater Company

- 10.10 Havells India Ltd.

- 10.11 Rheem Manufacturing Company

- 10.12 Rinnai Corporation

- 10.13 RECO USA

- 10.14 State Industries.

- 10.15 Stiebel Eltron GmbH & Co.

- 10.16 Sioux Corporation

- 10.17 Viessmann

- 10.18 Watts

- 10.19 Westinghouse Electric Corporation