PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684782

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684782

Steering Wheel Switches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

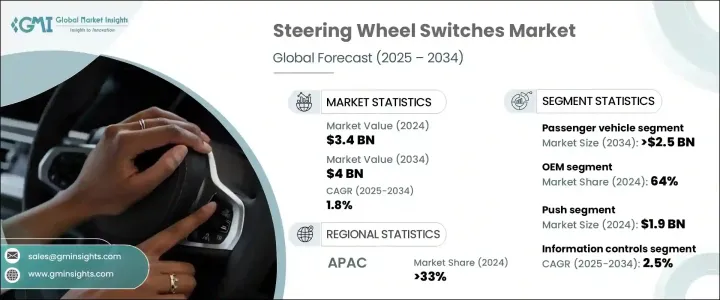

The Global Steering Wheel Switches Market was valued at USD 3.4 billion in 2024 and is projected to grow at a CAGR of 1.8% between 2025 and 2034. Road safety remains a major concern worldwide, particularly in developed regions where vehicle accidents result in significant casualties. High consumer awareness, combined with regulatory influences and advanced purchasing power, has led to a growing demand for modern safety technologies. Automakers are increasingly integrating advanced driver-assist features into vehicles, enhancing both safety and market expansion. The rising emphasis on driver protection is fueling the adoption of steering wheel electronics, reducing distractions, and improving overall driving efficiency. Multi-functional steering wheel controls are gaining popularity as they enhance user convenience while aligning with industry trends, particularly the rapid acceptance of electric vehicles. The shift towards seamless in-car control systems further strengthens the market outlook.

Passenger vehicles held a market share of over 60% in 2024 and are expected to surpass USD 2.5 billion by 2034. Sedans, hatchbacks, and SUVs contribute significantly to the demand for steering wheel switches, as these vehicles continue to dominate global sales. With built-in controls allowing drivers to manage infotainment, cruise control, and communication systems without distractions, manufacturers are focusing on integrating more intuitive and user-friendly interfaces. The increasing demand for daily-use vehicles, especially in urban areas, is further driving the need for steering wheel-mounted switches. As automakers prioritize driver convenience and efficiency, all-in-one control solutions are becoming a key component in modern passenger cars.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.4 billion |

| Forecast Value | $4 billion |

| CAGR | 1.8% |

The market is divided into OEM and aftermarket sales channels, with the OEM segment holding a 64% share in 2024. Steering wheel switches are predominantly supplied by original equipment manufacturers, which ensures seamless integration into vehicles during production. As these switches become standard across most modern cars, automakers are expanding production cycles to meet rising demand. Automotive assembly lines rely on suppliers for efficient sourcing, with manufacturers investing in automation to streamline production. The increasing need for new vehicles, especially in high-growth markets, is boosting demand for OEM steering wheel switches.

The product segment includes push and see-saw switches, with the push button segment generating USD 1.9 billion in 2024. Push buttons are widely used for infotainment, audio, cruise control, and communication functions, providing an intuitive user experience. Their durability and cost-effectiveness make them a preferred choice for automakers, supporting multi-functional applications while maintaining affordability. The shift towards simplified in-car control systems, combined with the integration of advanced electronics, continues to drive segment growth.

Infotainment controls are expected to grow at a CAGR of over 2.5% from 2025 to 2034. The rising adoption of connected vehicle technologies has increased the demand for steering wheel-integrated infotainment features, ensuring safer and more convenient interactions. Hands-free access to navigation, voice commands, and other functions enhances both driver safety and user experience, making infotainment controls a crucial component in modern vehicles.

The Asia Pacific region led the global market in 2024, accounting for over 33% of the total share. With strong automotive production and increasing demand for steering wheel controls, the region continues to drive market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distributors

- 3.1.1.6 End users

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trend

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing sales of vehicles across the globe

- 3.6.1.2 Increased awareness about road safety

- 3.6.1.3 Emergence of automotive parts & components industry

- 3.6.1.4 Steadily developing automotive manufacturing sector

- 3.6.1.5 Advancements in automotive electronics & adaptive cruise control technology

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Increasing implementation of automotive touchscreen displays

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger vehicles

- 5.2.1 Hatchback

- 5.2.2 Sedan

- 5.2.3 SUVs

- 5.3 Commercial vehicles

- 5.3.1 Light commercial vehicles (LCVs)

- 5.3.2 Heavy commercial vehicles (HCVs)

Chapter 6 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Push

- 7.3 See-saw

Chapter 8 Market Estimates & Forecast, By application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Infotainment control

- 8.3 Audio controls

- 8.4 Cruise control

- 8.5 Phone control

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ALPS

- 10.2 Changjiang Automobile Electronic System

- 10.3 COBO

- 10.4 Continental

- 10.5 Delphi

- 10.6 Denso

- 10.7 Dongguan

- 10.8 Hyundai Motor

- 10.9 Johnson Electric Holdings

- 10.10 Kia Corporation

- 10.11 Leopold Kostal

- 10.12 LS Automotive Technologies

- 10.13 Marquardt Group

- 10.14 Nissan Motor

- 10.15 Panasonic Corporation

- 10.16 Preh

- 10.17 TOKAI RIKA

- 10.18 Toyota Motor

- 10.19 Valeo

- 10.20 ZF Friedrichshafen