PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684779

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684779

ECG Stress Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

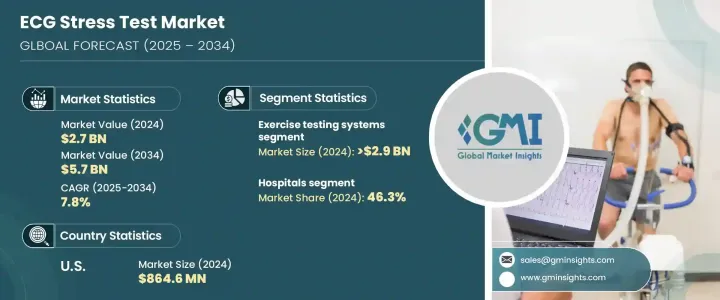

The Global ECG Stress Test Market reached USD 2.7 billion in 2024 and is projected to grow at a CAGR of 7.8% between 2025 and 2034. This growth is driven by the rising incidence of cardiovascular diseases worldwide, fueled by sedentary lifestyles, unhealthy dietary habits, and an aging population. As heart disease remains a leading cause of mortality, healthcare providers are prioritizing early diagnosis and preventive care, increasing the demand for ECG stress test systems. Advanced diagnostic technologies are playing a crucial role in improving patient outcomes, reducing long-term healthcare costs, and enhancing the efficiency of cardiac assessments. The shift towards preventive healthcare has further accelerated the adoption of ECG stress tests, as regular cardiac monitoring becomes an essential component of disease management.

Technological advancements in ECG stress testing systems have made these diagnostic tools more accurate, efficient, and accessible. AI-driven ECG analysis, wireless monitoring, and integration with electronic health records (EHR) are transforming cardiac diagnostics, enabling faster and more precise assessments. Additionally, the increasing focus on telehealth and remote monitoring solutions has further expanded the market's growth potential, making ECG stress testing more convenient and widely available. Healthcare facilities are also investing in sophisticated ECG systems that offer enhanced data analytics and real-time monitoring, allowing for early detection of cardiovascular conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $ 2.7 Billion |

| Forecast Value | $ 5.7 Billion |

| CAGR | 7.8% |

The market is segmented by product type into exercise testing systems, stress ECG, stress blood pressure monitors and pulse oximeters. Exercise testing systems are expected to witness the highest growth, with a projected CAGR of 8.1%, reaching USD 2.9 billion by 2034. These systems are vital in assessing heart function under physical exertion, making them indispensable for detecting coronary artery disease and irregular heart rhythms. Growing awareness about the importance of cardiovascular screening and advancements in exercise testing equipment are driving widespread adoption across healthcare settings. As the prevalence of heart disease rises, demand for high-precision stress testing solutions continues to grow, with medical professionals emphasizing early intervention strategies to mitigate risks.

By end use, the ECG stress test market is categorized into hospitals, diagnostic centers, ambulatory surgical centers, and other healthcare facilities. Hospitals held the largest market share in 2024, accounting for 46.3% of total revenue. Equipped with state-of-the-art diagnostic tools and specialized cardiac care units, hospitals remain the preferred choice for ECG stress testing. The increasing burden of heart disease has led to a surge in hospital visits, with patients seeking expert medical evaluations and accurate cardiovascular assessments. Hospital infrastructure expansion, along with advancements in cardiac care, is further supporting market growth.

The U.S. ECG stress test market was valued at USD 864.6 million in 2024 and is projected to grow at a CAGR of 7.1% through 2034. The high prevalence of cardiovascular diseases, driven by lifestyle-related health risks such as poor dietary habits, obesity, and physical inactivity, is a key factor fueling demand. With an aging population contributing to a rising number of heart conditions, healthcare providers are investing in cutting-edge diagnostic technologies to facilitate early detection and preventive care. Increasing awareness of cardiovascular health, coupled with rapid technological advancements in diagnostic equipment, is expected to sustain the market's upward trajectory. The integration of AI, cloud-based ECG monitoring, and enhanced data analytics is further strengthening the U.S. market, making ECG stress tests more efficient and accessible for both patients and healthcare professionals.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increase in prevalence of cardiovascular disorders

- 3.2.1.2 Rising awareness for benefits associated with early diagnosis of heart diseases

- 3.2.1.3 Surge in number of tests performed by sporting athletes

- 3.2.1.4 Integration with electronic health records (EHRs)

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of ECG stress testing systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Future market trends

- 3.10 Value chain analysis

- 3.11 Machine learning in cardiac stress test interpretation

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 — 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Exercise testing systems

- 5.3 Stress ECG

- 5.4 Stress blood pressure monitors

- 5.5 Pulse oximeters

Chapter 6 Market Estimates and Forecast, By End Use, 2021 — 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic centers

- 6.4 Ambulatory surgical centers

- 6.5 Other end users

Chapter 7 Market Estimates and Forecast, By Region, 2021 — 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Baxter

- 8.2 BD (Becton Dickinson)

- 8.3 BIOSENSORS INTERNATIONAL

- 8.4 Cardinal Health

- 8.5 COSMED

- 8.6 FUKUDA

- 8.7 GE (General Electric)

- 8.8 Halma

- 8.9 MGC DIAGNOSTICS

- 8.10 Neurosoft

- 8.11 NIHON KOHDEN

- 8.12 NONIN

- 8.13 OSI

- 8.14 PHILIPS

- 8.15 SCHILLER