PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684765

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684765

Medical Electrodes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

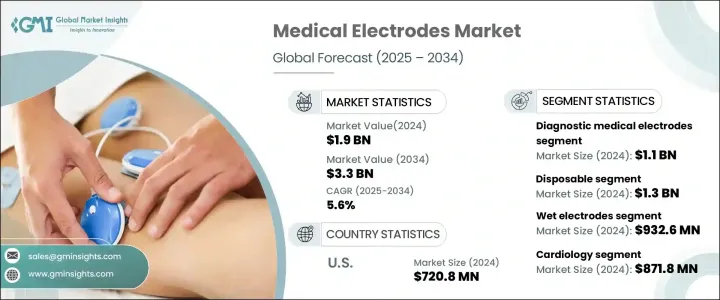

The Global Medical Electrodes Market was valued at USD 1.9 billion in 2024 and is projected to grow at a CAGR of 5.6% from 2025 to 2034. This growth is driven by the increasing prevalence of chronic diseases such as cardiovascular and neurological disorders, coupled with the rising adoption of wearable medical devices and advancements in electrode technology. The demand for medical electrodes is further fueled by the growing emphasis on non-invasive diagnostic procedures and the need for continuous health monitoring. As healthcare systems worldwide focus on improving patient outcomes and reducing hospital visits, the integration of medical electrodes in wearable devices and homecare applications is gaining momentum. Additionally, the market benefits from innovations in electrode design, which enhance accuracy, patient comfort, and overall performance. The increasing healthcare expenditure in both developed and developing regions, along with the shift towards at-home care, is expected to sustain market growth over the forecast period.

Medical electrodes, essential for transmitting electrical signals from the body to diagnostic or therapeutic equipment, play a critical role in capturing physiological data such as heart rate, brain waves, and muscle contractions. These devices are widely used in applications like electrocardiography (ECG), electroencephalography (EEG), electromyography (EMG), and defibrillators. The diagnostic medical electrodes segment generated USD 1.1 billion in revenue in 2024, driven by their extensive use in monitoring and diagnosing various medical conditions. With the rising prevalence of cardiovascular diseases and neurological disorders, the demand for diagnostic electrodes has surged. These electrodes enable healthcare providers to detect early symptoms, ensuring timely treatment and improving patient outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 5.6% |

Wet electrodes, which accounted for USD 932.6 million in revenue in 2024, dominate the market due to their superior performance in delivering high-quality electrical signals. These electrodes use conductive gel or liquid to establish a strong connection with the skin, ensuring minimal impedance and making them ideal for diagnostic applications like EEG, ECG, and EMG. Their high signal-to-noise ratio enhances the accuracy and reliability of patient monitoring. Despite advancements in dry electrode technology, wet electrodes remain the preferred choice for long-term use in hospital settings and electrotherapy applications such as TENS and neuromuscular stimulation.

The disposable electrodes segment, valued at USD 1.3 billion in 2024, holds a significant market share due to their convenience, hygiene benefits, and cost-effectiveness. Designed for single use, disposable electrodes eliminate the risk of cross-contamination, making them ideal for high-volume healthcare settings like emergency departments and operating rooms. The growing adoption of homecare applications and wearable health monitoring devices has further increased the demand for disposable electrodes, as they offer ease of use and improved patient comfort.

The cardiology segment, which generated USD 871.8 million in revenue in 2024, is anticipated to grow at a CAGR of 6% from 2025 to 2034. The rising prevalence of cardiovascular diseases globally drives the demand for electrodes used in diagnosing and monitoring heart conditions such as arrhythmias and myocardial infarctions. Innovations in electrode technology, including wireless capabilities and flexible designs, are expanding their applications in wearable ECG devices, enabling real-time heart health monitoring outside clinical settings.

Hospitals, the largest end-use segment, are projected to reach USD 2 billion by 2032. As critical healthcare providers managing acute and chronic conditions, hospitals rely heavily on medical electrodes for diagnostic and therapeutic applications. The increasing adoption of wearable and wireless electrodes for real-time patient monitoring is enhancing care delivery efficiency in hospital environments.

In the United States, the medical electrodes market accounted for USD 720.8 million in revenue in 2024 and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The well-established healthcare system, rising healthcare expenditures, and increasing prevalence of chronic diseases are key factors driving market growth in the region. The growing popularity of home healthcare and wearable devices, along with advancements in electrode technology, further supports the expansion of the US market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Rising demand for minimally invasive and non-invasive diagnostic procedures

- 3.2.1.3 Technological advancements in electrode design and materials

- 3.2.1.4 Growing adoption of wearable medical devices

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Challenges in biocompatibility and patient comfort

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Value chain analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Diagnostic medical electrodes

- 5.2.1 Electrocardiography (ECG) electrodes

- 5.2.2 Electroencephalography (EEG) electrodes

- 5.2.3 Other diagnostic electrodes

- 5.3 Therapeutic medical electrodes

- 5.3.1 Defibrillator electrodes

- 5.3.2 Pacemaker electrodes

- 5.3.3 Other therapeutic electrodes

Chapter 6 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Wet electrodes

- 6.3 Dry electrodes

- 6.4 Needle electrodes

Chapter 7 Market Estimates and Forecast, By Usability, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Disposable

- 7.3 Reusable

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Cardiology

- 8.3 Neurophysiology

- 8.4 Sleep disorders

- 8.5 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Diagnostic centers

- 9.4 Other end users

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 3M

- 11.2 Ambu

- 11.3 B. Braun

- 11.4 Boston Scientific

- 11.5 Cardinal Health

- 11.6 ConMed

- 11.7 Dymedix Diagnostics

- 11.8 GE Healthcare

- 11.9 Medtronic

- 11.10 Nihon Kohden

- 11.11 Nissha Medical

- 11.12 Philips Healthcare

- 11.13 Rhythmlink

- 11.14 Schiller AG

- 11.15 ZOLL Medical