PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684764

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684764

Biliary Stents Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

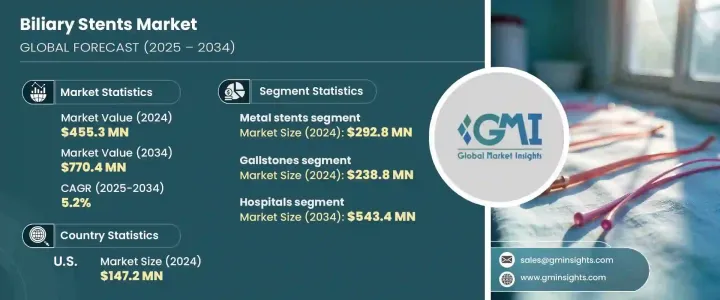

The Global Biliary Stents Market reached USD 455.3 million in 2024 and is projected to grow at a steady CAGR of 5.2% through 2034. This growth can largely be attributed to the increasing prevalence of liver and bile duct diseases, in line with ongoing advancements in stent technologies. Biliary stents are primarily used to manage conditions that cause bile duct blockages, such as cholangitis, pancreatitis, and certain cancers. These conditions can result in obstructions that disrupt bile flow, necessitating the use of stents for relief and treatment.

As the global population ages and lifestyle-related health issues rise, the demand for biliary stents is expected to surge significantly. Moreover, with innovations in stent technology, including the development of drug-eluting and biodegradable materials, these devices have become more effective, ensuring better patient outcomes and longer-lasting solutions. This expansion is also driven by increasing healthcare access and improvements in procedural techniques that allow more efficient stent placements, contributing to the market's positive trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $455.3 Million |

| Forecast Value | $770.4 Million |

| CAGR | 5.2% |

The market is primarily divided into two key segments: metal and polymer stents. In 2024, the metal stents segment was worth USD 292.8 million. Metal stents, particularly self-expanding versions, are favored for their ability to treat malignant obstructions and provide long-lasting solutions, reducing the frequency of replacements. These stents are critical in palliative care for cancer patients, offering additional benefits such as the prevention of tumor ingrowth and migration through fully and partially covered versions. The introduction of biodegradable and drug-eluting metal stents has increased their appeal, further driving their adoption across medical settings due to their advanced features.

The hospitals segment, the primary end-user of biliary stents, is expected to reach USD 543.4 million by the end of the forecast period. Hospitals have necessary infrastructure and expertise to perform complex procedures like ERCP and PTC, essential for diagnosing and treating biliary conditions. These procedures play a crucial role in ensuring the accurate placement of biliary stents, which ultimately contributes to improved treatment outcomes for patients. With continuous advancements in stent technology and placement techniques, hospitals are expected to continue leading the market, offering optimal care for individuals suffering from biliary disorders.

In the U.S., the biliary stents market was valued at USD 147.2 million in 2024, with an anticipated growth rate of 4.9% between 2025 and 2034. This growth is primarily driven by the rising incidence of biliary diseases and enhanced access to healthcare. Insurance coverage, including programs such as Medicare and Medicaid, are vital in making stent procedures more accessible to a broader patient base, further accelerating the demand for biliary stents. This financial support ensures that patients receive the necessary treatment to manage bile duct obstructions effectively.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of bile duct and chronic liver disease

- 3.2.1.2 Technological advancements in stents

- 3.2.1.3 Adoption of minimally invasive approach during the procedure

- 3.2.1.4 Growing geriatric population globally

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complications and risks related to bile duct stents

- 3.2.2.2 High cost of the plastic bile duct stents

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pricing analysis, 2024

- 3.5 Regulatory landscape

- 3.6 Reimbursement scenario

- 3.7 Technology landscape

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Metal stents

- 5.3 Polymer stents

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Gallstones

- 6.3 Pancreatic cancer

- 6.4 Bilio-pancreatic leakages

- 6.5 Benign biliary strictures

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Other end-users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 B Braun

- 9.2 Becton, Dickinson & Company

- 9.3 Boston Scientific

- 9.4 Cardinal Health

- 9.5 CONMED Corporation

- 9.6 Cook Group

- 9.7 ENDO-FLEX GmbH

- 9.8 M.I Tech

- 9.9 Mediwood

- 9.10 Medtronic

- 9.11 Merit Medical System

- 9.12 Olympus Corporation

- 9.13 S & G Biotech

- 9.14 TAEWOONG