PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684763

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684763

Network as a Service (NaaS) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

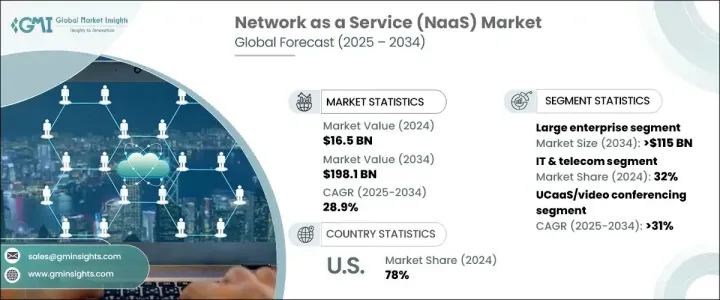

The Global Network As A Service Market was valued at USD 16.5 billion in 2024 and is projected to expand at a CAGR of 28.9% between 2025 and 2034. The growing shift toward decentralized data processing is driving demand for flexible and efficient networking solutions. As businesses increasingly rely on real-time data processing, the adoption of edge computing fuels the demand for NaaS, enabling seamless connectivity and minimal latency. Industries such as healthcare, manufacturing, and IoT require more adaptable network infrastructures to keep up with evolving technological needs.

The rapid move to hybrid cloud models is further accelerating the market as enterprises seek scalable and cost-effective network solutions that enhance connectivity across on-premises, private, and public cloud environments. The ability to scale network services without significant upfront investment is a major factor driving NaaS adoption. As large organizations continue expanding, the demand for robust network control solutions is rising. The increasing number of large enterprises across different industries, particularly in Europe and North America, has created a substantial need for NaaS solutions that provide efficiency and scalability.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16.5 billion |

| Forecast Value | $198.1 billion |

| CAGR | 28.9% |

Businesses are turning to NaaS to maintain flexible and cost-effective networking infrastructures without requiring heavy investments in physical hardware. As organizations expand globally, they need adaptable network systems that optimize resources while keeping costs under control. Enterprises are increasingly prioritizing network solutions that allow them to scale operations efficiently, making NaaS an essential component of business growth strategies. The IT and telecom industry, which accounted for a significant share of the market in 2024, is at the forefront of NaaS adoption. The rapid digital transformation across the industry is creating new opportunities as telecom companies leverage NaaS to enhance service delivery in a cloud-driven world. The growing demand for high-speed connectivity, 5G, and edge computing is further fueling the market as telecom providers seek to offer scalable and agile network services. The expansion of IT services is also playing a crucial role in market growth, with businesses requiring automated and integrated solutions to improve efficiency and reduce operational costs.

The rise of remote and hybrid work environments is accelerating demand for WAN as a service, which led the market in 2024 with a valuation exceeding USD 60 billion. Companies require secure, flexible, and efficient networking solutions to manage distributed teams, and WANaaS offers an affordable pay-as-you-go model that eliminates the need for significant capital investment. The ability to create and expand networks virtually while maintaining seamless connectivity across global operations is increasing the appeal of WANaaS, making it a key driver of NaaS growth.

Unified communications as a service (UCaaS) and video conferencing are seeing significant traction, with the segment projected to grow at a CAGR of over 31% during the forecast period. The increasing reliance on cloud-based communication tools to facilitate seamless remote interactions is pushing companies to adopt more reliable, secure, and scalable network solutions. The demand for uninterrupted global communication is fueling the expansion of NaaS as businesses seek advanced networking capabilities to support collaboration across multiple locations.

The United States dominated the global NaaS market in 2024, holding over 78% of the total market share. The country's advanced technological infrastructure, rapid adoption of cloud computing, and strong digital transformation initiatives across industries are propelling market growth. The expansion of 5G and edge computing, along with the increasing number of connected devices, is driving the need for high-speed, low-latency network solutions. As businesses in the US continue integrating these technologies, the demand for NaaS solutions that offer speed, performance, and scalability is expected to rise significantly.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Service provider

- 3.1.2 Cloud service provider

- 3.1.3 Technology providers

- 3.1.4 End users

- 3.2 Profit margin analysis

- 3.3 Supplier landscape

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Use cases

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Increasing demand for scalable and flexible networks

- 3.8.1.2 Shift to cloud-based infrastructure and services

- 3.8.1.3 Rising adoption of digital transformation across industries

- 3.8.1.4 Growing importance of cybersecurity and data privacy

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Complexity in network management and integration

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Service, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 LAN as a service

- 5.3 WAN as a service

- 5.4 VPN as a service

- 5.5 Communication as a service

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 UCaaS/video conferencing

- 6.3 Virtual private network

- 6.4 Cloud and SaaS connectivity

- 6.5 Bandwidth on Demand

- 6.6 Multi-branch connectivity

- 6.7 Wan optimization

- 6.8 Secure web gateway

- 6.9 Network access control

- 6.10 Others

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Large enterprises

- 7.3 SME

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 IT & telecom

- 8.3 BFSI

- 8.4 Manufacturing

- 8.5 Government & public sector

- 8.6 Healthcare

- 8.7 Retail

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aerohive

- 10.2 Akamai

- 10.3 ALE

- 10.4 Amazon Web Services

- 10.5 Aryaka

- 10.6 AT&T

- 10.7 AWS

- 10.8 Brocade

- 10.9 Ciena

- 10.10 Cisco

- 10.11 Citrix

- 10.12 Cloudgenix

- 10.13 Cradlepoint

- 10.14 Extreme Networks

- 10.15 IBM

- 10.16 NEC

- 10.17 Rackspace

- 10.18 Talari

- 10.19 Tata Communications

- 10.20 Verizon