PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684724

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684724

Mobile Broadband Infrastructure Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

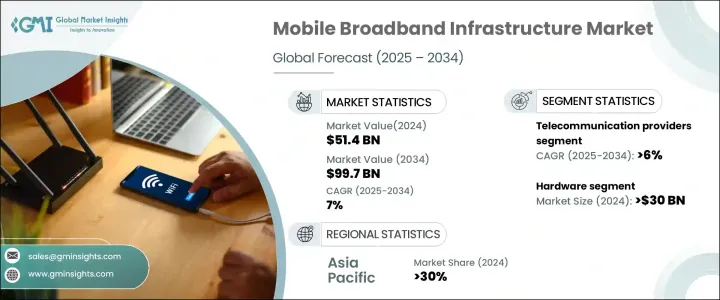

The Global Mobile Broadband Infrastructure Market reached USD 51.4 billion in 2024 and is expected to experience robust growth at a CAGR of 7% from 2025 to 2034. This growth is largely driven by the rapid expansion of 5G networks and significant investments aimed at enhancing 4G LTE coverage, particularly in emerging economies. As mobile device usage continues to rise, along with video streaming and the proliferation of IoT applications, the demand for telecom services has surged. These trends are intensifying the need for more advanced network infrastructure to handle the increasing volume of data traffic and connectivity requirements. The mobile broadband infrastructure market plays a vital role in ensuring that users and businesses have reliable, high-speed access to the Internet, especially in regions where mobile networks are still in the development phase. The ability to support growing data consumption and device connectivity is key, making infrastructure upgrades and expansion a top priority for telecom companies worldwide.

One of the primary components driving the growth of this market is the hardware segment, which accounted for USD 30 billion in 2024. The demand for hardware solutions remains strong as modern mobile networks require increasingly advanced systems to meet the higher power, lower latency, and scalability demands of 5G and beyond. Network infrastructure must handle substantial increases in data transfer and device connectivity, which requires highly reliable, high-performance hardware. This growing need for robust hardware solutions is expected to escalate as telecom providers roll out more advanced technologies like 5G.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $51.4 Billion |

| Forecast Value | $99.7 Billion |

| CAGR | 7% |

When it comes to end users, the mobile broadband infrastructure market is divided into telecommunications providers, enterprises, and government sectors. Telecom providers, in particular, are expected to experience steady growth, with a projected CAGR of 6% between 2025 and 2034. The demand for greater network capacity, driven by data-heavy activities such as video streaming, IoT integration, and real-time communications, is pushing telecom companies to heavily invest in upgrading their networks. These investments are essential to expanding coverage areas and improving bandwidth capabilities, ensuring that telecom services can meet the rising demands of consumers and businesses alike.

The Asia Pacific region held a dominant 30% market share in 2024, with China playing a leading role. The Chinese government's aggressive investment in advancing its technological infrastructure, particularly in the deployment of 5G networks, has positioned the country as a global leader in network expansion. Chinese technology giants are spearheading the large-scale rollout of 5G base stations, contributing significantly to the region's infrastructure development. This rapid progress has positioned China not only as a key player in its own market but also as a major supplier of mobile broadband infrastructure solutions worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component providers

- 3.2.2 Manufacturers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Mobile internet user penetration rate in major countries, 2024

- 3.7 Cellular network connection statistics, 2024

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for high-speed connectivity due to smart devices and IoT expansion

- 3.9.1.2 Accelerated adoption of 5G networks boosting infrastructure capabilities

- 3.9.1.3 Increased telecom investments in network upgrades and expansion

- 3.9.1.4 Growing reliance on mobile satellite services for remote and underserved regions

- 3.9.1.5 Advances in cloud and edge computing driving robust network requirements

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High capital costs for deploying advanced infrastructure

- 3.9.2.2 Regulatory and compliance hurdles delaying technology rollouts

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Antennas & transceivers

- 5.2.2 Remote Radio Units (RRU)

- 5.2.3 Baseband Units (BBU)

- 5.2.4 Filters & duplexers

- 5.2.5 Power amplifiers

- 5.2.6 Others

- 5.3 Software

- 5.3.1 Network management systems

- 5.3.2 Operation Support Systems (OSS)

- 5.3.3 Business Support Systems (BSS)

- 5.3.4 Network Function Virtualization (NFV)

- 5.3.5 Others

- 5.4 Services

- 5.4.1 Network consulting

- 5.4.2 Integration & deployment

- 5.4.3 Support & maintenance

Chapter 6 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 3G

- 6.3 4G

- 6.4 5G

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Telecommunications providers

- 7.3 Enterprises

- 7.4 Government

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Altiostar Networks

- 9.2 Arista Networks

- 9.3 Aviat Networks

- 9.4 Cambium Networks

- 9.5 Ciena

- 9.6 Cisco Systems

- 9.7 CommScope

- 9.8 Ericsson

- 9.9 FiberHome

- 9.10 Fujitsu

- 9.11 Huawei Technologies

- 9.12 Juniper Networks

- 9.13 Mavenir Systems

- 9.14 NEC

- 9.15 Nokia

- 9.16 Parallel Wireless

- 9.17 Qualcomm

- 9.18 Radwin

- 9.19 Samsung Electronics

- 9.20 ZTE