PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684697

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684697

Digital Utility Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

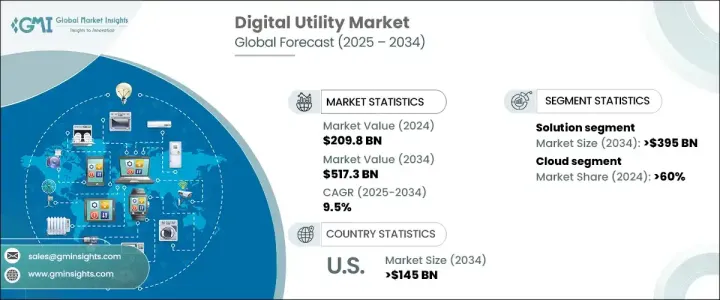

The Global Digital Utility Market reached USD 209.8 billion in 2024 and is set to grow at a CAGR of 9.5% between 2025 and 2034. The rapid adoption of smart grid technologies is driving this expansion as utility providers seek to enhance energy efficiency, lower operational costs, and integrate renewable energy sources. Digital transformation in the utility sector is reshaping operations by enabling real-time monitoring, predictive analytics, and automation, ultimately improving service reliability. With increasing energy demands and growing climate concerns, the need for advanced digital solutions is more crucial than ever. Companies are investing heavily in digital infrastructure to modernize aging grids, enhance grid security, and streamline operations, ensuring adaptability to evolving energy requirements.

Governments worldwide are implementing sustainability initiatives and regulatory frameworks that promote modernization, accelerating the adoption of digital utilities. The demand for resilient and secure grid solutions is surging as utilities face challenges posed by rising energy consumption and extreme weather events. Advanced metering infrastructure, intelligent energy distribution systems, and automation tools are becoming fundamental in enhancing grid stability. The rise of decentralized energy resources, including solar and wind power, is further compelling utilities to adopt digital solutions that optimize energy distribution and demand management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $209.8 Billion |

| Forecast Value | $517.3 Billion |

| CAGR | 9.5% |

The market is segmented by components into solutions and services. In 2024, solutions dominated with a 75% share and are projected to generate USD 390 billion by 2034. The increasing deployment of smart meters, automated energy management systems, and grid automation is transforming the industry. These innovations optimize energy distribution and provide real-time insights, improving operational efficiency. Predictive maintenance and demand response solutions are becoming indispensable as utilities navigate complex energy fluctuations. The ability to instantly analyze and respond to grid conditions is making digital solutions a critical element of modern utility operations. Utility providers are leveraging AI-powered analytics to predict energy demand, detect faults, and enhance grid performance, ensuring minimal service disruptions.

Deployment methods in the market are categorized into on-premises and cloud-based solutions. The cloud segment accounted for 60% of the market share in 2024, offering scalable and cost-effective infrastructure solutions for utilities. Cloud-based platforms seamlessly integrate with IoT and big data analytics, enabling real-time monitoring and efficient grid management without requiring significant upfront investments. As digital utilities expand, the need for remote operations and continuous data-driven decision-making is intensifying. Cloud deployment ensures flexibility and resilience, supporting utilities in managing complex energy distribution networks. Security remains a top priority, with providers investing in advanced encryption, automated updates, and threat detection to safeguard digital utility ecosystems. The growing reliance on connected energy systems and distributed energy resources is further fueling the demand for cloud solutions.

The US digital utility market held an 84% share in 2024 and is projected to generate USD 140 billion by 2034. Government policies and incentives, including legislative measures promoting energy innovation, are driving the expansion of digital utilities across the country. A competitive landscape featuring leading technology providers is propelling advancements in smart utility solutions. The integration of renewable energy sources and the emphasis on enhancing grid reliability are shaping the market's growth. Increasing demand for smart metering and energy management systems is further strengthening the industry. The US continues to lead the digital utility transformation, with a strong focus on automation, analytics, and next-generation grid infrastructure.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Solution Providers

- 3.2.2 Service Providers

- 3.2.3 Distributors

- 3.2.4 End users

- 3.3 Profit margin analysis

- 3.4 Patent Landscape

- 3.5 Cost Breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rising demand for smart grid technologies

- 3.9.1.2 Increasing adoption of IoT and big data analytics

- 3.9.1.3 Government initiatives and investments in renewable energy

- 3.9.1.4 Growing focus on energy efficiency and sustainability

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High initial costs of digital utility solutions

- 3.9.2.2 Data security and privacy concerns

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Advanced Metering Infrastructure (AMI)

- 5.2.2 Energy Management System (EMS)

- 5.2.3 Customer Information System (CIS)

- 5.2.4 Geographic Information System (GIS)

- 5.3 Services

- 5.3.1 Consulting services

- 5.3.2 System integration

- 5.3.3 Managed services

Chapter 6 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 On-premises

- 6.3 Cloud

Chapter 7 Market Estimates & Forecast, By Utility, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Power utilities

- 7.3 Water utilities

- 7.4 Gas utilities

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2032 ($Bn)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Accenture

- 10.3 Aclara Technologies

- 10.4 Capgemini

- 10.5 Cisco Systems

- 10.6 Eaton

- 10.7 Emerson Electric

- 10.8 General Electric Company

- 10.9 Hitachi Energy

- 10.10 Honeywell

- 10.11 IBM

- 10.12 Infosys

- 10.13 Itron

- 10.14 Landis+Gyr Group

- 10.15 Microsoft

- 10.16 Oracle

- 10.17 SAP SE

- 10.18 Schneider Electric

- 10.19 Siemens

- 10.20 Wipro