PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684696

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684696

Automotive Power Distribution Modules Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

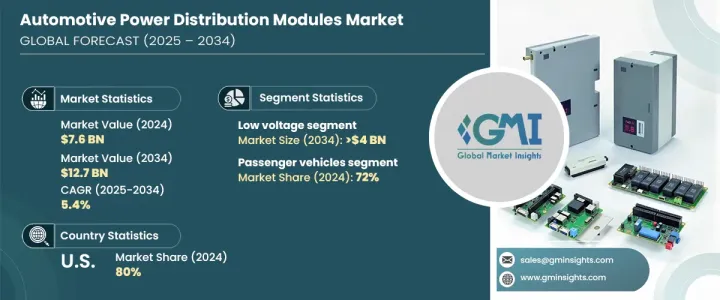

The Global Automotive Power Distribution Modules Market reached USD 7.6 billion in 2024 and is projected to grow at a CAGR of 5.4% between 2025 and 2034. Rising demand for fuel-efficient and eco-friendly vehicles is driving significant advancements in power distribution technology. These modules are critical in managing power consumption across various vehicle systems, ensuring optimal energy use and minimizing waste. As automakers continue to integrate more electronic components, from advanced driver-assistance systems (ADAS) to next-generation infotainment and climate control, the need for efficient power management has become more pressing than ever.

The growing adoption of electric and hybrid vehicles is further fueling demand, as these platforms require sophisticated power distribution to enhance overall performance and safety. Governments worldwide are implementing stricter emissions regulations and providing incentives to boost electric vehicle (EV) adoption, pushing automakers to invest in cutting-edge energy-efficient solutions. Technological innovations such as smart power distribution, load-balancing capabilities, and integration with onboard diagnostics are enhancing the reliability and efficiency of modern vehicles. Moreover, shifting consumer preferences toward sustainable transportation solutions reinforces the market's expansion, with industry leaders investing in next-generation modules to optimize power flow, reduce energy loss, and support growing electrification trends.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.6 Billion |

| Forecast Value | $12.7 Billion |

| CAGR | 5.4% |

The market is segmented by module type into low voltage, medium voltage, and high voltage. In 2024, low voltage modules accounted for 40% of the market share and are expected to generate USD 4 billion by 2034. The increasing use of these modules in electric and hybrid vehicles is a major driver of growth, as they power essential auxiliary functions such as lighting, infotainment, and climate control. With the EV market expanding rapidly, the need for efficient power management solutions has intensified to ensure these systems operate reliably without draining battery reserves. Manufacturers are integrating advanced power distribution modules to improve safety, energy efficiency, and conservation, making them a key component in modern vehicle architecture. Advanced smart systems allow seamless distribution of electricity, preventing overload and ensuring efficient energy use, further driving adoption.

Based on vehicle type, the market is categorized into passenger and commercial vehicles. Passenger vehicles dominated in 2024, holding 72% of the market share. The increasing complexity of in-vehicle electronics, including electric powertrains and ADAS, has heightened the demand for efficient power distribution solutions. As automotive technology evolves, vehicles now rely on multiple electronic components that require stable power delivery. Power distribution modules regulate energy flow, preventing overloads, optimizing system performance, and enhancing reliability. Automakers are continuously upgrading distribution systems to support evolving consumer expectations for technology-driven driving experiences, integrating features that enhance both safety and user convenience. As smart vehicle technology continues to advance, the demand for next-generation power management solutions is expected to surge.

The US automotive power distribution modules market accounted for 80% of the global share in 2024. The country's aggressive push toward vehicle electrification, supported by government incentives and stringent emissions regulations, is accelerating market growth. The expanding EV industry has intensified the need for advanced power management solutions that optimize electrical flow between battery systems, motors, and other critical components. Power distribution modules enable efficient energy allocation, ensuring electric vehicles operate safely and efficiently. As manufacturers prioritize sustainable solutions and cutting-edge technology, the demand for optimized power distribution continues to rise, solidifying the US as a dominant player in this evolving industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material providers

- 3.1.2 Component providers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 End customers

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price analysis

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Advancements in automotive electronics

- 3.9.1.2 growing consumer preference for fuel-efficient vehicles

- 3.9.1.3 Adoption of smart power distribution solutions

- 3.9.1.4 Expansion of electric vehicle infrastructure

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High cost of advanced modules

- 3.9.2.2 Complexity in design and integration

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Power modules

- 5.3 Fuses and circuit breakers

- 5.4 Connectors and terminals

- 5.5 Relays

- 5.6 Voltage regulators

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Module, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Low voltage

- 6.3 Medium voltage

- 6.4 High voltage

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUVs

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCVs)

- 7.3.2 Heavy Commercial Vehicles (HCVs)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Lighting systems

- 8.3 Infotainment systems

- 8.4 HVAC systems

- 8.5 Safety and driver assistance systems

- 8.6 Battery management systems

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Nordics

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 South Korea

- 10.3.6 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 UAE

- 10.5.2 South Africa

- 10.5.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Bosch

- 11.3 Continental

- 11.4 Delphi (BorgWarner)

- 11.5 Denso

- 11.6 Eaton

- 11.7 Hitachi

- 11.8 Infineon

- 11.9 Lear Corporation

- 11.10 Mitsubishi

- 11.11 NXP Semiconductors

- 11.12 ON Semiconductor

- 11.13 Panasonic

- 11.14 Sensata

- 11.15 STMicroelectronics

- 11.16 TE Connectivity

- 11.17 Texas Instruments

- 11.18 Valeo

- 11.19 ZF Friedrichshafen