PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684685

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684685

Smart Vehicle Architecture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

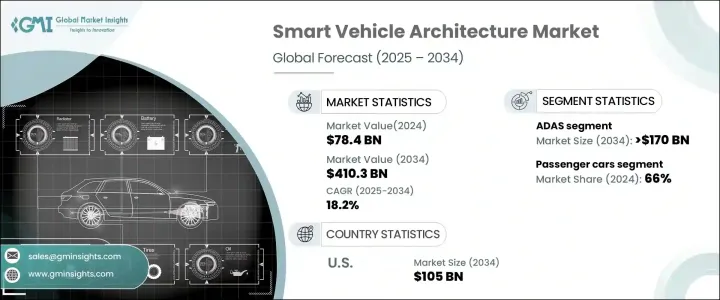

The Global Smart Vehicle Architecture Market generated USD 78.4 billion in 2024 and is expected to expand at a remarkable CAGR of 18.2% between 2025 and 2034. As automotive technology evolves, manufacturers are prioritizing seamless connectivity, integrating cutting-edge communication systems such as Vehicle-to-Everything (V2X), intelligent telematics, and advanced diagnostic tools. The widespread rollout of 5G networks is further accelerating this shift, enabling faster data transmission, enhanced service reliability, and reduced latency.

These advancements are transforming the automotive landscape, paving the way for intelligent, software-driven vehicles that offer unparalleled connectivity and user experience. With electric vehicles (EVs) gaining momentum, automakers are reimagining vehicle architectures to accommodate flexible, modular designs that support both traditional and electric powertrains. This shift is not only optimizing production efficiency but also meeting the rising consumer demand for connected, software-defined vehicles that enhance safety, convenience, and automation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $78.4 Billion |

| Forecast Value | $410.3 Billion |

| CAGR | 18.2% |

Smart vehicle architecture is being driven by a suite of transformative technologies, including V2X communication, Advanced Driver Assistance Systems (ADAS), infotainment and connectivity, Over-the-Air (OTA) updates, cybersecurity solutions, and artificial intelligence (AI) with machine learning (ML). In 2024, ADAS accounted for 51% of the market share, playing a critical role in improving vehicle safety and automation. As automakers focus on advanced driver-assistance capabilities, features such as adaptive cruise control, automatic emergency braking, and traffic sign recognition are becoming industry standards. The rapid integration of these technologies is not only enhancing user experience but also propelling market growth as regulatory bodies push for stricter safety compliance.

The market is segmented by vehicle type, including passenger cars, commercial vehicles, and EVs. In 2024, passenger cars dominated the market with a 66% share, driven by high production volumes, growing consumer demand, and widespread adoption of advanced in-car technologies. As urbanization accelerates and city populations grow, passenger vehicles remain the preferred mode of transport, with consumers increasingly seeking vehicles that offer seamless connectivity, electrification, and innovative features. The demand for next-generation infotainment systems, autonomous driving capabilities, and integrated AI solutions is fueling further innovation, making smart vehicle architectures a key component of the automotive future.

U.S. smart vehicle architecture market held a commanding 85% share in 2024, a testament to the country's leadership in automotive innovation. By 2034, the U.S. market is projected to generate USD 105 billion, reflecting its aggressive adoption of advanced automotive technologies. The presence of major tech companies, along with a strong emphasis on AI-driven autonomous vehicle development, is positioning the U.S. as a global leader in smart vehicle architecture. Automakers in the region are spearheading the integration of intelligent vehicle systems in both EVs and autonomous vehicles, reinforcing the market's dominance. With ongoing advancements in AI, connectivity, and electrification, the future of smart vehicle architecture is set to redefine mobility and transportation on a global scale.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Technology providers

- 3.1.2 Component suppliers

- 3.1.3 OEMs

- 3.1.4 End user

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increasing demand for connected vehicles

- 3.7.1.2 Growth of electric vehicles

- 3.7.1.3 Rising adoption of autonomous vehicles

- 3.7.1.4 Increasing focus on software-defined vehicles

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High development costs

- 3.7.2.2 Data security & privacy concerns

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 ADAS

- 5.3 Infotainment & connectivity

- 5.4 V2x communication

- 5.5 Over-the-air (OTA) updates

- 5.6 Cybersecurity solutions

- 5.7 AI & ML

Chapter 6 Market Estimates & Forecast, By Architecture, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Centralized architectures

- 6.3 Zonal architectures

- 6.4 Modular platforms

- 6.5 Distributed architectures

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger cars

- 7.3 Commercial vehicles

- 7.4 Electric vehicles

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Autonomous driving

- 8.3 Infotainment & user experience

- 8.4 Safety & security

- 8.5 Fleet management

- 8.6 Energy management

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aptiv

- 10.2 Mobileye

- 10.3 Magna International

- 10.4 RT-RK

- 10.5 Huawei Intelligent Automotive Solution (Yinwang)

- 10.6 Infineon Technologies

- 10.7 Momenta

- 10.8 Bosch

- 10.9 Continental AG

- 10.10 NVIDIA

- 10.11 Qualcomm

- 10.12 Texas Instruments

- 10.13 Renesas Electronics

- 10.14 Valeo

- 10.15 Denso Corporation

- 10.16 ZF Friedrichshafen

- 10.17 Panasonic Automotive Systems

- 10.18 Harman International

- 10.19 Delphi Technologies

- 10.20 Lear Corporation