PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684684

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684684

Marine Transducers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

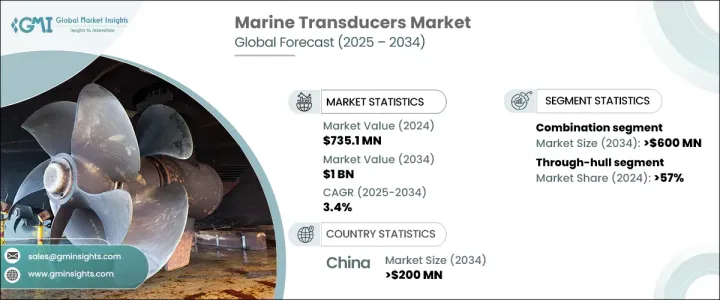

The Global Marine Transducers Market was valued at USD 735.1 million in 2024 and is expected to experience a CAGR of 3.4% between 2025 and 2034. This growth is primarily fueled by rapid advancements in sonar and imaging technologies, which continue to enhance the precision, clarity, and effectiveness of underwater visualizations. Cutting-edge innovations, such as CHIRP and side-scan sonars, are revolutionizing underwater imaging, making navigation, fishing, and marine research more accurate and efficient.

As demand for high-resolution sonar systems increases, industries that rely on marine transducers are adopting sophisticated solutions to improve their operations. The growing need for real-time data in commercial fishing, naval defense, and oceanographic research is further driving market expansion. Additionally, the integration of AI and machine learning into sonar technologies is improving detection capabilities, while wireless connectivity and smart features are making marine transducers more user-friendly. These factors collectively contribute to the increasing adoption of advanced marine transducers, solidifying their role in modern marine applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $735.1 Million |

| Forecast Value | $1 Billion |

| CAGR | 3.4% |

The market is segmented by type, with key categories including temperature transducers, depth transducers, speed transducers, and combination transducers. In 2024, combination transducers led the market with a commanding 60% share. This segment is anticipated to generate USD 600 million by 2034, thanks to its multifunctional capabilities that integrate depth measurement, fish detection, and underwater imaging into a single device. The ability to consolidate multiple functionalities into one transducer significantly reduces costs and space requirements, making them highly preferred for smaller vessels and commercial fishing applications. The demand for combination transducers is also increasing in military and research sectors, where efficiency and space optimization are critical.

By installation method, the market is categorized into through-hull, in-hull, and transom-mount transducers. In 2024, through-hull transducers dominated with a 57% share due to their exceptional durability and ability to function efficiently in harsh marine environments. These transducers, installed beneath the water surface, provide highly accurate readings for depth and temperature, outperforming alternative options in challenging conditions. Their widespread use in commercial fishing, offshore exploration, and naval applications continues to bolster their demand. Manufacturers are also developing advanced materials and coatings to enhance longevity and performance, making through-hull transducers a preferred choice for professional and industrial applications.

China remains a dominant force in the marine transducers market, accounting for 45% of global sales in 2024. By 2034, the country's market is projected to generate USD 200 million. As a global leader in marine electronics and shipbuilding, China continues to drive innovation and efficiency in marine transducer manufacturing. The nation's well-developed naval infrastructure, expanding shipping industry, and increasing investments in marine research and development are key factors fueling growth. Government-backed initiatives to modernize fishing fleets and enhance maritime security further support market expansion. With strong domestic demand and a thriving export market, China is poised to remain at the forefront of marine transducer production in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.2 Pricing analysis

- 3.3 Patent landscape

- 3.4 Cost breakdown

- 3.5 Technology & innovation landscape

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Advancements in sonar and imaging technologies

- 3.8.1.2 Growth in recreational boating and fishing activities

- 3.8.1.3 Increasing adoption of IoT and AI-enabled marine devices

- 3.8.1.4 Expansion of commercial and defense marine applications

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High cost of advanced transducers and installation

- 3.8.2.2 Limited adoption in small and non-commercial vessels

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Depth transducers

- 5.3 Speed transducers

- 5.4 Temperature transducers

- 5.5 Combination transducers

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Commercial shipping

- 6.3 Recreational boating

- 6.4 Fisheries

- 6.5 Naval defense

- 6.6 Offshore energy exploration

- 6.7 Oceanographic research

Chapter 7 Market Estimates & Forecast, By Installation, 2021 - 2032 ($Bn, Units)

- 7.1 Key trends

- 7.2 Through-hull

- 7.3 In-hull

- 7.4 Transom-mount

Chapter 8 Market Estimates & Forecast, By Technology, 2021 - 2032 ($Bn, Units)

- 8.1 Key trends

- 8.2 Single beam

- 8.3 Multi-beam

- 8.4 Side-scan sonar

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Airmar

- 10.2 Benthos

- 10.3 BioSonics

- 10.4 EdgeTech

- 10.5 eSonar

- 10.6 Furuno

- 10.7 Garmin

- 10.8 Hydroacoustic

- 10.9 Johnson Outdoors

- 10.10 Kongsberg

- 10.11 Marport

- 10.12 Navico

- 10.13 Phoenix

- 10.14 SAIYANG

- 10.15 SEIWA

- 10.16 Simrad

- 10.17 Sonotronics

- 10.18 Teledyne Technologies

- 10.19 Tritech

- 10.20 Wesmar