PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684664

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684664

Potassium Formate Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

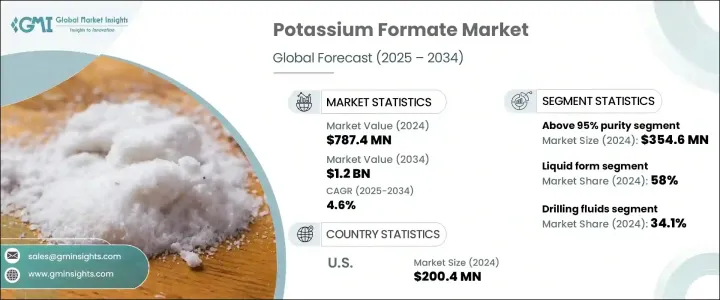

The Global Potassium Formate Market was valued at USD 787.4 million in 2024 and is expected to grow at a CAGR of 4.6% from 2025 to 2034. Potassium formate, an organic salt created by neutralizing formic acid with potassium hydroxide, is a versatile compound with applications across various industries due to its outstanding performance, particularly under extreme conditions. The increasing adoption of potassium formate in several sectors is driven by its environmentally friendly properties, making it a preferred solution for industries focused on sustainability.

The compound's ability to perform effectively in high-temperature environments and its low toxicity make it ideal for challenging applications, especially in sectors like oil and gas, aviation, and de-icing. As the global demand for eco-friendly and sustainable products continues to rise, potassium formate is gaining significant traction as a safer alternative in industries traditionally reliant on harsher chemicals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $787.4 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 4.6% |

One of the key drivers of the potassium formate market growth is the enhanced oil recovery (EOR) sector. Potassium formate's excellent thermal stability and minimal environmental impact make it an optimal choice for oil extraction from difficult reservoirs. The demand for more sustainable and non-toxic chemicals in oil recovery processes is rising, and potassium formate is increasingly being adopted as a solution to meet these needs. Beyond the oil and gas industry, potassium formate's low toxicity, high stability, and eco-friendly characteristics are attracting attention from various other applications, including heat transfer fluids and de-icing agents.

The potassium formate market is segmented by purity levels, such as below 90%, 90%-95%, and above 95%. The above 95% purity segment led the market in 2024, generating USD 354.6 million in revenue. This high-purity form of potassium formate is widely used in critical applications, including EOR, de-icing, and heat transfer fluids, where performance and stability are paramount. Its superior solubility and low impurity levels make it ideal for industries that demand precise, reliable solutions. As sustainable practices continue to gain priority, the demand for potassium formate in high-purity applications is expected to grow even further.

In terms of form, the market is divided into solid and liquid potassium formate. Liquid potassium formate dominated the market in 2024, holding 58% of the share. Its ease of use, quick dissolution, and smooth flow make it highly effective in various applications, particularly in EOR, de-icing, and heat transfer fluids. The liquid form is popular due to its efficiency and ability to meet the evolving needs of industrial processes. With growing demand for environmentally safe products, the liquid potassium formate segment is projected to maintain its leading position in the coming years.

In the U.S., the potassium formate market generated USD 200.4 million in 2024, driven by its applications in the oil and gas, aviation, and HVAC industries. The push for sustainable, non-toxic chemicals in sectors such as EOR and de-icing has significantly boosted the market. Additionally, regulatory frameworks encouraging the use of safer, environmentally friendly alternatives are contributing to the rising demand for potassium formate across North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing adoption of high-purity potassium formate in enhanced oil recovery operations

- 3.6.1.2 Rising demand for environmentally friendly de-icing agents in aviation and transportation industries

- 3.6.1.3 Growth in heat transfer fluid applications driven by advancements in HVAC and refrigeration systems

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Regulatory restrictions on drilling and completion fluids in environmentally sensitive regions.

- 3.6.2.2 Competition from alternative de-icing and drilling fluid formulations

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Purity, 2021-2034 (USD Million, Kilo Tons)

- 5.1 Key trends

- 5.2 Below 90%

- 5.3 90% - 95%

- 5.4 Above 95%

Chapter 6 Market Size and Forecast, By Form, 2021-2034 (USD Million, Kilo Tons)

- 6.1 Key trends

- 6.2 Solid

- 6.3 Liquid

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Million, Kilo Tons)

- 7.1 Key trends

- 7.2 Drilling fluids

- 7.3 Completion fluids

- 7.4 De-icing agents

- 7.5 Heat transfer fluids

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Million, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Addcon

- 9.2 American Elements

- 9.3 BASF SE

- 9.4 Clariant

- 9.5 Dynalene

- 9.6 Hangzhou Focus Chemical

- 9.7 Hawkins

- 9.8 Honeywell International

- 9.9 Perstorp

- 9.10 TETRA Technologies