PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684656

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684656

Non-steroidal Anti-inflammatory Drugs (NSAIDs) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

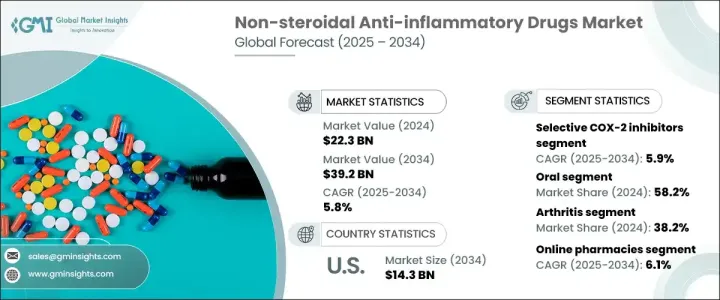

The Global Non-Steroidal Anti-Inflammatory Drugs Market was valued at USD 22.3 billion in 2024, with expectations to expand at a robust CAGR of 5.8% from 2025 to 2034. NSAIDs are widely recognized for their effectiveness in reducing inflammation, alleviating pain, and controlling fever. They achieve this by inhibiting cyclooxygenase (COX) enzymes that produce pain-causing prostaglandins. The rise in demand for these drugs is largely driven by the increasing prevalence of chronic pain conditions, including arthritis, musculoskeletal disorders, and back pain, all of which require ongoing management. As the global population continues to age, the need for NSAIDs becomes even more significant. Older adults are more susceptible to inflammatory conditions, and this demographic shift is expected to further fuel market growth.

In recent years, the market has seen an increasing shift toward drugs that are both effective and easier on the stomach. Selective COX-2 inhibitors are predicted to be the fastest-growing segment within the NSAID market, with a projected CAGR of 5.9% through 2034. These drugs target the COX-2 enzyme, which is primarily responsible for inflammation and pain while minimizing the gastrointestinal issues commonly seen with non-selective COX inhibitors. This makes selective COX-2 inhibitors a preferred choice for long-term pain management, especially in patients suffering from chronic conditions such as osteoarthritis and rheumatoid arthritis.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.3 Billion |

| Forecast Value | $39.2 Billion |

| CAGR | 5.8% |

Looking at the route of administration, the oral segment holds the largest market share, capturing 58.2% in 2024. Oral NSAIDs are favored for their ease of use, cost-effectiveness, and wide availability, making them the go-to solution for managing both acute and chronic pain. They offer convenience for patients and healthcare providers, particularly when used for conditions that require daily medication.

The U.S. market for NSAIDs is expected to reach USD 14.3 billion by 2034. This growth is driven by the aging population, which is rapidly increasing and creating a growing demand for treatments for age-related inflammatory diseases. As a result, the U.S. is set to play a pivotal role in the expansion of the global NSAID market. As the need for effective anti-inflammatory treatments continues to rise, this will open doors for further innovations in drug formulations.

In conclusion, the NSAID market is set for steady and sustained growth, fueled by a combination of demographic shifts, the increasing prevalence of chronic pain, and technological advancements in drug development. Whether through new formulations or improved delivery methods, opportunities for innovation in NSAID treatments will continue to shape the market's future.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic pain and inflammatory diseases

- 3.2.1.2 Technological advancement in drug delivery systems

- 3.2.1.3 Awareness and accessibility of OTC NSAIDs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and safety concerns

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Pipeline analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Selective COX-2 inhibitors

- 5.3 Non-selective COX inhibitors

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Parenteral

- 6.4 Topical

Chapter 7 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Arthritis

- 7.3 Migraine

- 7.4 Ophthalmic diseases

- 7.5 Other applications

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 Bayer AG

- 10.3 Cipla

- 10.4 Dr. Reddy’s Laboratories

- 10.5 Glenmark Pharmaceuticals

- 10.6 Hikma Pharmaceuticals

- 10.7 Johnson & Johnson

- 10.8 Lupin

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sun Pharmaceutical Industries

- 10.12 Teva Pharmaceuticals

- 10.13 Torrent Pharmaceuticals

- 10.14 Viatris

- 10.15 Zydus Healthcare