PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684612

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684612

CNC Plasma Cutting Machines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

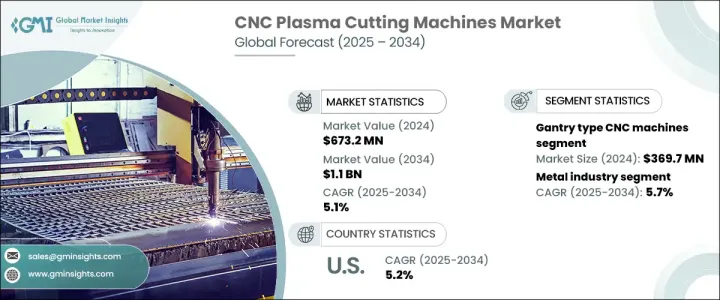

The Global CNC Plasma Cutting Machines Market reached USD 673.2 million in 2024 and is estimated to exhibit a CAGR of 5.1% between 2025 and 2034. This growth is driven by technological advancements, increasing demand from key industries, and the rising adoption of automation. Industries like metalworking, automotive, construction, and shipbuilding rely on these machines for their unmatched precision, speed, and cost-effectiveness. The growing need for customized cutting solutions in the manufacturing and construction sectors further propels demand. Additionally, higher production levels of steel and other metals are contributing to market expansion.

Automation and advanced control systems in CNC plasma cutting machines enhance productivity by minimizing manual labor and ensuring consistent precision. High-definition plasma technology has revolutionized the industry by delivering cleaner, distortion-free cuts, making it an essential tool for industries requiring high-performance cutting solutions. These advancements align with the increasing emphasis on efficiency and quality in industrial operations, enabling businesses to streamline workflows and reduce costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $673.2 Million |

| Forecast Value | $1.1 Billion |

| CAGR | 5.1% |

In terms of machine type, gantry CNC plasma cutting machines dominated the market, generating USD 369.7 million in 2024, with an anticipated CAGR of 5.4% through 2034. These machines are integral to heavy-duty applications across industries like shipbuilding, aerospace, construction, and metal fabrication. Their large-scale capabilities, combined with advancements in automation and high-definition plasma cutting, make them highly attractive for industrial use. As industries prioritize efficiency and precision, gantry CNC machines continue to meet the growing demand for cutting solutions that can handle large, complex projects.

The metal industry accounted for 31% of the global CNC plasma cutting machines market in 2024 and is expected to grow at a CAGR of 5.7% between 2025 and 2034. This sector relies heavily on precise cutting for materials such as steel and stainless steel, addressing the increasing demand for custom metal components in fabrication and metalworking. Advanced plasma technology and cost-effective cutting solutions are key drivers for this segment, aligning with the industry's focus on precision and high-quality outputs.

In the United States, the CNC plasma cutting machines market reached USD 122.7 million in 2024, with a projected CAGR of 5.2% through 2034. Growth is fueled by advancements in high-definition plasma technology, expanding demand across aerospace, automotive, and metal fabrication sectors, and government investments in infrastructure development. High-definition plasma cutting, known for superior cut quality and minimal post-processing, is particularly favored in these industries. Its ability to deliver cleaner, more accurate results supports the country's focus on sustainability and innovation, further boosting market potential.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Technological advancements

- 3.6.1.2 Increased manufacturing and construction activities

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investments

- 3.6.2.2 Competition from alternative cutting technologies

- 3.6.1 Growth drivers

- 3.7 Technological overview

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021-2034 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Gantry type CNC machines

- 5.3 Table type CNC machines

- 5.4 Others (dual purpose etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Portable

- 6.3 Fixed

Chapter 7 Market Estimates & Forecast, By Automation Grade, 2021-2034 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Semi-automatic

- 7.3 Fully automatic

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Metal working

- 8.3 Wood working

- 8.4 Stone working

- 8.5 Others (glass working etc.)

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Automotive

- 9.3 Metal industry

- 9.4 Manufacturing

- 9.5 Aerospace & defense

- 9.6 Shipping and maritime

- 9.7 Construction and infrastructure

- 9.8 Others (energy & power etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct sales

- 10.3 Indirect sales

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Ador Welding

- 12.2 Ajan Electronics

- 12.3 AKS Cutting Systems

- 12.4 ALLtra

- 12.5 Daihen

- 12.6 Fengwei

- 12.7 Hildebrand Machinery

- 12.8 Hornet Cutting Systems

- 12.9 Hypertherm

- 12.10 Kinetic

- 12.11 Koike Aronson

- 12.12 Kutavar

- 12.13 Messer

- 12.14 Torchmate

- 12.15 Zinser Cutting Systems