PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684579

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684579

Epoxy Active Diluent Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

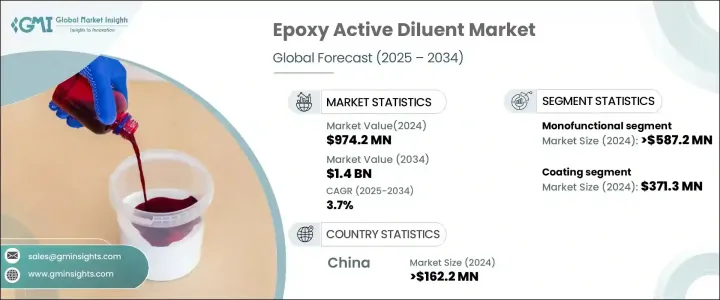

The Global Epoxy Active Diluent Market was valued at USD 974.2 million in 2024 and is projected to grow at a CAGR of 3.7% from 2025 to 2034. The increasing demand for epoxy resins in coatings, adhesives, and composites is driving this growth. These diluents play a critical role in reducing resin viscosity, making them easier to process and apply. Their use is expanding across multiple industries as manufacturers seek high-performance materials that enhance durability and efficiency. The push for superior coatings that offer long-lasting protection and aesthetic appeal is further fueling market expansion.

The shift toward environmentally friendly products is shaping the market landscape. Epoxy active diluents emit lower levels of volatile organic compounds (VOCs) than traditional solvents, making them a preferred choice as companies focus on sustainability. Additionally, advancements in bio-based diluents are providing eco-conscious alternatives, aligning with global regulations. The market is poised to grow steadily as industries integrate innovative formulations to meet performance and environmental standards.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $974.2 million |

| Forecast Value | $1.4 billion |

| CAGR | 3.7% |

The monofunctional segment generated over USD 587.2 million in 2024 and is set to expand at a CAGR of 3.9% through 2034. Its dominance is attributed to versatility and reliability in industrial applications. These diluents ensure better curing properties, chemical resistance, and adhesion, making them essential for high-precision applications. Industries favoring controlled viscosity and improved processing efficiency continue to drive the demand for monofunctional diluents. Their predictable performance makes them indispensable for specialized coatings and formulations, reinforcing their market leadership.

The coatings segment led the market with USD 371.3 million in revenue in 2024 and is expected to grow at a 3.8% CAGR from 2025 to 2034. The widespread adoption of epoxy-based coatings stems from their ability to provide excellent adhesion, durability, and resistance to environmental factors. Industries increasingly rely on these coatings to enhance product longevity and aesthetic value. As manufacturers prioritize efficiency and sustainability, demand for coatings continues to rise, solidifying their position as the leading application segment.

China accounted for over USD 162.2 million in 2024 and is expected to grow at a 3.4% CAGR. Its dominant position in the global market is driven by a strong manufacturing base and rising demand for cost-effective, high-performance materials. The country's ongoing industrialization and infrastructure projects contribute to substantial consumption of epoxy resins. Moreover, regulatory measures promoting sustainability are accelerating the transition toward low-VOC and eco-friendly solutions. China remains a key player in production and consumption, strengthening its influence in the global market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for lightweight materials in automotive and aerospace

- 3.6.1.2 Expansion of construction and infrastructure projects

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Fluctuating raw material prices

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Monofunctional

- 5.3 Difunctional

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Coatings

- 6.2.1 Industrial coatings

- 6.2.2 Marine coatings

- 6.2.3 Protective coatings

- 6.3 Adhesives and sealants

- 6.3.1 Structural adhesives

- 6.3.2 Non-structural adhesives

- 6.4 Composite material

- 6.5 Electrical and electronics

- 6.6 Construction

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Adeka Corporation

- 8.2 Aditya Birla Chemicals

- 8.3 Anhui Hengyuan (Group)

- 8.4 EMS-GRILTECH

- 8.5 Evonik Industries

- 8.6 Hexion Inc.

- 8.7 Hubei Green Home Chemical

- 8.8 Huntsman Corporation

- 8.9 Kukdo Chemical

- 8.10 Leuna Harze GmbH

- 8.11 Olin Corporation

- 8.12 Sanmu Group