PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684561

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684561

Passive Optical Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

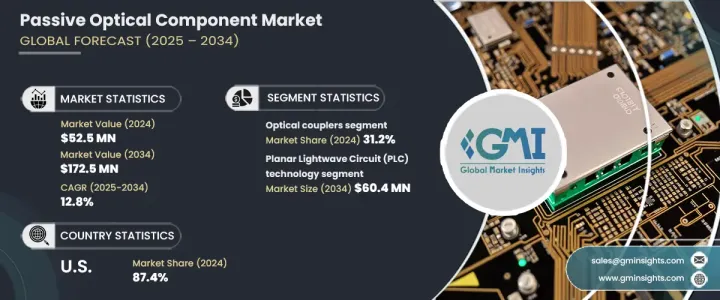

The Global Passive Optical Component Market reached USD 52.5 million in 2024 and is projected to grow at an impressive CAGR of 12.8% between 2025 and 2034. The growing demand for high-speed internet and the exponential increase in data consumption are driving the adoption of fiber optic communication as a critical element of modern network infrastructures. As industries and consumers prioritize seamless digital connectivity, passive optical components have become indispensable for ensuring the efficient transmission, routing, and amplification of data. Furthermore, the rise of next-generation technologies, such as 5G, artificial intelligence (AI), and the Internet of Things (IoT), is fueling the need for robust optical networks. These components support high bandwidth, low latency, and energy-efficient data transmission, making them essential for telecom operators, enterprises, and hyperscale data centers.

Cloud computing continues to gain traction as businesses migrate to cloud-based applications and storage solutions. Hyperscale data centers, which form the backbone of these cloud services, depend heavily on advanced optical networks to manage vast volumes of data traffic. Passive optical components, including optical couplers, splitters, and wavelength division multiplexers (WDMs), play a pivotal role in enabling seamless data flow within these networks. Their ability to provide efficient, cost-effective solutions for data routing and signal distribution makes them a cornerstone of modern digital infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $52.5 Million |

| Forecast Value | $172.5 Million |

| CAGR | 12.8% |

The market is segmented by component type, including optical couplers, optical splitters, optical filters, optical circulators, WDMs, and other components. In 2024, optical couplers accounted for 31.2% of the market share. These devices are integral to optical fiber networks, enabling the combination or division of light signals without converting them to electrical signals, thereby preserving their efficiency and integrity. Optical couplers are widely used in applications such as telecommunications, industrial automation, and data centers, where reliable signal routing is a priority.

In terms of technology, the passive optical component market encompasses Planar Lightwave Circuit (PLC) technology, Fiber Bragg Grating (FBG) technology, thin-film technology, Fused Biconical Taper (FBT) technology, and others. PLC technology is projected to reach USD 60.4 million by 2034, driven by its advanced fabrication processes that etch optical waveguides onto silica substrates. This technology ensures precision and enables miniaturization, making it ideal for components like splitters and multiplexers.

In the United States, the passive optical component market held an 87.4% share in 2024. Growth in North America is propelled by significant investments in infrastructure, including 5G rollouts, fiber-to-the-home (FTTH) initiatives, and data center expansions. Telecom operators and technology firms are at the forefront of enhancing digital connectivity, driving demand for components like couplers, splitters, and WDM devices. The U.S. continues to lead the global market thanks to its focus on innovation and adoption of advanced networking technologies.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising adoption of fiber optic communication

- 3.6.1.2 Proliferation of cloud services and data centers

- 3.6.1.3 Increasing investments in 5G infrastructure

- 3.6.1.4 Advancements in passive optical technologies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Complex installation and maintenance

- 3.6.2.2 Competition from wireless technologies

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Glass

- 5.3 Plastic

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Technology, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Planar Lightwave Circuit (PLC) Technology

- 6.3 Fiber Bragg Grating (FBG) Technology

- 6.4 Thin film technology

- 6.5 Fused Biconical Taper (FBT) Technology

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Component Type, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Optical couplers

- 7.3 Optical splitters

- 7.4 Optical filters

- 7.5 Optical circulators

- 7.6 Wavelength Division Multiplexers (WDMs)

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Telecommunications

- 8.3 Data centers

- 8.4 Cable Television (CATV)

- 8.5 Fiber to the Home (FTTH)

- 8.6 Enterprise networks

- 8.7 Aerospace and defense

- 8.8 Medical and healthcare

- 8.9 Industrial networking

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Accelink Technologies Co., Ltd.

- 10.2 Amphenol Corporation

- 10.3 Broadcom Inc.

- 10.4 Ciena Corporation

- 10.5 Cisco Systems, Inc.

- 10.6 Corning Incorporated

- 10.7 Fujitsu Limited

- 10.8 Furukawa Electric Co., Ltd.

- 10.9 Huawei Technologies Co., Ltd.

- 10.10 Huber+Suhner AG

- 10.11 II-VI Incorporated

- 10.12 Lumentum Holdings Inc.

- 10.13 Molex LLC

- 10.14 NEC Corporation

- 10.15 Nokia Corporation

- 10.16 Sterlite Technologies Limited

- 10.17 Sumitomo Electric Industries Ltd.

- 10.18 TE Connectivity

- 10.19 Tellabs Inc.

- 10.20 ZTE Corporation