PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684554

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684554

Construction Power Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

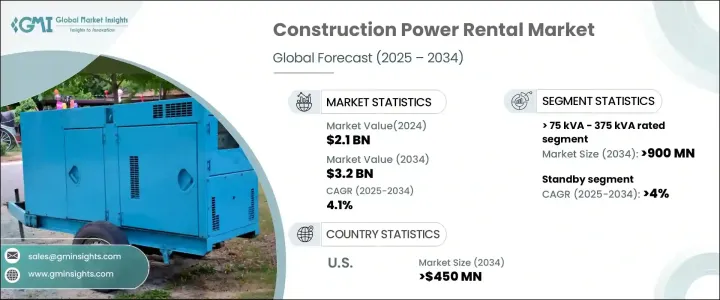

The Global Construction Power Rental Market, valued at USD 2.1 billion in 2024, is set to experience robust growth at a CAGR of 4.1% from 2025 to 2034. This expansion is largely attributed to key factors such as technological advancements, the growing demand for sustainable energy solutions, and an increase in infrastructure financing projects. As construction projects become more complex and environmentally conscious, the need for efficient, eco-friendly power sources is becoming a priority. The ongoing integration of renewable energy sources, such as solar and wind power, into temporary power systems is fueling the market. Digital technologies, which allow for better energy management and remote monitoring, are also playing a crucial role in improving the efficiency and reliability of power rental services. Moreover, there is a rising demand for hybrid power systems that combine traditional fuel sources like diesel with cleaner energy options, aligning with global sustainability goals.

One of the most promising segments within the construction power rental market is the demand for generators rated between 75 kVA and 375 kVA. This segment is projected to generate USD 900 million by 2034, reflecting the growing need for mid-range generators suitable for medium-scale construction sites. These generators are designed to provide a consistent and reliable power supply for heavy construction equipment and machinery, ensuring continuous operations without interruptions. With more construction companies seeking to reduce downtime and boost productivity, these versatile generators are becoming essential for keeping projects on track. At the same time, as construction companies face increasing pressure to reduce their environmental footprint, the demand for hybrid generators, which use both diesel and renewable energy, is rapidly increasing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.2 Billion |

| CAGR | 4.1% |

The standby construction power rental market is also witnessing notable growth and is projected to achieve a CAGR of 4% through 2034. As the need for backup power intensifies, especially in remote and developing regions, more construction projects are relying on reliable power systems to avoid costly delays. The growing frequency of extreme weather events, such as hurricanes and floods, further underscores the importance of dependable power backup systems. Additionally, large-scale infrastructure projects and smart city developments, which often require temporary power solutions during the construction phase, are contributing to the rising demand for standby power.

In the U.S., the construction power rental market is expected to generate USD 450 million by 2034, driven by technological innovations, stringent environmental regulations, and a rising demand for temporary power solutions. The rapid growth in construction across sectors like transportation, energy, and utilities is expected to continue supporting this expansion. Strict emissions regulations are also encouraging the use of cleaner, more sustainable power sources. Furthermore, the increasing frequency of natural disasters is leading to a greater demand for modular, scalable power solutions, which are essential for disaster recovery efforts. As construction projects evolve, so too does the need for flexible, efficient power rental services to meet diverse and growing demands.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Rating, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 ≤ 75 kVA

- 5.3 > 75 kVA - 375 kVA

- 5.4 > 375 kVA - 750 kVA

- 5.5 > 750 kVA

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Standby

- 6.3 Peak shaving

- 6.4 Prime/continuous

Chapter 7 Market Size and Forecast, By Fuel, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Diesel

- 7.3 Gas

- 7.4 Others

Chapter 8 Market Size and Forecast, By Region, 2021 – 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Russia

- 8.3.2 UK

- 8.3.3 Germany

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.4.8 Thailand

- 8.4.9 Vietnam

- 8.4.10 Philippines

- 8.5 Middle East

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Qatar

- 8.5.4 Turkey

- 8.5.5 Iran

- 8.5.6 Oman

- 8.6 Africa

- 8.6.1 Egypt

- 8.6.2 Nigeria

- 8.6.3 Algeria

- 8.6.4 South Africa

- 8.6.5 Angola

- 8.6.6 Kenya

- 8.6.7 Mozambique

- 8.7 Latin America

- 8.7.1 Brazil

- 8.7.2 Mexico

- 8.7.3 Argentina

- 8.7.4 Chile

Chapter 9 Company Profiles

- 9.1 Aggreko

- 9.2 APR Energy

- 9.3 Atlas Copco

- 9.4 Bredenoord

- 9.5 Byrne Equipment Rental

- 9.6 Caterpillar

- 9.7 Cummins

- 9.8 Generac Power Systems

- 9.9 Herc Rentals

- 9.10 HIMOINSA

- 9.11 Paikane

- 9.12 Perennial Technologies

- 9.13 Powermak

- 9.14 Rehlko

- 9.15 Shenton Group

- 9.16 Sudhir Power

- 9.17 Teksan

- 9.18 United Rentals