PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684529

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684529

Lawn and Turf Aerators Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

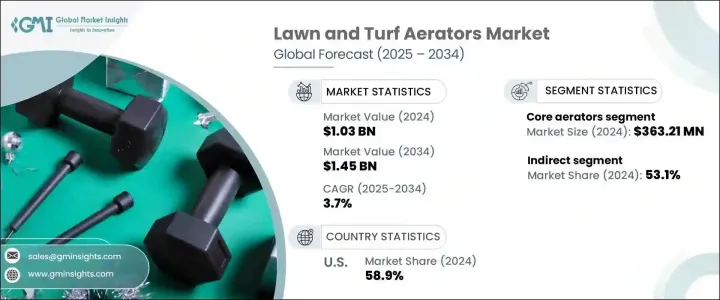

The Global Lawn And Turf Aerators Market, valued at USD 1.03 billion in 2024, is projected to grow at a CAGR of 3.7% during the forecast period. The increasing adoption of aeration systems is fueled by their critical role in enhancing turf health, managing landscaping needs, and maintaining sports fields. Aerators are widely recognized for their ability to alleviate soil compaction, improve water infiltration, promote nutrient absorption, and support stronger root development. These benefits have led to a surge in demand across residential, commercial, and recreational applications. Additionally, the growing emphasis on sustainable and efficient lawn care practices, coupled with advancements in aeration technology, is further driving market growth. Consumers are increasingly prioritizing lawn care solutions that ensure healthy and visually appealing turf, making aerators a fundamental part of turf management strategies.

The market is categorized by aerator type, including core aerators, spike aerators, liquid aerators, rolling aerators, and tow-behind aerators. Core aerators are anticipated to experience the most significant growth from 2025 to 2034. In 2024, this segment generated USD 363.21 million in revenue and is forecasted to reach USD 536.67 million by 2034. Core aerators are particularly valued for their ability to extract small plugs of soil, which effectively reduces soil compaction while improving water and nutrient retention. This process encourages healthier and more robust root systems, making core aerators a preferred choice for residential and commercial lawn care alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.03 Billion |

| Forecast Value | $1.45 Billion |

| CAGR | 3.7% |

The market is also segmented by distribution channels, encompassing both direct and indirect sales. Indirect channels, which include retailers, specialized merchants, and resellers, accounted for 53.1% of the market share in 2024. These channels cater to a broad audience, ranging from professional landscapers to DIY enthusiasts. The widespread availability of aerators through diverse retail platforms has significantly contributed to market expansion. Consumers benefit from the convenience of accessing a wide array of aeration products, fostering a positive purchasing experience and driving overall market growth.

In 2024, the U.S. lawn and turf aerators market held a commanding 58.9% share, largely due to the extensive demand for aeration solutions across residential, commercial, and public spaces. Parks, sports fields, and private lawns in the United States require consistent maintenance, creating a robust market for aerators. The U.S. market is expected to grow at a rate of 4.1% during the forecast period, supported by increasing awareness of aeration's benefits in achieving healthier and more visually appealing turf across various applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier Landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Growing demand for lawn and turf maintenance

- 3.6.1.2 Increased lawn and garden DIY activities

- 3.6.1.3 Rising adoption of sustainable practices

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial investment

- 3.6.2.2 Complexity of operation

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Technological overview

- 3.9 Consumer behavior analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021-2034 (USD Million) (Units in Thousand)

- 5.1 Key trends

- 5.2 Core aerators

- 5.3 Spike aerators

- 5.4 Liquid aerators

- 5.5 Rolling aerators

- 5.6 Tow-Behind aerators

Chapter 6 Market Estimates & Forecast, By Power Source, 2021-2034 (USD Million) (Units in Thousand)

- 6.1 Key trends

- 6.2 Manual aerators

- 6.3 Electric aerators

- 6.4 Powered aerators

- 6.5 Gas-Powered aerators

Chapter 7 Market Estimates & Forecast, By Application 2021-2034 (USD Million) (Units in Thousand)

- 7.1 Key trends

- 7.2 Residential lawns

- 7.3 Golf courses

- 7.4 Sports fields

- 7.5 Commercial landscapes

- 7.6 Agricultural land

- 7.7 Public spaces and parks

Chapter 8 Market Estimates & Forecast, By End Use 2021-2034 (USD Million) (Units in Thousand)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Sports and leisure

- 8.4 Commercial turf management

- 8.5 Golf Course management

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Units in Thousand)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Units in Thousand)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 United States

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 United Kingdom

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 Middle East & Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 United Arab Emirates

Chapter 11 Company Profiles

- 11.1 1st Products

- 11.2 Aerworx

- 11.3 Billy Goat

- 11.4 Classen

- 11.5 Clark

- 11.6 Ecolawn

- 11.7 Groundsman

- 11.8 Jacobsen

- 11.9 John Deere

- 11.10 Millcreek

- 11.11 Salford

- 11.12 Toro

- 11.13 Tracmaster

- 11.14 Turfco

- 11.15 Turftime