PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684519

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684519

Arterial Cannula Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

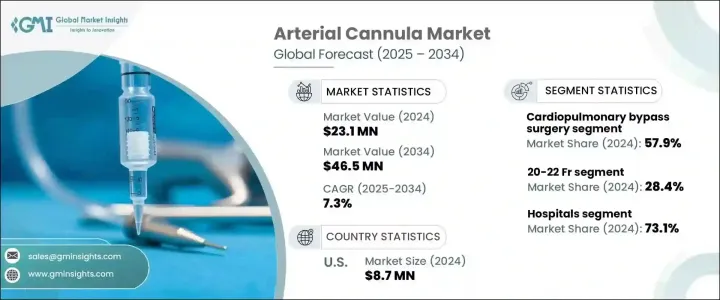

The Global Arterial Cannula Market was valued at USD 23.1 million in 2024 and is projected to experience significant growth with an anticipated CAGR of 7.3% from 2025 to 2034. Several key factors are driving this market expansion, including the rising prevalence of cardiovascular diseases, advancements in cannula technology, and the increasing adoption of respiratory and cardiac support systems in critical care settings. Additionally, the availability of reimbursement policies for cardiac procedures is fostering the wider use of arterial cannulas, contributing to the overall market growth.

The growing global burden of cardiovascular diseases, including coronary artery disease, heart failure, and stroke, has heightened the demand for advanced medical devices such as arterial cannulas, which are critical for various cardiac surgeries, ECMO (extracorporeal membrane oxygenation) procedures, and other life-saving interventions. These devices play a crucial role in improving patient outcomes during surgeries and critical care treatments, thereby spurring their widespread use across hospitals and surgical centers. Innovations in cannula technology, which improve safety, effectiveness, and patient comfort, are also helping propel market demand. Furthermore, as healthcare systems continue to invest in the latest medical technologies and surgical interventions, arterial cannulas remain a core component of treatment protocols.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.1 Million |

| Forecast Value | $46.5 Million |

| CAGR | 7.3% |

The market is segmented by size, with options such as 14-16 Fr, 17-19 Fr, 20-22 Fr, 23-25 Fr, 26-28 Fr, 29-31 Fr, 32-34 Fr, and 35-36 Fr. The 20-22 Fr size category held the largest market share of 28.4% in 2024. This size is particularly favored due to its balanced performance during ECMO procedures and cardiac surgeries, especially for adult patients. Offering an optimal mix of effectiveness and safety, the 20-22 Fr cannula reduces complications like vascular damage and bleeding during insertion, ensuring compatibility with adult arterial structures. Its less invasive nature, compared to larger cannula sizes, makes it the preferred choice for arterial cannulation in adult patients.

In terms of end-users, the market is categorized into hospitals, ambulatory surgical centers, and others. Hospitals dominated the market with a 73.1% share in 2024. The increasing number of critical cardiac and intensive care procedures being performed in hospitals is a major factor contributing to this segment's dominance. Arterial cannulas are an essential tool in life-saving treatments such as cardiopulmonary bypass and ECMO, both of which are extensively used in hospital settings. As the demand for advanced surgical interventions and critical care treatments continues to rise, hospitals are expected to maintain their position as the largest end-user segment.

In the U.S. arterial cannula market, the sector generated USD 8.7 million in 2024. The high prevalence of cardiovascular diseases such as coronary artery disease, heart failure, and stroke plays a significant role in driving the demand for ECMO procedures and cardiac surgeries. Both of these treatments heavily rely on arterial cannulas, solidifying the device's critical role in the country's healthcare system and further fueling market growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular disorders

- 3.2.1.2 Growing use of respiratory and cardiac support in critical care settings

- 3.2.1.3 Advancements in cannula design

- 3.2.1.4 Availability of reimbursements and coverage for cardiac and critical care procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory requirements

- 3.2.2.2 Complexity associated with ECMO and cardiopulmonary procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy outlook

Chapter 5 Market Estimates and Forecast, By Size, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 14-16 Fr

- 5.3 17-19 Fr

- 5.4 20-22 Fr

- 5.5 23-25 Fr

- 5.6 26-28 Fr

- 5.7 29-31 Fr

- 5.8 32-34 Fr

- 5.9 35-36 Fr

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Cardiopulmonary bypass surgery

- 6.3 Extracorporeal membrane oxygenation

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Andocor

- 9.2 B. Braun

- 9.3 Becton, Dickinson and Company

- 9.4 Edward Lifesciences

- 9.5 Freelife Medical

- 9.6 Fresenius Medical Care

- 9.7 Getinge

- 9.8 ICU Medical

- 9.9 Kangxin Medical

- 9.10 LivaNova

- 9.11 Medtronic

- 9.12 Nipro Corporation

- 9.13 Polymedicure

- 9.14 Surgical Holdings

- 9.15 Terumo Corporation