PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684197

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684197

PVC Cling Film Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

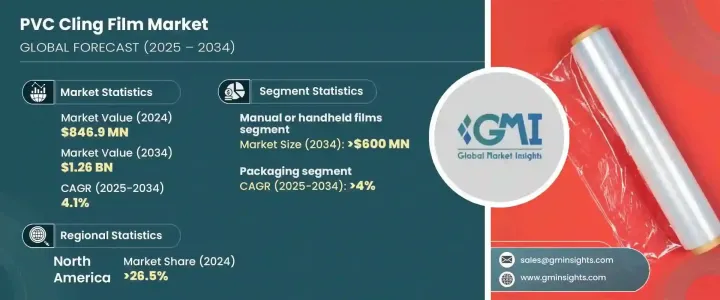

The Global PVC Cling Film Market reached USD 846.9 million in 2024 and is projected to grow at a CAGR of 4.1% from 2025 to 2034. A key driver behind this growth is the increasing demand for eco-friendly and sustainable packaging solutions. With rising awareness of environmental challenges and more stringent plastic waste regulations, there is a clear shift toward recyclable materials that align with global sustainability efforts. Consumers and manufacturers alike are prioritizing greener options that reduce carbon footprints and meet the ever-evolving recycling standards. The growing preference for sustainable packaging is particularly visible in sectors like food and non-food packaging, where eco-conscious choices are becoming the norm. As these trends continue to shape consumer behavior, the demand for PVC cling film, especially in its more sustainable forms, is expected to surge.

The market is divided into machine films and manual or handheld films, with the manual segment emerging as a strong contender in terms of growth. By 2034, the manual PVC cling film segment is projected to generate USD 600 million. This growth is largely attributed to the widespread use of manual films for food storage, particularly in households and small-scale packaging operations. Manual cling films offer a practical and budget-friendly solution for keeping food fresh. The simplicity, cost-effectiveness, and ease of use of these films make them the go-to choice for consumers looking for an efficient and affordable food preservation method. Their widespread availability and versatility further contribute to their dominance in this sector.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $846.9 Million |

| Forecast Value | $1.26 Billion |

| CAGR | 4.1% |

When it comes to end-use applications, the PVC cling film market is largely split between food and non-food packaging. The food packaging segment is leading the way and is expected to grow at a CAGR of 4% from 2025 to 2034. PVC cling films play a vital role in the preservation of fresh food, from meats and vegetables to fruits, by extending shelf life and protecting against contaminants. With a growing focus on fresh, convenient meals and smaller packaging sizes, especially in fast-paced lifestyles, the demand for PVC cling films as a fundamental food storage tool is rising. The popularity of on-the-go meals, ready-to-eat products, and online food deliveries further bolsters the need for high-quality, effective packaging solutions.

North America, particularly the United States, accounted for 26.5% of the PVC cling film market share in 2024. This region is experiencing significant growth, driven by the increasing demand for fresh, visually appealing, and convenient food products. The rise of ready-to-eat meals, the boom in online food delivery services, and the focus on maintaining product quality during transportation are key factors propelling the need for durable and effective packaging options. Additionally, technological innovations in film production, which improve clarity and durability, are contributing to the market's expansion, ensuring that manufacturers can meet the growing demand for high-quality cling films in the food packaging sector.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2022-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Key news & initiatives

- 3.3 Regulatory landscape

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Rising demand for sustainable packaging solutions

- 3.4.1.2 Advancements in film technology and performance

- 3.4.1.3 Cost efficiency through lighter, thinner films

- 3.4.1.4 Increased consumer preference for freshness retention

- 3.4.1.5 Compliance with evolving regulatory requirements

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs of advanced films

- 3.4.2.2 Strong market presence of PVC alternatives

- 3.4.1 Growth drivers

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Machine films

- 5.3 Manual or handheld films

Chapter 6 Market Estimates & Forecast, By Thickness, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Up to 10 microns

- 6.3 10 to 15 microns

- 6.4 15-20 microns

- 6.5 Above 20 microns

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Food packaging

- 7.2.1 Meat poultry, & seafood

- 7.2.2 Fresh produce

- 7.2.3 Frozen food

- 7.2.4 Bakery and confectionery

- 7.2.5 Others

- 7.3 Non-food packaging

- 7.3.1 Industrial goods

- 7.3.2 Electronics

- 7.3.3 Medical and pharmaceutical

- 7.3.4 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 BenKai

- 9.2 Berry Global

- 9.3 Boston Polymers

- 9.4 Changzhou Plastics Researching and Manufacturing

- 9.5 CL Industries India

- 9.6 Divya Plastic Industries

- 9.7 Galaxy Converting

- 9.8 IPG

- 9.9 Jiashan Hengyu Plastic

- 9.10 Magnum Packaging

- 9.11 Maskati Bros

- 9.12 Nan Ya Plastics

- 9.13 NRR Industries

- 9.14 Pactiv Evergreen

- 9.15 Pragya Flexifilm Industries

- 9.16 Qingdao Kingchuan Packaging

- 9.17 Shenzhen Jingfeng Industrial

- 9.18 US Packaging and Wrapping

- 9.19 Zhengzhou Eming Aluminium Industry