PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684191

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1684191

Decorative Laminates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

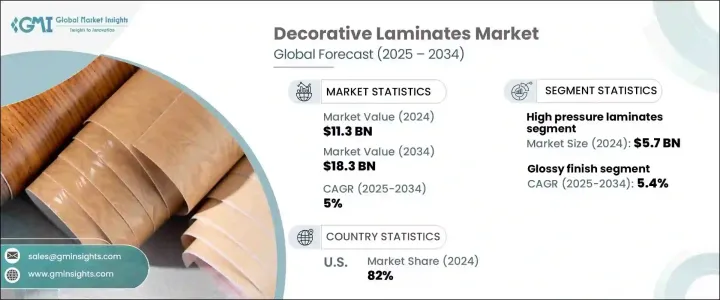

The Global Decorative Laminates Market reached USD 11.3 billion in 2024 and is projected to expand at a CAGR of 5% from 2025 to 2034. The market is experiencing steady growth, driven by the rising demand for aesthetically appealing and durable interior surfaces across residential, commercial, and industrial sectors. As interior design trends continue to evolve, consumers and businesses are increasingly opting for decorative laminates to enhance the visual appeal of spaces while ensuring cost-effectiveness and longevity. The growing preference for modern, stylish interiors has led to a surge in demand for laminates in furniture, cabinetry, and flooring applications, where aesthetics, durability, and affordability are crucial. These materials offer an extensive range of colors, patterns, and finishes, catering to diverse consumer preferences and allowing for seamless integration into contemporary interior designs.

The rapid urbanization and expansion of the real estate sector further contribute to market growth, with both new construction and renovation projects incorporating decorative laminates for their versatility and ease of maintenance. Consumers are drawn to laminates due to their resistance to stains, moisture, and scratches, making them a practical choice for high-traffic areas. Additionally, advancements in manufacturing technology have enhanced the performance and sustainability of laminates, leading to improved scratch resistance, antimicrobial properties, and eco-friendly production methods. With growing awareness of sustainable materials, manufacturers are also introducing laminates with recycled content and low-VOC emissions to meet consumer preferences for environmentally responsible products.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $11.3 Billion |

| Forecast Value | $18.3 Billion |

| CAGR | 5% |

High-pressure laminates (HPL) generated USD 5.7 billion in 2024 and are expected to grow at a CAGR of 5.2% between 2025 and 2034. Recognized for their superior durability, scratch resistance, and ability to withstand moisture and heat, HPL remains a preferred option for both residential and commercial applications. The demand for these laminates is particularly strong in office spaces, retail outlets, and hospitality establishments, where high-traffic surfaces require long-lasting materials. Businesses and homeowners favor HPL for countertops, wall panels, and workstations due to its ability to maintain its appearance over time with minimal maintenance.

The glossy finish segment accounted for 41% of the market share in 2024 and is projected to grow at a CAGR of 5.4% during the forecast period. Consumers are increasingly drawn to glossy laminates for their reflective, high-end appeal that adds sophistication to luxury interiors. These finishes are widely used in modern kitchens, bathrooms, and upscale retail spaces, where a polished, elegant look is highly desirable. Apart from their visual appeal, glossy laminates are easy to clean and maintain, making them a practical yet stylish choice for residential and commercial settings.

The U.S. decorative laminates market dominated with an 82% share in 2024, largely fueled by growth in residential and commercial construction. As new housing developments, office spaces, and hospitality projects continue to rise, the demand for functional yet stylish laminates remains high. These materials are widely used for countertops, cabinetry, wall panels, and flooring, offering an ideal blend of durability, affordability, and aesthetic appeal.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis.

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing construction activities

- 3.6.1.2 Increasing demand for laminating solutions

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Market saturation and intense competition

- 3.6.2.2 Sustainability concerns

- 3.6.1 Growth drivers

- 3.7 Raw material analysis

- 3.8 Trade analysis (HS Code- 482390)

- 3.8.1 Top 10 export countries

- 3.8.2 Top 10 import countries

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 5.1 Key trends

- 5.2 High pressure laminates

- 5.3 Low pressure laminates

- 5.4 Melamine laminates

- 5.5 Veneer laminates

- 5.6 Others (compact laminates, etc.)

Chapter 6 Market Estimates & Forecast, By Design, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 6.1 Key trends

- 6.2 Matte finish

- 6.3 Glossy finish

- 6.4 Wood gain designs

- 6.5 Abstract design

- 6.6 Others (pattern designs, etc.)

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 7.1 Key trends

- 7.2 Wall panels

- 7.3 Flooring

- 7.4 Countertops

- 7.5 Furniture

- 7.6 Others (doors, cabinets, etc.)

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Educational

- 8.3.2 Retail

- 8.3.3 HoReCa

- 8.3.4 Corporates

- 8.3.5 Others (spa services, BFSI, healthcare, etc.)

- 8.4 Industrial

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 9.1 Key trends

- 9.2 Direct

- 9.3 Indirect

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Thousand Sq Mts)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Arauco

- 11.2 Duratuff Products

- 11.3 Egger Group

- 11.4 Formica Corporation

- 11.5 FunderMax

- 11.6 Greenlam Industries

- 11.7 Kronospan

- 11.8 Merino Group

- 11.9 Pfleiderer

- 11.10 Samling Group

- 11.11 Sonae Industries

- 11.12 Tafisa

- 11.13 Travis Perkins

- 11.14 Wilsonart