PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801926

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801926

Medical Imaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

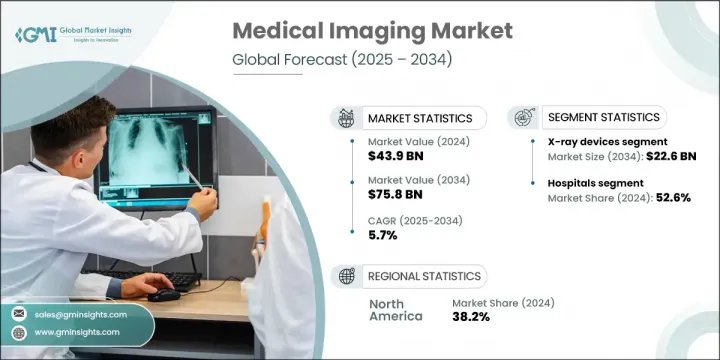

The Global Medical Imaging Market was valued at USD 43.9 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 75.8 billion by 2034. This growth is largely supported by the increasing burden of chronic diseases, a rising aging population, ongoing advancements in imaging technologies, and greater healthcare spending across both emerging and developed nations. Medical imaging continues to be a cornerstone in clinical diagnostics and treatment planning, as it enables healthcare providers to visualize internal organs, tissues, and bones in detail. These technologies help in early disease detection, guide minimally invasive procedures, and contribute to long-term patient management. Innovations in hardware and software, improved image clarity, and faster image processing are further elevating clinical decision-making, improving patient outcomes, and boosting demand worldwide.

Medical imaging relies on technologies that produce high-definition visual data to assist in clinical evaluations and surgical interventions. These tools have evolved into essential components of diagnostics, offering precision and speed across medical disciplines. Devices such as MRI systems, X-rays, CT scanners, and ultrasound machines are deployed across clinical settings to evaluate internal injuries, chronic conditions, and abnormalities. Their real-time imaging capabilities support diagnosis and improve workflow efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $43.9 Billion |

| Forecast Value | $75.8 Billion |

| CAGR | 5.7% |

In 2024, the X-ray devices segment led the market, primarily due to its increased usage for early diagnosis of chronic illnesses. This segment's growth is supported by the constant upgrades in X-ray technologies that now include AI-powered imaging solutions designed to ensure accuracy, streamline workflows, and reduce the burden on radiologists. These advanced systems have proven their efficacy in multicenter evaluations and are widely adopted across clinical setups. The incorporation of smart diagnostic capabilities is significantly enhancing provider confidence and contributing to the rising utilization of X-ray systems in modern medical imaging practices.

The hospitals segment held a 52.6% share in 2024. Their growing share is influenced by rapid urbanization, population growth, and a rise in healthcare infrastructure investments. The widespread installation of advanced diagnostic equipment, coupled with skilled professionals available to operate them, is positioning hospitals as dominant end-users in this market. Additionally, increased funding for hospital upgrades and new construction, especially across developing regions, is elevating the adoption of imaging equipment. Government and private investments in improving hospital infrastructure are driving significant demand for high-performance imaging technologies.

United States Medical Imaging Market was valued at USD 15.1 billion in 2024. The rising cancer prevalence across the country, stemming from environmental and lifestyle-related factors, has intensified the need for effective and advanced imaging tools for early cancer detection and monitoring. The growing incidence of such conditions is pushing hospitals and clinics to invest in imaging systems that offer high diagnostic value and patient-specific accuracy, thus accelerating overall market growth in the U.S.

Prominent companies operating in the Global Medical Imaging Market include GE HealthCare Technologies, Shimadzu, Samsung Medison, Carestream Health, Canon Medical Systems, Fujifilm Holdings, Hologic, Konica Minolta, Esaote, Siemens Healthineers, and Koninklijke Philips. Leading medical imaging companies are prioritizing innovation by investing in AI integration, machine learning algorithms, and automation to boost image accuracy and diagnostic speed. They are expanding their digital health platforms to support remote diagnostics, cloud-based image storage, and data interoperability. Global market players are actively pursuing mergers, acquisitions, and collaborations with hospitals and technology firms to broaden their solution portfolios. Expansion into high-growth emerging markets is another critical strategy, supported by localized manufacturing and service centers. To remain competitive, manufacturers are also offering modular imaging systems that reduce maintenance and allow for easier upgrades.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Product

- 2.2.2 End use

- 2.2.3 Regional

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Value addition at each stage

- 3.1.3 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Incremental innovations and advancements in medical imaging technology

- 3.2.1.2 Rise in healthcare expenditure

- 3.2.1.3 Increasing disease burden along with rapidly growing geriatric population base

- 3.2.1.4 Emergence of artificial intelligence (AI) in radiology

- 3.2.1.5 Favorable government initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of imaging devices

- 3.2.2.2 Changes in reimbursement policies

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion in emerging markets

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.6 Future market trends

- 3.7 Pricing analysis, 2024

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy outlook matrix

- 4.7 Key developments

- 4.7.1 Mergers and acquisitions

- 4.7.2 Partnerships and collaborations

- 4.7.3 New product launches

- 4.7.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 X-ray devices

- 5.2.1 Digital

- 5.2.1.1 Direct radiography systems

- 5.2.1.2 Computed radiography systems

- 5.2.2 Analog

- 5.2.1 Digital

- 5.3 MRI

- 5.4 Ultrasound

- 5.4.1 2D Ultrasound

- 5.4.2 3D Ultrasound

- 5.4.3 Other ultrasounds

- 5.5 Computed tomography

- 5.6 Nuclear imaging

- 5.7 Mammography

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Diagnostic centers

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Canon Medical Systems

- 8.2 Carestream Health

- 8.3 Esaote

- 8.4 Fujifilm Holdings

- 8.5 GE HealthCare Technologies

- 8.6 Hologic

- 8.7 Konica Minolta

- 8.8 Koninklijke Philips

- 8.9 Samsung Medison

- 8.10 Shimadzu

- 8.11 Siemens Healthineers