PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667087

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667087

Positron Emission Tomography (PET) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

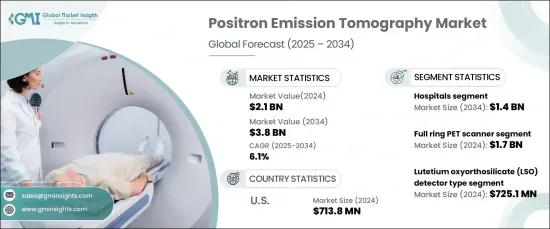

The Global Positron Emission Tomography Market, valued at USD 2.1 billion in 2024, is poised for significant growth, with a projected CAGR of 6.1% from 2025 to 2034. PET technology, a cutting-edge imaging method, has become indispensable in medical diagnostics by providing high-resolution functional images that reveal metabolic and physiological activities within the body. Its precise imaging capabilities are vital in diagnosing, monitoring, and managing complex medical conditions. The increasing prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is further driving demand for advanced diagnostic tools like PET scanners. As healthcare systems worldwide emphasize early detection and precision medicine, PET imaging is gaining widespread adoption, cementing its role in modern clinical practices.

Rapid technological advancements are broadening PET's applications and transforming its role in disease management. One notable innovation is time-of-flight PET technology, which enhances image resolution and reduces scan times by calculating the time photons take to travel between the source and detector. This breakthrough not only enables faster imaging but also delivers superior-quality visuals, making it a cornerstone of the PET market's future growth. Healthcare providers are increasingly recognizing the value of such technologies in improving patient outcomes, which is fueling further investment in PET innovations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.8 Billion |

| CAGR | 6.1% |

The market is segmented by product type into partial ring PET scanners and full ring PET scanners, with the latter leading the market in 2024 by generating USD 1.7 billion in revenue. Full-ring PET scanners are celebrated for their versatility, as they support a wide range of applications across oncology, cardiology, neurology, and psychiatry. Their ability to deliver detailed imaging across diverse clianical specialties ensures their continued dominance in the market. Growing awareness of PET's diagnostic accuracy, coupled with the rising demand for personalized medicine and advancements in imaging technology, further boosts the adoption of full ring PET systems.

By detector type, the market includes digital photon counters (DPC), silicon photomultiplier (SiPM), lutetium yttrium orthosilicate (LYSO), lutetium oxyorthosilicate (LSO), and other detector technologies. LSO detectors stood out in 2024, contributing USD 725.1 million to the market. These detectors are highly sought after for their superior sensitivity, enhanced spatial resolution, and faster imaging capabilities. The advanced performance of LSO crystals, including their rapid light decay time and precise photon detection, sets them apart in the PET landscape, making them a preferred choice for cutting-edge imaging systems.

The U.S. PET market, generating USD 713.8 million in 2024, is positioned for sustained growth throughout the forecast period. The rising incidence of chronic diseases, particularly cancer and cardiovascular conditions, is driving increased adoption of advanced imaging solutions. Coupled with continuous advancements in PET technology, such as improved resolution and reduced scan durations, the U.S. market remains at the forefront of global PET innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Integration of X-ray computed tomography (CT) into PET

- 3.2.1.2 Technological advancements in positron emission tomography

- 3.2.1.3 Rising demand for PET analysis in radio pharmaceuticals

- 3.2.1.4 Increasing shift towards image-guided interventions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Diminished life span of radioisotopes

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Key news and initiatives

- 3.8 Gap analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn, Units)

- 5.1 Key trends

- 5.2 Partial ring PET scanner

- 5.3 Full ring PET scanner

Chapter 6 Market Estimates and Forecast, By Detector Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lutetium oxyorthosilicate (LSO)

- 6.3 Silicon photomultiplier (SiPM)

- 6.4 Lutetium yttrium orthosilicate (LYSO)

- 6.5 Digital photon counters (DPC)

- 6.6 Other detector types

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic centers

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Canon Medical Systems Corporation

- 9.2 CMR Naviscan

- 9.3 Fujifilm Holdings Corporation

- 9.4 GE Healthcare

- 9.5 Koninklijke Philips

- 9.6 Mediso

- 9.7 Minfound Medical Systems

- 9.8 Molecubes

- 9.9 Neusoft Corporation

- 9.10 Oncovision

- 9.11 Positron

- 9.12 Radialis

- 9.13 Siemens Healthineers

- 9.14 Toshiba International Corporation

- 9.15 Yangzhou Kindsway Biotech