PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667072

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667072

Stationary Catalytic Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

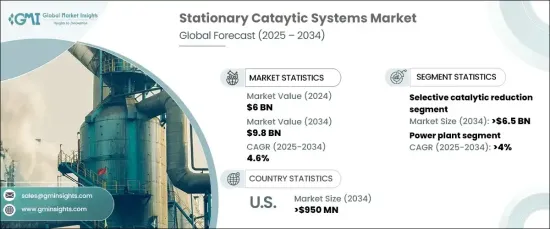

The Global Stationary Catalytic Systems Market was valued at USD 6 billion in 2024 and is projected to expand at a CAGR of 4.6% from 2025 to 2034. This growth is driven by rising energy demands, rapid industrialization, and stricter energy efficiency regulations. Stationary catalytic systems are increasingly used in energy-intensive industries for their ability to reduce nitrogen oxide emissions and support clean energy goals. Their adoption across cement production, power plants, metal processing, and manufacturing industries is being propelled by government mandates focused on minimizing NOx and CO emissions.

The selective catalytic reduction (SCR) segment is poised for significant growth, with projections exceeding USD 6.5 billion by 2034. SCR technology is highly effective in reducing nitrogen oxides, achieving up to 95% NOx emission reduction. These systems are designed to meet stringent regulatory standards while maintaining ammonia emissions within acceptable thresholds, which enhances their market demand. Continuous advancements in SCR technology, including cost-efficient and compact designs suitable for diverse industrial applications, further accelerate adoption.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 4.6% |

Power plants represent a key application for stationary catalytic systems, with the segment expected to grow at a CAGR of over 4% by 2034. The increasing need for effective industrial emission controls, in line with growing electricity demands, encourages power generation facilities to integrate these systems. Regulatory frameworks mandating reduced emissions of harmful gases have intensified the focus on deploying reliable emission control technologies across this sector.

The cement production sector, along with rising levels of atmospheric pollutants, is also bolstering demand for emission control systems. Strict compliance requirements and the risk of financial penalties for exceeding emission limits have amplified the importance of technologies like SCR and oxidation catalysts. Developing economies, with their expanding infrastructure and growing construction activities, are expected to drive significant growth in these systems.

The U.S. stationary catalytic systems market is projected to surpass USD 950 million by 2034, supported by increasing manufacturing activities and the shift from coal-based power plants to gas-fired facilities. Stricter environmental regulations targeting NOx and CO emissions, along with heightened awareness of the environmental impacts of these pollutants, are strengthening market growth. As industries adopt cleaner technologies to align with evolving environmental policies, the demand for stationary catalytic systems is set to rise substantially.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 – 2034 (USD Million)

- 5.1 Selective catalytic reduction

- 5.2 Oxidation catalyst

Chapter 6 Market Size and Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Power plants

- 6.3 Chemical & petrochemical

- 6.4 Cement

- 6.5 Metal

- 6.6 Marine

- 6.7 Manufacturing

- 6.8 Others

Chapter 7 Market Size and Forecast, By Region, 2021 – 2034 (USD Million, ‘000 Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 Agriemach

- 8.2 Babcock & Wilcox

- 8.3 CECO Environmental

- 8.4 Cormetech

- 8.5 DCL International

- 8.6 Ducon

- 8.7 Environmental Energy Services

- 8.8 GE Vernova

- 8.9 Hug Engineering

- 8.10 Johnson Matthey

- 8.11 Kwangsung

- 8.12 MAN Energy Solutions

- 8.13 McGill AirClean

- 8.14 Mitsubishi Heavy Industries

- 8.15 Thermax

- 8.16 Yara International