PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667057

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667057

Automotive Gesture Recognition Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

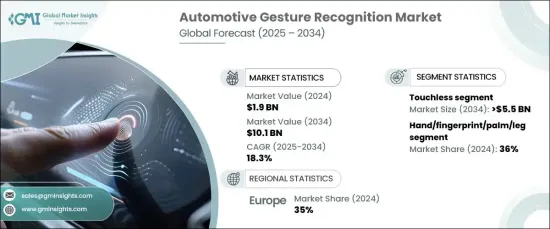

The Global Automotive Gesture Recognition Market, valued at USD 1.9 billion in 2024, is set to experience a CAGR of 18.3% from 2025 to 2034. This surge is largely driven by the growing demand for innovative in-car technologies that offer enhanced convenience, better user experiences, and improved vehicle safety. With consumers increasingly seeking smarter vehicles, gesture recognition technology has emerged as a key solution that allows drivers to control a variety of functions such as infotainment, navigation, and climate control without needing to physically touch any buttons or screens. By leveraging natural hand movements, this technology seamlessly integrates into daily driving, making the car experience more intuitive and user-friendly. The shift toward more advanced gesture recognition systems reflects an ongoing trend towards automating and streamlining car interfaces, meeting the needs of modern consumers who expect more from their driving experience.

The market is split into two primary technology categories: touch-based and touchless systems. The touchless segment dominated the market in 2024, accounting for 55% of the total share, and is projected to reach USD 5.5 billion by 2034. The appeal of touchless gesture recognition lies in its ability to enhance driver safety by minimizing distractions. Since the technology enables drivers to interact with vehicle controls without physical contact, it helps maintain focus on the road while still providing seamless operation. Simple hand gestures allow drivers to control various features, such as adjusting volume or changing navigation settings, further improving the driving experience by eliminating the need to look away from the road.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.9 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 18.3% |

In terms of authentication, the automotive gesture recognition market is segmented into hand/fingerprint/palm/leg, face, vision, voice, and hybrid systems. The hand/fingerprint/palm/leg authentication segment represented 36% of the market share in 2024. This biometric system offers not only increased security but also the potential for a more personalized user experience. With biometric authentication, traditional methods like key fobs or PIN codes are replaced by secure, unique identifiers that make vehicle access and engine starting faster and safer. Furthermore, this technology can tailor the vehicle's settings-such as seat position and preferred driving mode-based on the specific driver's data, enhancing overall convenience and comfort.

Europe played a significant role in shaping the automotive gesture recognition market, holding 35% of the market share in 2024. Stringent automotive safety and environmental regulations in the region are accelerating the adoption of advanced technologies like gesture recognition. With European regulators pushing for safer vehicles and fewer road accidents, manufacturers are increasingly integrating gesture control and biometric systems to meet these high standards. As these technologies play a crucial role in improving both safety and user experience, the European market for automotive gesture recognition is poised for continued expansion in the coming years.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Software developers

- 3.1.4 Technology providers

- 3.1.5 Aftermarket providers

- 3.1.6 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Pricing analysis

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for advanced vehicle safety features

- 3.10.1.2 Growing focus on improving driver and passenger experiences

- 3.10.1.3 Regulatory support and safety standards are driving the adoption of driver monitoring systems

- 3.10.1.4 Increasing adoption of autonomous and connected vehicles

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High implementation costs

- 3.10.2.2 Challenges exist in achieving accurate recognition in different driving conditions

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Touch-based

- 5.3 Touchless

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Technology)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchbacks

- 6.2.3 SUVs

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Authentication, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Hand/Fingerprint/Palm/Leg

- 7.3 Face

- 7.4 Vision

- 7.5 Voice

- 7.6 Hybrid

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Multimedia/infotainment/navigation

- 8.3 Lighting system

- 8.4 Climate control

- 8.5 Window and sunroof operation

- 8.6 Driver monitoring systems

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn,Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Apple

- 11.2 Aptiv

- 11.3 Bosch

- 11.4 Cognitec Systems

- 11.5 Continental

- 11.6 Eyesight Technologies

- 11.7 Gestigon

- 11.8 Harman

- 11.9 Intel

- 11.10 Magna

- 11.11 Melexis

- 11.12 Navtek Solutions

- 11.13 Neonode

- 11.14 NXP Semiconductors

- 11.15 Qualcomm

- 11.16 Renesas Electronics

- 11.17 Synaptics

- 11.18 Texas Instruments

- 11.19 Valeo

- 11.20 Visteon