PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667009

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1667009

Fluoroelastomers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

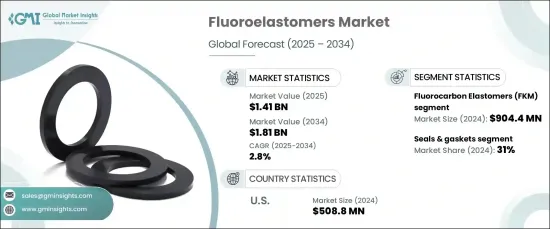

The Global Fluoroelastomers Market is projected to reach USD 1.41 billion in 2024 and is expected to grow at a CAGR of 2.8% from 2025 to 2034. This growth is primarily driven by the rising demand for high-performance elastomers across various industries requiring superior durability and resistance to harsh environments. Fluoroelastomers, known for their unique ability to withstand extreme heat, chemicals, and pressures, are increasingly being adopted in critical sectors such as automotive, aerospace, and oil and gas. As industries evolve and demand more resilient materials, fluoroelastomers are becoming essential components in numerous applications, ranging from fuel systems and engine components to seals and gaskets. Furthermore, as companies prioritize sustainability and energy efficiency, fluoroelastomers are in high demand for their long-lasting performance and ability to meet environmental standards.

Fluoroelastomers are mainly categorized into fluorocarbon elastomers (FKM) and perfluoroelastomers (FFKM). In 2024, fluorocarbon elastomers dominated the market, accounting for a significant share of the overall revenue. This can be attributed to their exceptional thermal stability, chemical resistance, and wide range of uses in industries that require robust sealing solutions. These elastomers are commonly found in gaskets, seals, and o-rings used in engines, transmissions, and fuel systems. Perfluoroelastomers, on the other hand, are gaining traction due to their enhanced chemical and heat resistance, making them ideal for highly specialized applications in industries that demand the utmost reliability, such as semiconductor and chemical processing sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.41 Billion |

| Forecast Value | $1.81 Billion |

| CAGR | 2.8% |

The application segment of the fluoroelastomers market includes seals & gaskets, o-rings, hoses & tubings, and other specialized applications. Seals and gaskets held the largest market share, accounting for 31% of the total revenue in 2024, and are expected to maintain strong growth throughout the forecast period. The automotive industry is a significant driver of this demand, relying on fluoroelastomers for their ability to withstand extreme heat and harsh chemicals. O-rings, widely used in aerospace applications, continue to be in high demand, as they ensure leak-proof seals in critical components. Hoses and tubings also play a vital role in fluid transfer and containment across various industrial processes, further bolstering the growth of the fluoroelastomers market.

In the U.S., the fluoroelastomers market generated USD 508.8 million in 2024. Growth in this region is driven by advancements in material technologies and a growing demand for high-performance sealing solutions, particularly in the automotive, aerospace, and energy sectors. Ongoing investments in research and development, along with infrastructure improvements, are expected to fuel continued expansion. As industries evolve and seek more efficient and reliable materials, the fluoroelastomers market in the U.S. is set to experience further growth through both traditional and emerging applications.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand in automotive industry

- 3.6.1.2 Rising adoption in aerospace applications

- 3.6.1.3 Growing chemical processing industries

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High cost of fluoroelastomers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Fluorocarbon elastomers (FKM)

- 5.3 Perfluoroelastomers (FFKM)

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 D seals and gaskets

- 6.3 O-rings

- 6.4 Hoses and tubings

- 6.5 Others

Chapter 7 Market Size and Forecast, By End Use Industries, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Aerospace

- 7.4 Oil & gas

- 7.5 Chemical processing

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 3M

- 9.2 AGC (Asahi Glass)

- 9.3 Chemours

- 9.4 Daikin Industries

- 9.5 DowDuPont

- 9.6 DuPont (E. I. du Pont de Nemours and Company)

- 9.7 Gujarat Fluorochemicals

- 9.8 HaloPolymer

- 9.9 Mitsui Chemicals

- 9.10 Momentive Performance Materials

- 9.11 Saint-Gobain Performance Plastics

- 9.12 Shin-Etsu Chemical

- 9.13 Solvay

- 9.14 Wacker Chemie

- 9.15 Zeon Corporation