PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666978

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666978

Vehicle Networking Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

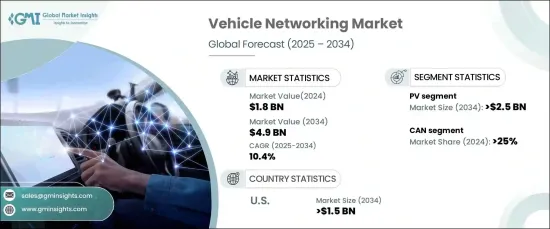

The Global Vehicle Networking Market, with a valuation of USD 1.8 billion in 2024, is expected to grow at a robust CAGR of 10.4% from 2025 to 2034. This growth is primarily driven by the accelerating adoption of connected car technologies, fueled by the integration of the Internet of Things (IoT) and 5G networks. These cutting-edge technologies enable seamless real-time communication between vehicles and infrastructure, enhancing safety, efficiency, and the overall driving experience. The expansion of autonomous vehicles has further spurred demand for advanced networking solutions. Efficient vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communication are vital for the smooth functioning of self-driving cars, making them a critical component in the future of the automotive industry.

Furthermore, the increasing emphasis on vehicle diagnostics and predictive maintenance is becoming a major market driver. With advanced networking technologies in place, continuous monitoring of vehicle performance is now possible, allowing for early detection of potential issues. This early detection not only ensures better reliability but also helps to reduce maintenance costs and vehicle downtime, benefiting both individual consumers and fleet operators. In addition, advancements in safety features, such as real-time collision avoidance and emergency braking, are pushing the need for reliable, high-performance vehicle networking systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $4.9 Billion |

| CAGR | 10.4% |

In terms of vehicle types, the market is segmented into Passenger Vehicles (PV), Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), and Autonomous Guided Vehicles (AGV). The PV segment held a dominant 50% share in 2024 and is forecast to reach USD 2.5 billion by 2034. This dominance is largely due to the growing consumer demand for advanced in-car technologies, including infotainment systems, real-time navigation, and enhanced safety features that are increasingly being incorporated into passenger vehicles.

On the connectivity front, the vehicle networking market is categorized into LIN, CAN, RF, Ethernet, FlexRay, and MOST. The CAN (Controller Area Network) segment held a 25% share in 2024 thanks to its reliability, robustness, and cost-effectiveness. It's widely used for real-time data transmission in critical automotive systems like engine control and braking, providing exceptional performance even in harsh environments with high electromagnetic interference.

The U.S. vehicle networking market was the leader in 2024, accounting for 90% of the global share. The market in the U.S. is expected to reach USD 1.5 billion by 2034, driven by the country's well-established automotive sector and rapid adoption of groundbreaking technologies such as autonomous driving, electric vehicles, and 5G connectivity. These innovations rely heavily on advanced vehicle networking solutions, propelling the U.S. market toward substantial growth. As consumer expectations rise and technology continues to evolve, the vehicle networking market is poised for remarkable expansion, delivering innovative solutions that enhance vehicle connectivity and performance.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Technology providers

- 3.2.2 Service providers

- 3.2.3 Distributors

- 3.2.4 End use

- 3.3 Profit margin analysis

- 3.4 Pricing analysis of

- 3.5 Cost breakdown

- 3.6 Technology & innovation landscape

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Government focus on reducing carbon emissions

- 3.9.1.2 Growing sales of electric vehicles

- 3.9.1.3 Government support for automotive components industry

- 3.9.1.4 Strategic initiatives by market players

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Increasing consumption of semiconductors in electric vehicles

- 3.9.2.2 Lack of autonomous mobility infrastructure in developing and underdeveloped countries

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 PV

- 5.3 LCV

- 5.4 HCV

- 5.5 AGV

Chapter 6 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 CAN (Controller Area Network)

- 6.3 LIN (Local Interconnect Network)

- 6.4 RF (Radio Frequency)

- 6.5 FlexRay

- 6.6 Ethernet

- 6.7 MOST (Media Oriented Systems Transport)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Powertrain

- 7.3 Safety

- 7.4 Body electronics

- 7.5 Chassis

- 7.6 Infotainment

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Acome

- 9.2 Analog Devices

- 9.3 Bosch

- 9.4 Broadcom

- 9.5 Continental

- 9.6 Intel

- 9.7 Harman

- 9.8 Marvell Semiconductor

- 9.9 Microchip Technology

- 9.10 NXP Semiconductors

- 9.11 ON Semiconductor

- 9.12 Qualcomm

- 9.13 Renesas

- 9.14 Sierra Wireless

- 9.15 Spiarent

- 9.16 Communications

- 9.17 STMicroelectronics NV

- 9.18 Texas Instrumental

- 9.19 Toshiba

- 9.20 Xilinx