PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666947

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666947

Phenolic Antioxidants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

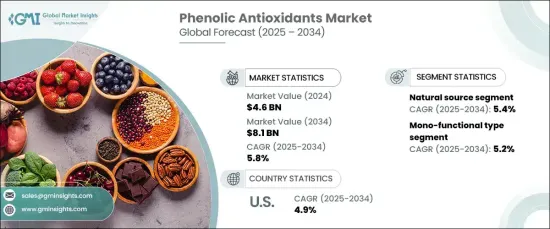

The Global Phenolic Antioxidants Market reached USD 4.6 billion in 2024 and is projected to grow at an impressive CAGR of 5.8% from 2025 to 2034. Phenolic antioxidants play a critical role in protecting products from oxidative damage, making them indispensable across industries such as food, cosmetics, and pharmaceuticals. Their ability to enhance product stability, extend shelf life, and improve performance has positioned them as essential ingredients in modern manufacturing. The growing demand for natural, clean-label, and sustainable products has further propelled the market, as consumers increasingly seek safer and eco-friendly options in their everyday choices. This trend underscores the expanding importance of phenolic antioxidants in addressing evolving consumer preferences and industrial needs.

The market's momentum is fueled by the surging preference for natural phenolic antioxidants, expected to generate USD 5.8 billion by 2034 with a CAGR of 5.4%. Natural antioxidants derived from plants, including herbs, spices, and fruits, are gaining widespread adoption due to their alignment with wellness, sustainability, and non-toxic ingredient trends. As consumers prioritize health benefits and environmentally responsible products, the demand for these plant-based solutions continues to rise. This transition reflects the broader movement toward natural health products, emphasizing clean-label ingredients that cater to the modern emphasis on holistic well-being and ecological consciousness.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.6 Billion |

| Forecast Value | $8.1 Billion |

| CAGR | 5.8% |

Mono-functional antioxidants dominated the market in 2024 with a commanding 44.3% share, generating USD 2.1 billion. These antioxidants, valued for their ability to prevent oxidation and prolong product longevity, are expected to grow at a CAGR of 5.2% during the forecast period. However, the demand for bi-functional antioxidants is accelerating, driven by their dual capabilities, such as protecting against oxidation and UV damage, which are particularly valued in the cosmetics and pharmaceutical industries. Meanwhile, multi-functional antioxidants are gaining traction as they offer a combination of benefits, including anti-aging properties, corrosion resistance, and preservation, meeting the need for versatile and efficient solutions across diverse applications.

The U.S. phenolic antioxidants market is set to reach USD 2.1 billion by 2034, growing at a CAGR of 4.9%. Increasing demand across the food and beverage, personal care, and industrial sectors is driving this growth. In the food industry, consumers are shifting toward natural ingredients, favoring plant-based and clean-label products. Concurrently, the cosmetics sector is embracing advanced antioxidants to cater to the rising demand for anti-aging and skin protection solutions. These trends are expected to sustain robust growth in the U.S. market over the coming years, solidifying its position as a key player in the global landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.7 Industry impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising Demand in Food and Beverage Industry

- 3.7.1.2 Expanding Cosmetic and Personal Care Applications

- 3.7.1.3 Growing automotive and industrial applications

- 3.7.2 Market challenges

- 3.7.2.1 Environmental and regulatory concerns related to chemical usage

- 3.7.1 Growth drivers

- 3.8 Regulations & market impact

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Natural

- 5.3 Synthetic

Chapter 6 Market Size and Forecast, By Type, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Mono-functional

- 6.3 Bi-functional

- 6.4 Multi-functional

Chapter 7 Market Size and Forecast, By Form, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Liquid

- 7.3 Granule

- 7.4 Powder

Chapter 8 Market Size and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Plastic & rubber

- 8.3 Fuel & lubricants

- 8.4 Cosmetic & personal care

- 8.5 Food & feed additive

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Afton Chemical

- 10.2 Adeka Corporation

- 10.3 Addivant

- 10.4 BASF SE

- 10.5 Chitec

- 10.6 Clariant International AG

- 10.7 Dorf Ketal

- 10.8 Dover Chem

- 10.9 Eastman Chemical Company

- 10.10 Lanxess AG

- 10.11 Lubrizol Corporation

- 10.12 Mayzo Inc

- 10.13 OXIRIS

- 10.14 SI Group

- 10.15 Songwon Industrial