PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666925

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1666925

Natural Aroma Chemicals Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

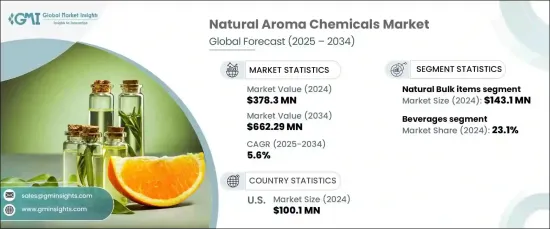

The Global Natural Aroma Chemicals Market for flavors reached USD 378.3 million in 2024 and is projected to grow at a CAGR of 5.6% between 2025 and 2034. This remarkable growth is driven by the increasing consumer preference for natural ingredients as health and wellness awareness continues to rise. Natural aroma chemicals are highly sought after for their ability to enhance taste and aroma while adhering to the demand for clean-label products free of synthetic additives. The growing popularity of organic and sustainable options, especially in premium and artisanal food and beverages, further fuels market expansion. In addition, rapid economic progress and population growth are bolstering bakery and confectionery sectors, creating a robust demand for natural aroma chemicals. Rising consumption of beverages and packaged food products is amplifying the need for natural flavors that preserve aroma, improve taste, and extend shelf life.

The market is witnessing a significant shift toward natural and clean-label products as consumers increasingly favor items made with authentic and minimally processed ingredients. With global food manufacturers prioritizing innovation, the adoption of natural aroma chemicals is surging across diverse applications. Advances in flavor formulation technologies, combined with the availability of diverse natural extracts and essential oils, are revolutionizing the food and beverage industry. Companies are capitalizing on the strong demand for sustainable and plant-based flavoring solutions to gain a competitive edge in a dynamic market landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $378.3 Million |

| Forecast Value | $662.29 Million |

| CAGR | 5.6% |

The natural aroma chemicals market is segmented into natural high-impact chemicals, natural menthol, natural specialties, natural vanillin, natural maltol, natural bulk items, and other mint-derived products. Natural bulk items dominated in 2024, generating USD 143.1 million, and are forecasted to reach USD 250.4 million by 2034. These products, including essential oils and natural extracts, play a critical role in large-scale food and beverage production due to their cost-effectiveness, availability in bulk quantities, and versatility in flavor formulations.

Among various applications, beverages held a significant market share of 23.1% in 2024. Clean-label and naturally flavored drinks are driving growth in this segment as consumers increasingly demand authentic taste profiles. From soft drinks and juices to alcoholic beverages, natural aroma chemicals are essential for enhancing flavor and appeal. The trend toward health-conscious consumption continues to boost innovation in naturally flavored beverage products.

In the United States, the natural aroma chemicals market for flavors was valued at USD 100.1 million in 2024. This growth is driven by a strong preference for clean-label and natural ingredient-based food items. As health-conscious consumers increasingly opt for organic, plant-based, and sustainable products, the demand for natural aroma chemicals has soared across diverse food and beverage categories in North America.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Booming food flavours industry

- 3.6.1.2 Surging adoption of natural ingredients in flavoured beverages

- 3.6.1.3 Increasing consumption of nutritious and healthier food products

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High prices compared to synthetic aroma chemicals

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Natural bulk items

- 5.3 Acids

- 5.3.1 Natural acetic acid

- 5.3.2 Natural butyric acid

- 5.3.3 Natural isobutyric acid

- 5.3.4 Natural lactic acid

- 5.3.5 Natural formic acid

- 5.3.6 Natural propionic acid

- 5.3.7 Natural stearic acid

- 5.3.8 Others

- 5.4 Alcohols

- 5.4.1 Natural nerolidol

- 5.4.2 Natural anisyl alcohol

- 5.4.3 Natural benzyl alcohol

- 5.4.4 Natural borneol

- 5.4.5 Natural cinnamic alcohol

- 5.4.6 Natural citronellol

- 5.4.7 Natural fenchyl alcohol

- 5.4.8 Natural geraniol

- 5.4.9 Natural nerol

- 5.4.10 Others

- 5.5 Aldehyde

- 5.5.1 Natural benzaldehyde

- 5.5.2 Natural cinnamic aldehyde

- 5.5.3 Natural citronellal

- 5.5.4 Natural propionaldehyde

- 5.5.5 Natural anisyl aldehyde

- 5.5.6 Natural aldehyde c-9

- 5.5.7 Natural isovaleraldehyde

- 5.5.8 Others

- 5.6 Esters

- 5.6.1 Natural benzyl benzoate

- 5.6.2 Natural benzyl acetate

- 5.6.3 Natural benzyl butyrate

- 5.6.4 Natural ethyl acetate

- 5.6.5 Natural ethyl benzoate

- 5.6.6 Natural ethyl lactate

- 5.6.7 Natural ethyl butyrate

- 5.6.8 Natural acetal

- 5.6.9 Natural anethol

- 5.6.10 Natural eugenol

- 5.6.11 Natural guaiacol

- 5.6.12 Natural ethyl hexanoate

- 5.6.13 Natural hexyl acetate

- 5.6.14 Others

- 5.7 Ketones

- 5.7.1 Natural acetoin

- 5.7.2 Natural acetophenone

- 5.7.3 Natural d-carvone

- 5.7.4 Natural l-carvone

- 5.7.5 Natural alpha-ionone

- 5.7.6 Natural beta-ionone

- 5.7.7 Others

- 5.8 Lactones

- 5.8.1 Natural gamma-decalactone

- 5.8.2 Natural delta-decalactone

- 5.8.3 Natural gamma-nonalactone

- 5.8.4 Natural gamma-octalactone

- 5.8.5 Others

- 5.9 Natural high impact chemicals

- 5.9.1 Natural diallyl disulfide

- 5.9.2 Natural furfuryl mercaptan

- 5.9.3 Natural indole

- 5.9.4 Natural dimethyl sulfide

- 5.9.5 Natural methional

- 5.9.6 Natural difurfuryl disulfide

- 5.9.7 Natural pyrazines

- 5.9.8 Natural furfuryl thioacetate

- 5.9.9 Others

- 5.10 Natural specialities

- 5.10.1 Natural myrcene

- 5.10.2 Natural alpha-pinene

- 5.10.3 Natural beta-pinene

- 5.10.4 Natural beta damascenone

- 5.10.5 Natural beta damascone

- 5.10.6 Others

- 5.11 Natural vanillin

- 5.12 Natural maltol

- 5.13 Natural menthol and other mint derived products

Chapter 6 Market Size and Forecast, By End Use, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bakery & confectionery

- 6.3 Beverages

- 6.4 Dairy products

- 6.5 Savory foods

- 6.6 Pharmaceuticals & dietary supplements

- 6.7 Others

Chapter 7 Market Size and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 Germany

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Russia

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 South Korea

- 7.4.5 Australia

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.6 MEA

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Archer Daniels Midland Company

- 8.2 BASF

- 8.3 Dohler

- 8.4 Ernesto Ventós

- 8.5 Firmenich

- 8.6 Flavaroma

- 8.7 Givaudan

- 8.8 Ingredion

- 8.9 International Flavours & Fragrances

- 8.10 Kerry Group

- 8.11 McCormick & Company

- 8.12 Solvay

- 8.13 Symrise

- 8.14 Takasago

- 8.15 Treatt

- 8.16 Wild Flavours & Specialty Ingredients